Vodafone 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F Board’s Report to Shareholders on Directors’ Remuneration60

Board’s Report to Shareholders on Directors’ Remuneration continued

Illustration

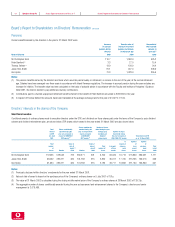

Based on the analysis of externally provided market data on the total

remuneration levels of chief executives of major European companies and on the

new policy in respect of total remuneration levels that is described above, it is

proposed that under the new policy the Chief Executive would receive in 2002

performance shares with a face value of one and three quarters-times salary

and options with a face value of seven-times salary. The graph below illustrates

the approximate pre-tax long term incentive gains to the Chief Executive that

would be achieved based on various Company growth, EPS and TSR

performance scenarios:

For example, if the Company value increases by £50 billion, and there is

50% vesting of long term incentives, the Chief Executive would have a pre-tax

gain of just under £4 million, representing less than 0.008% of the total increase

in shareholder value.

The awards of performance shares and share options are intended to be

made to executive directors following the 2002 Annual General Meeting on

31 July 2002.

Share ownership guidelines

It is a condition of participation by the executive directors in these long term

incentive plans that they comply with the Company’s share ownership guidelines.

These guidelines, which were first introduced in 2000, require the Chief

Executive to have a shareholding in the Company of four times base salary and

other executive directors to have a shareholding of three times base salary.

The majority of the executive directors have attained these shareholding levels.

In recognition that options held by the more recently appointed executive

directors will not at the present time yield shares to enable these levels of

ownership to be attained, the Remuneration Committee has approved an

extension of the time limits for compliance. Originally, the share ownership levels

were to be attained by July 2003, with progress to be shown in the interim.

The Remuneration Committee has agreed that no penalties will be imposed so

long as all shares (net of tax) arising from the vesting of long term incentives are

retained until the requirements are met.

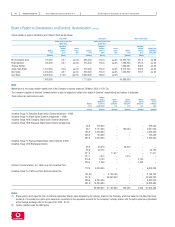

Report on 2001/02 Executive Directors’ Remuneration

Components of executive directors’ remuneration

Overview

The principal components of executive directors’ remuneration packages are

salary, short/medium term incentives, medium/long term incentives and pension

benefits. These components, and key terms of the various incentive and benefit

programmes, are explained further below.

The vesting of all short and long term incentives is subject to the achievement of

performance targets that are set by the Remuneration Committee before the

awards are granted.

Salary

Salaries are reviewed annually with effect from 1 July and adjustments may be

made to reflect competitive national pay levels, changes in responsibilities and

Group performance. If the responsibilities of executive directors change during

the year the Remuneration Committee reviews remuneration packages, including

salaries, at that time. Only base salary is used to determine pensionable salary.

Short/medium term incentives

Executive directors are eligible to participate in the STIP, a deferred share bonus

plan that has been described in the section entitled “Remuneration Review and

New Policy”above.

The target level for base awards granted to executive directors for the year

ended 31 March 2002 was 100% of salary with a maximum of 200% of salary.

Awards are contingent on achievement of a one-year performance target. For the

year to 31 March 2002 the performance target was the achievement of Group

budgeted pro forma proportionate EBITDA. For enhancement shares, for the two

years from 1 April 2001 the performance target was that the growth in adjusted

earnings per share must exceed the growth in the UK retail price index by

six percentage points over the two-year period.

STIP awards from the 1998/99 base performance year vested in 2001.

Details of STIP awards are given in the table on page 64.

Medium/long term incentives

Medium/long term incentives were provided to executive directors in the form of

restricted shares and share options.

Arun Sarin has previously received long term incentive awards under the

AirTouch Long Term Incentive Program. No awards were granted to him under

this plan during the year and as a non-executive director he is no longer eligible

to receive such awards.

Restricted shares

Awards of restricted shares were made to executive directors annually under the

Vodafone Group Long Term Incentive Plan (“LTIP”) by the Trustees of the

Vodafone Group Employee Trust. If and to the extent that the LTIP performance

targets are achieved over the three-year performance period the shares are

released to participants. The targets for LTIP awards granted in June 2001 are

the same as for the 2001 GMR share options (see below). The grant value at

10.48

+£25 bn

+£50 bn

+£75bn

100% Vesting (80th percentile

TSR ranking & UK RPI+15%

EPS growth per annum)

75% Vesting (73rd percentile

TSR ranking & UK RPI+11.7%

EPS growth per annum)

50% Vesting (64th percentile

TSR ranking & UK RPI+8.3%

EPS growth per annum)

25% Vesting (median TSR

ranking & UK RPI+5% EPS

growth per annum)

12

10

8

6

4

2

0

Chief Executive Pre-Tax Gain (£’millions)

Growth in value of Company from grant date (£’billions)