Vodafone 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

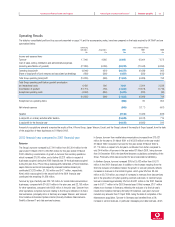

Vodafone Group Plc Annual Report & Accounts and Form 20-F Operating and Financial Review and Prospects40

Operating and Financial Review and Prospects continued

organic growth in Australia, New Zealand and Fiji, and the Group’s share of the

results of its associated undertakings in Japan. Japan’s cellular market remained

robust as mobile services continued to expand, with the number of mobile phone

users increasing by 19% year on year. J-Phone Vodafone added 1,859,000 new

customers during the year, increasing its customer base by 23% to 9,966,000 at

31 March 2001, representing a market share of approximately 16%. Almost

6,200,000 (62%) of its customers now have internet-capable phones, a higher

proportion of its customer base than any other operator in Japan. A combination

of competitor activity and the Japanese consumers’ appetite for internet-access

phones resulted in a substantial increase in customer upgrade and connection

costs compared with the previous year, leading to a decrease in J-Phone

Vodafone’s EBITDA margin in the year.

In the Middle East and Africa region, total Group operating profit, before goodwill

amortisation, increased from £148 million for the year ended 31 March 2000 to

£213 million for the year ended 31 March 2001. This profit growth is attributable

to strong operating results in both the Group’s subsidiary in Egypt and associated

undertaking in South Africa.

The Group’s other operations reported an operating loss, before goodwill and

exceptional items, of £281 million. This includes the results of Arcor, which is

EBITDA positive, Telecommerce, the Group’s share of the start-up losses incurred

by Vizzavi Europe, a 50% owned multi-access consumer portal joint venture with

Vivendi Universal, and the Group’s share of the results of Cegetel, the second

largest fixed line operator in France in which Vodafone has a 15% stake.

Consolidated cost of sales increased from £4,359 million in the year ended

31 March 2000 to £8,702 million in the year ended 31 March 2001, including

£4,851 million in respect of acquisitions completed in the year. Cost of sales for

continuing operations represented 58.0% of turnover for the year ended

31 March 2001, an increase from 55.4% for the year ended 31 March 2000.

The Group’s cost of sales as a proportion of turnover increased in the year ended

31 March 2001 due primarily to increases in the level of equipment costs,

depreciation of the network infrastructure and payments of financial incentives in

relation to the increase in customer connections.

The Group’s equipment costs and cost of providing financial incentives to service

providers and dealers for obtaining new customers amounted to £1,853 million,

or 23.5% of turnover, for the year ended 31 March 2000, compared with £3,364

million, or 22.4% of turnover for the year ended 31 March 2001. In Germany,

the significant customer growth in a highly competitive market resulted in a

substantial increase in total customer acquisition costs, although blended cost to

connect per customer remained largely unchanged at 1116. Customer churn

was 11%, a decrease of four percentage points from the prior year. In Italy, net

connection costs stabilised at 137 per customer for the year to 31 March 2001

despite growing competitive pressures. Churn increased slightly from 13% for

the year ended 31 March 2000 to 14% for the year ended 31 March 2001.

The Italian market is characterised by a high level of prepaid product and

relatively low ARPU, with customer acquisition costs and churn also being low in

comparison with other major markets in Europe. In the United Kingdom, cost to

connect for contract customers increased from £94 for the year ended 31 March

2000 to £121 for the year to 31 March 2001, reflecting the competitive market

and the connection of higher value customers in the period. Prepaid cost to

connect in the United Kingdom for the year to 31 March 2001 was £56

compared with £50 for the year ended 31 March 2000, reflecting competitive

pressures. In the United Kingdom, Vodafone announced significant reductions in

distribution incentives for prepaid products in order to improve the profitability of

this market segment.

Selling and distribution costs increased from £869 million in the year ended

31 March 2000 to £1,162 million in the year ended 31 March 2001,

representing 11.0% and 7.7% of turnover for each year, respectively. Selling and

distribution costs as a proportion of turnover for the Group’s continuing

operations was 7.4% in the 2001 financial year, compared with 8.0% for

acquisitions. In the 2000 financial year, selling and distribution costs for

acquisitions were 16.7% of turnover, resulting in an increase in the aggregate

proportion of these costs to 11.0% of turnover. The percentage result for

acquisitions in 2000 reflects the higher connection costs incurred by the US

operations acquired through the merger with AirTouch, which are not

consolidated in the results for the 2001 financial year following the formation of

Verizon Wireless.

Administrative expenses increased from £1,664 million for the year ended

31 March 2000 to £11,579 million in the year ended 31 March 2001.

Administrative expenses include a charge for goodwill amortisation increasing from

£674 million for the year ended 31 March 2000 to £9,585 million for the year

ended 31 March 2001, relating to the consolidation of subsidiary undertakings,

and an increase in exceptional operating costs from £30 million for the year ended

31 March 2000 to £176 million for the year ended 31 March 2001. Excluding

amortisation charges for goodwill and exceptional operating costs, administrative

expenses represented 12.1% of Group turnover for the year ended 31 March

2001, compared with 12.2% for the year ended 31 March 2000.

Profit on ordinary activities before interest

During the year ended 31 March 2001, the Group reported a loss on ordinary

activities before interest of £6,909 million, compared with a profit for the year

ended 31 March 2000 of £1,752 million. The items having the most significant

impact on this result were the increase, before goodwill amortisation and

exceptional items, in total Group operating profit from £2,538 million for the year

ended 31 March 2000 to £5,204 million for the year ended 31 March 2001,

including £2,087 million from acquisitions, offset by an increase in the charge

for the amortisation of goodwill from £1,710 million for the year ended 31 March

2000 to £11,873 million for the year ended 31 March 2001, including

amortisation of goodwill attributed to joint ventures and associated undertakings,

an increase in exceptional operating costs from £30 million for the year to

31 March 2000 to £320 million for the year to 31 March 2001 and a decrease

in the profit from exceptional non-operating items from £954 million in the year

ended 31 March 2000 to £80 million for the year ended 31 March 2001.

The exceptional, non-operating profit of £954 million in the year ended 31 March

2000, arose mainly from the disposal of the Group’s interest in E-Plus Mobilfunk,

as described below.

The increase in the charge for the amortisation of goodwill in the year ended

31 March 2001 reflects the increase in the net book value of capitalised

goodwill, including amounts attributed to joint ventures and associated

undertakings, from £40,453 million at 31 March 2000 to £125,808 million at

31 March 2001. This includes goodwill, before amortisation charges, of £83,028

million arising on the acquisition of Mannesmann during the year ended

31 March 2001.