Vodafone 2002 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

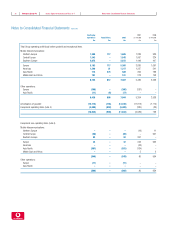

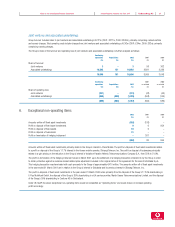

Vodafone Group Plc Annual Report & Accounts and Form 20-F Notes to the Consolidated Financial Statements78

1. Basis of Consolidated Financial Statements

Statutory financial information

The Consolidated Financial Statements are prepared in accordance with applicable accounting standards and conformity with generally accepted accounting

principles in the United Kingdom (“UK GAAP”), which differ in certain material respects from accounting principles generally accepted in the United States of

America (“US GAAP”) – see note 37.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Amounts in the Consolidated Financial Statements are stated in pounds sterling (£), the currency of the country in which the Company is incorporated.

The translation into US dollars of the Consolidated Financial Statements as of, and for the financial year ended 31 March 2002, is for convenience only and

has been made at the noon buying rate for cable transfers as announced by the Federal Reserve Bank of New York for customs purposes on 29 March

2002. This rate was $1.4250 : £1. This translation should not be construed as a representation that the pound sterling amounts actually represented have

been, or could be, converted into dollars at this or any other rate.

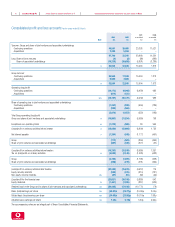

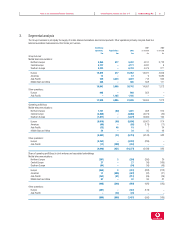

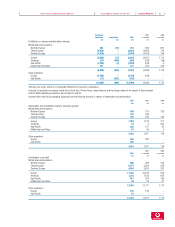

Restatements

a) Segmental basis of reporting. Following the reorganisation of the Group’s overall management structure and geographical division of operations on

1 April 2001 and 1 January 2002, the Group has adopted the following segments for the presentation of its geographical analysis of results: Europe (further

sub-analysed between Northern Europe, Central Europe and Southern Europe); Americas; Asia Pacific; and Middle East and Africa. Prior period comparatives

have been restated on the new segmental basis.

b) FRS 19, “Deferred tax”. Deferred taxation is now stated on a full liability basis in accordance with FRS 19 and comparative financial information

has been restated as necessary. The impact of adopting FRS 19 was to increase the tax charge for the year ended 31 March 2002 and the year ended

31 March 2001 by £521 million and £136 million, respectively, and to reduce the tax charge for the year ended 31 March 2000 by £53 million.

In accordance with FRS 19, goodwill in respect of certain past acquisitions has been restated which resulted in the charge for the amortisation of goodwill for

the years ended 31 March 2002, 31 March 2001 and 31 March 2000, reducing by £9 million, £9 million and £2 million, respectively. Equity shareholders’

funds were also restated, resulting in a reduction of £386 million and £239 million as at 31 March 2001 and 31 March 2000, respectively.

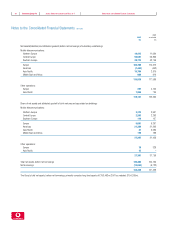

2. Accounting policies

Accounting convention

The Consolidated Financial Statements are prepared under the historical cost convention and in accordance with applicable accounting standards of the

Accounting Standards Board and pronouncements of its Urgent Issues Task Force.

Basis of consolidation

The Consolidated Financial Statements include the accounts of the Company, its subsidiary undertakings and its share of the results of joint ventures and

associated undertakings for financial statements made up to 31 March 2002. A listing of the Company’s principal subsidiary undertakings, joint ventures and

associated undertakings is given in note 36.

The acquisition of Eircell, the acquisition of increased stakes in Japan Telecom and the J-Phone Group and the acquisition of an interest in Grupo Iusacell,

have been accounted for as acquisitions in accordance with FRS 6, “Acquisitions and Mergers”.

Foreign currencies

Transactions in foreign currencies are recorded at the exchange rates ruling on the dates of those transactions, adjusted for the effects of any hedging

arrangements. Foreign currency monetary assets and liabilities are translated into sterling at year end rates.

The results of international subsidiary undertakings, joint ventures and associated undertakings are translated into sterling at average rates of exchange.

The adjustment to year end rates is taken to reserves. Exchange differences, which arise on the retranslation of international subsidiary undertakings’, joint

ventures’ and associated undertakings’ balance sheets at the beginning of the year, and equity additions and withdrawals during the financial year, are dealt

with as a movement in reserves.

Other translation differences are dealt with in the profit and loss account.

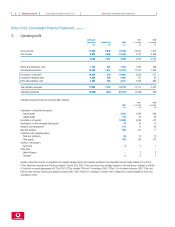

Notes to the Consolidated Financial Statements