Vodafone 2002 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

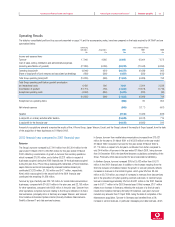

Operating and Financial Review and Prospects Vodafone Group Plc 41Annual Report & Accounts and Form 20-F

Basic earnings per share

Basic earnings per share, before goodwill and exceptional items, decreased by

28%, from 4.90p for the year ended 31 March 2000 to 3.54p as at 31 March

2001, primarily reflecting the dilution arising from the issue of new shares in

connection with the Mannesmann acquisition.

Basic earnings per share, after goodwill and exceptional items, fell from 2.00p as

at 31 March 2000 to a loss per share of 16.09p for the year ended 31 March

2001. The loss per share of 16.09p includes an increase in the charge for the

amortisation of goodwill from 6.31p per share, for the year ended 31 March

2000, to a charge of 19.32p per share for the year ended 31 March 2001.

Balance sheet

Total fixed assets decreased from £154,208 million as at 31 March 2001 to

£153,462 million at 31 March 2002.

Other fixed asset investments at 31 March 2002 totalled £1,407 million

(2001: £2,955 million), and include the Group’s equity interest in China Mobile.

Amounts for 2001 also include the Group’s equity interest in Japan Telecom

which became a subsidiary undertaking during the 2002 financial year.

Tangible fixed assets increased from £10,586 million at 31 March 2001 to

£18,541 million at 31 March 2002, of which network infrastructure assets of

£16,372 million (2001: £7,770 million) represented approximately 88%

(2001: 73%) of the total. Additions to network infrastructure in the year,

excluding acquisitions, totalled £3,305 million. The fair value of assets acquired

as part of acquisitions of businesses, most notably the J-Phone Group and

Japan Telecom, amounts to £7,725 million.

Current asset investments with an aggregate value of £1,792 million primarily

comprise liquid investments with a value of £1,789 million.

Equity shareholders’ funds

Total equity shareholders’ funds decreased from £145,007 million at 31 March

2001 to £130,573 million at 31 March 2002. The decrease comprises the loss

for the period of £16,155 million (which includes goodwill amortisation of

£13,470 million and net exceptional charges of £6,268 million), dividends of

£1,025 million, net currency translation losses of £2,263 million and a

£978 million reduction in amounts in relation to shares to be issued as

consideration for the acquisition of an interest in Swisscom Mobile which was

settled in cash. This was offset by the issue of new share capital of £5,984

million, primarily in relation to the acquisition of Eircell and the £3.5 billion share

placing during the year.

Dividends

The table on the following page sets out the amounts of interim, final and total

cash dividends paid and proposed in respect of each fiscal year indicated both

in pounds sterling per ordinary share and translated, solely for convenience,

into US dollars per ordinary share at the Noon Buying Rate on each of the

respective payment dates for such interim and final dividends, in both cases,

where relevant, net of the associated Advance Corporation Tax.

Exceptional non-operating items of £80 million in the year ended 31 March

2001 are analysed below.

£m

Profit on termination of hedging instrument 261

Impairment of fixed asset investments (193)

Profit on disposal of fixed assets 6

Profit on disposal of fixed asset investments 6

80

The profit on termination of the hedging instrument arose in March 2001 upon

the settlement of a hedging transaction entered into by the Group in February

2001, in order to obtain protection against an adverse market-related price

adjustment included in the original terms of the agreement for the sale of

Infostrada. This hedging transaction terminated with cash proceeds to the Group

of approximately 1410 million.

The impairments of fixed asset investments relate to the write-down of the value

of the Group’s investments in Globalstar and Shinsegi Telecom, Inc. At 31 March

2001, the Group had an approximate 7.8% interest in the Globalstar partnership,

a consortium of leading telecommunications companies established to develop,

through a constellation of 48 low-earth orbiting satellites, a cellular telephone

service for remote locations not covered by existing mobile communications

infrastructures. The Group has the exclusive rights to provide Globalstar service in

certain territories. At 31 March 2001 the Group had an 11.7% interest in Shinsegi

Telecom Inc., which operates wireless telecommunications services in South

Korea. This interest was acquired through the merger with AirTouch.

Net interest payable

Total Group net interest payable, including the Group’s share of the net

interest expense of joint ventures and associated undertakings, increased from

£401 million for the year ended 31 March 2000 to £1,177 million for the year

ended 31 March 2001. Net interest costs in respect of the Group’s net

borrowings increased from £333 million (before exceptional finance costs of

£17 million) in the year to 31 March 2000 to £850 million for the year ended

31 March 2001. The increase includes interest on Mannesmann’s debt of

£12,551 million, which was assumed at acquisition on 12 April 2000.

Taxation

Following the adoption of FRS 19, the effective rate of taxation has been

restated on a full provision basis for the year ended 31 March 2000 from

32.5% to 30.0%, and from 33.9% to 37.5% for the year ended 31 March 2001.

The adoption of FRS 19 has no impact on Group cash flows. Further information

on the restatement can be found on page 78.

The 7.5% increase in the effective tax rate in 2001 is primarily the result of the

integration of the Mannesmann businesses into the Group’s result. The results of

the Mannesmann businesses have been consolidated since the completion of the

acquisition of Mannesmann on 12 April 2000.