2K Sports 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

published products, there can be no assurance that we will be able to continue to retain these personnel at

current compensation levels, or at all. Failure to continue to attract and retain qualified management, creative,

development, financial, marketing, sales and technical personnel could materially adversely affect our business

and prospects.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

(Dollars in thousands)

We are subject to market risks in the ordinary course of our business, primarily risks associated with interest

rate and foreign currency fluctuations.

Historically, fluctuations in interest rates have not had a significant impact on our operating results. At

October 31, 2004, we had no outstanding variable rate indebtedness.

We transact business in foreign currencies and are exposed to risks resulting from fluctuations in foreign

currency exchange rates. Accounts relating to foreign operations are translated into United States dollars using

prevailing exchange rates at the relevant fiscal quarter or year end. Translation adjustments are included as a

separate component of stockholders’ equity. For fiscal 2004 our foreign currency translation adjustment gain

was $7,290 and our foreign exchange transaction gain was $1,199. A hypothetical 10% change in applicable

currency exchange rates at October 31, 2004 would result in a material translation adjustment.

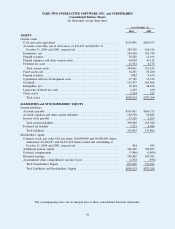

Item 8. Financial Statements and Supplementary Data

The financial statements appear in a separate section of this report following Part III.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

Not applicable.

Item 9A. Controls and Procedures

Based on their evaluation of the effectiveness of our disclosure controls and procedures as of the end of the

period covered by this report, our Chief Executive Officer and Chief Financial Officer have concluded that our

disclosure controls and procedures are effective at the reasonable assurance level for recording, processing,

summarizing and reporting the information we are required to disclose in our reports filed under the Securities

Exchange Act of 1934. There were no changes in our internal controls over financial reporting during the

fiscal quarter ended October 31, 2004 that have materially affected, or are reasonably likely to materially

affect, our internal controls over financial reporting.

Item 9B. Other Information

Not available.

30