Vodafone 2002 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F Notes to the Consolidated Financial Statements112

Notes to the Consolidated Financial Statements continued

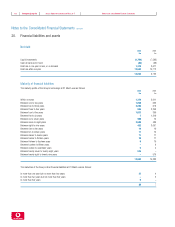

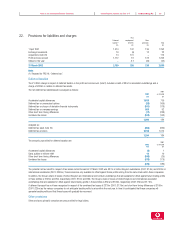

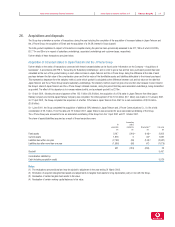

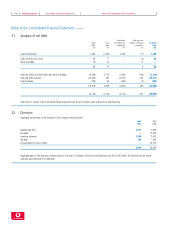

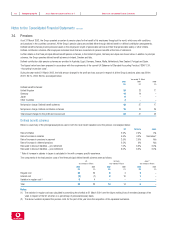

On 12 July 2001, the Group completed the acquisition of an additional aggregate interest of 4.9% in the J-Phone operating companies. The share of

assets/(liabilities) acquired were:

Accounting

At policy

acquisition conformity Revaluations Fair value

£m £m £m £m

Fixed assets 132 (7) –125

Current assets 106 1 (3) 104

Liabilities due within one year (56) (2) – (58)

Liabilities due after more than one year (70) (4) – (74)

112 (12) (3) 97

Goodwill 542

Consideration satisfied by:

Cash 639

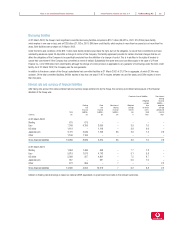

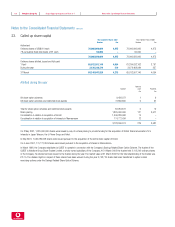

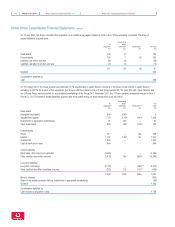

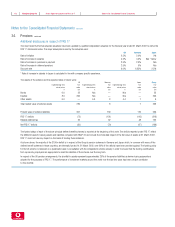

On 12 October 2001, the Group acquired an additional 21.7% shareholding in Japan Telecom, resulting in the Group’s total interest in Japan Telecom

increasing to 66.7%. As a result of this acquisition, the Group’s effective interest in the J-Phone Group became 69.7%. From this date, Japan Telecom and

the J-Phone Group were accounted for as subsidiary undertakings of the Group. On 1 November 2001, the J-Phone operating companies merged to form J-

Phone Co., Ltd. The share of assets/(liabilities) acquired and the goodwill arising on these transactions is shown below.

Accounting

At policy Fair

acquisition(1) conformity Revaluations (2) value

£m £m £m £m

Fixed assets

Intangible fixed assets 540 (534)(3) – 6

Tangible fixed assets 7,723 (179)(4) (141)(5) 7,403

Investments in associated undertakings 51 (30) – 21

Other investments 394 (86)(6) (116)(7) 192

Current assets

Stocks 217 –(59) 158

Debtors 1,702 149(8) 60 1,911

Investments 1,300 ––1,300

Cash at bank and in hand 844 ––844

Current liabilities

Bank loans, other loans and overdrafts (4,490) ––(4,490)

Other creditors due within one year (2,670) (10) (302)(9) (2,982)

Long-term liabilities

Long-term borrowings (2,722) –(190)(10) (2,912)

Other creditors due after more than one year (225) (74) (151)(11) (450)

2,664 (764) (899) 1,001

Minority interests (352)

Share of net assets previously held as investments in associated undertakings (66)

Goodwill 1,205

Consideration satisfied by:

Cash (including acquisition costs) 1,788