2K Sports 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

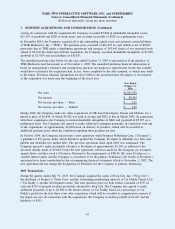

If the financial condition and operations of the Company’s customers deteriorate, the risk of collection could

increase substantially. As of October 31, 2004 and 2003, the receivable balances from the Company’s five

largest customers amounted to approximately 45.1% and 54.6% of the Company’s net receivable balance,

respectively, with two customers accounting for 12.8% and 11.2% of such balance at October 31, 2004 and

with two customers representing 16.6% and 11.7% at October 31, 2003. Except for the largest customers

noted above, all receivable balances from the remaining individual customers are less than 10% of the

Company’s net receivable balance.

Inventories, net

Inventories are stated at the lower of average cost or market. The Company periodically evaluates the carrying

value of its inventories and makes adjustments as necessary. Estimated product returns are included in the

inventory balance at their cost.

Prepaid Royalties

The Company’s agreements with licensors and developers generally provide it with exclusive publishing rights

and require it to make advance royalty payments that are recouped against royalties due to the developer

based on contractual amounts on product sales, adjusted for certain related costs. Prepaid royalties are

amortized as cost of sales on a title-by-title basis based on the greater of the proportion of current year sales

to total of current and estimated future sales for that title or the contractual royalty rate based on actual net

product sales as defined in the respective agreements. At each balance sheet date, the Company evaluates

the recoverability of prepaid royalties and charge to cost of sales the amount that management determines is

probable that will not be recouped at the contractual royalty rate based on current and future sales in the

period in which such determination is made or if the Company determines that it will cancel a development

project. Prepaid royalties are classified as current and non-current assets based upon estimated net product

sales within the next year.

Property and Equipment

Office equipment, furniture and fixtures are depreciated using the straight-line method over their estimated

lives ranging from five to seven years. Computer equipment and software are depreciated using the straight-

line method over three years. Leasehold improvements are amortized over the lesser of the term of the

related lease or estimated useful lives. The cost of additions and betterments are capitalized, and repairs and

maintenance costs are charged to operations in the periods incurred. When depreciable assets are retired or

sold, the cost and related allowances for depreciation are removed from the accounts and the gain or loss is

recognized. The carrying amounts of these assets are recorded at historical cost.

Capitalized Software Development Costs

The Company capitalizes internal software development costs, as well as film production and other content

costs, subsequent to establishing technological feasibility of a title. Capitalized software development

costs represent the costs associated with the internal development of the Company’s publishing products.

Amortization of such costs as a component of cost of sales is recorded on a title-by-title basis based on the

greater of the proportion of current year sales to total of current and estimated future sales for the title or

the straight-line method over the remaining estimated useful life of the title. At each balance sheet date,

the Company evaluates the recoverability of capitalized software costs based on undiscounted future cash

flows and will charge to cost of sales any amounts that are deemed unrecoverable or for projects that it

will abandon.

TAKE-TWO INTERACTIVE SOFTWARE, INC. and SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

(Dollars in thousands, except per share amounts)

2. SIGNIFICANT ACCOUNTING POLICIES (Continued)

42