Vodafone 2002 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F Notes to the Consolidated Financial Statements128

Notes to the Consolidated Financial Statements continued

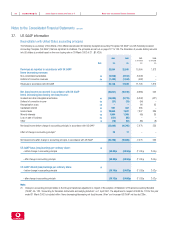

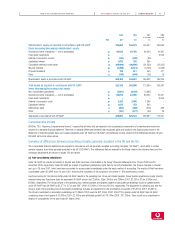

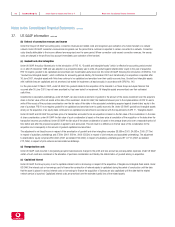

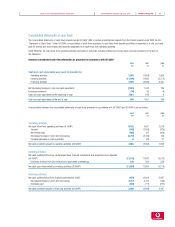

37. US GAAP information continued

(b) Deferral of connection revenues and income

Under the Group’s UK GAAP accounting policy, connection revenues and related costs are recognised upon activation of a mobile handset on a cellular

network. Under US GAAP, connection revenues are recognised over the period that a customer is expected to remain connected to a network. Connection

costs directly attributable to the income deferred are recognised over the same period. Where connection costs exceed connection revenues, the excess

costs are charged in the profit and loss account immediately upon activation of the handset.

(c) Goodwill and other intangibles

Under UK GAAP, the policy followed prior to the introduction of FRS 10, “Goodwill and Intangible Assets” (which is effective for accounting periods ended

on or after 23 December 1998 and was adopted on a prospective basis) was to write off goodwill against shareholders’ equity in the year of acquisition.

FRS 10 requires goodwill to be capitalised and amortised over its estimated useful economic life. Under US GAAP, following the introduction of SFAS No. 142,

“Goodwill and Intangible Assets”, which is effective for accounting periods starting 15 December 2001 and, transitionally, for acquisitions completed after

30 June 2001, intangible assets with finite lives continue to be capitalised and amortised over their useful economic lives. Goodwill and intangible assets

with indefinite lives are capitalised and not amortised, but tested for impairment, at least annually, in accordance with SFAS No. 142.

For the year ended 31 March 2002, under US GAAP, the goodwill related to the acquisition of the interests in J-Phone Group and Japan Telecom that

occurred after 30 June 2001, has not been amortised but has been tested for impairment. All intangible assets are amortised over their estimated

useful lives.

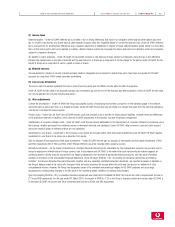

Investments in associated undertakings, under US GAAP, can also include an element of goodwill in the amount of the excess investment over the acquirer’s

share in the fair value of the net assets at the date of the investment. Under UK GAAP, the treatment followed prior to the implementation of FRS 10 was to

write off the excess of the purchase consideration over the fair value of the stake in the associated undertaking acquired against shareholders’ equity in the

year of purchase. FRS 10 now requires goodwill to be capitalised and amortised over its useful economic life. Under US GAAP, goodwill and intangible assets

arising on the acquisition of an equity stake continues to be capitalised and amortised in accordance with the requirements of APB 17, “Intangible Assets”.

Under UK GAAP and US GAAP the purchase price of a transaction accounted for as an acquisition is based on the fair value of the consideration. In the case

of share consideration, under UK GAAP the fair value of such consideration is based on the share price at completion of the acquisition or the date when the

transaction becomes unconditional. Under US GAAP the fair value of the share consideration is based on the average share price over a reasonable period of

time before and after the proposed acquisition is agreed to and announced. This will result in a difference in the fair value of the consideration for the

acquisition and consequently in the amount of goodwill capitalised and amortised.

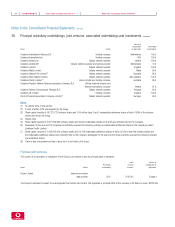

The adjustment to net (loss)/income in respect of the amortisation of goodwill and other intangibles comprises £8,980m (2001: £4,662m, 2000: £170m)

in respect of subsidiary undertakings and £736m (2001: £631m, 2000: £255m) in respect of joint ventures and associated undertakings. The adjustment

to shareholders’ equity comprises £50,494m (2001 as restated: £54,044m) in respect of subsidiary undertakings and £11,271m (2001 as restated:

£12,190m) in respect of joint ventures and associated undertakings.

(d) Reorganisation costs

Under UK GAAP, costs incurred in reorganising acquired businesses are charged to the profit and loss account as post-acquisition expenses. Under US GAAP,

certain of such costs are considered in the allocation of purchase consideration and thereby the determination of goodwill arising on acquisition.

(e) Capitalised interest

Under UK GAAP, the Group’s policy is not to capitalise interest costs on borrowings in respect of the acquisition of tangible and intangible fixed assets. Under

US GAAP, the interest cost on borrowings used to finance the construction of network assets is capitalised during the period of construction until the date

that the asset is placed in service. Interest costs on borrowings to finance the acquisition of licences are also capitalised until the date that the related

network service is launched. Capitalised interest costs are amortised over the estimated useful lives of the related assets.