Vodafone 2002 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F Notes to the Consolidated Financial Statements126

Notes to the Consolidated Financial Statements continued

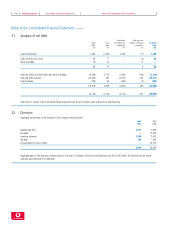

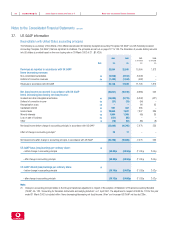

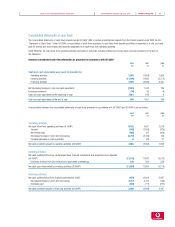

37. US GAAP information

Reconciliation with United States accounting principles

The following is a summary of the effects of the differences between US Generally Accepted Accounting Principles (‘US GAAP’) and UK Generally Accepted

Accounting Principles (‘UK GAAP’) that are significant to Vodafone. The principles are set out on pages 127 to 130. The translation of pounds sterling amounts

into US dollars is provided based on the noon buying rate on 29 March 2002 of £1 : $1.4250.

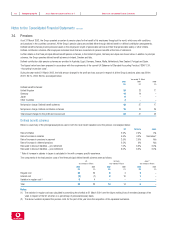

2002 2002 2001 2000

as restated as restated

Note $m £m £m £m

Revenues as reported in accordance with UK GAAP 32,554 22,845 15,004 7,873

Items decreasing revenues:

Non-consolidated subsidiaries (a) (5,930) (4,162) (3,409) –

Deferral of connection revenues (b) (1,488) (1,044) (492) –

Revenues in accordance with US GAAP 25,136 17,639 11,103 7,873

Net (loss)/income as reported in accordance with UK GAAP (23,021) (16,155) (9,885) 542

Items (increasing)/decreasing net (loss)/income:

Goodwill and other intangibles amortisation (c) (13,849) (9,719) (5,302) (427)

Deferral of connection income (b) (21) (15) (54) –

Reorganisation costs (d) ––84 25

Capitalised interest (e) 551 387 365 –

Income taxes (f) 10,868 7,627 7,847 386

Minority interests (g) 1,864 1,308 (40) 35

Loss on sale of business (h) (121) (85) ––

Other (i) (76) (53) (86) (8)

Net (loss)/income before change in accounting principle, in accordance with US GAAP (23,805) (16,705) (7,071) 553

Effect of change in accounting principle(1) 25 17 ––

Net (loss)/income after change in accounting principle, in accordance with US GAAP (23,780) (16,688) (7,071) 553

US GAAP basic (loss)/earnings per ordinary share : (l)

– before change in accounting principle (35.03)¢ (24.58)p (11.51)p 2.04p

– after change in accounting principle (34.99)¢ (24.56)p (11.51)p 2.04p

US GAAP diluted (loss)/earnings per ordinary share: (l)

– before change in accounting principle (35.15)¢ (24.67)p (11.52)p 2.02p

– after change in accounting principle (35.12)¢ (24.64)p (11.52)p 2.02p

Note:

(1) Change in accounting principle relates to the Group’s transitional adjustment in respect of the adoption of Statement of Financial Accounting Standard

(“SFAS”) No. 133, “Accounting for Derivative Instruments and Hedging Activities”, on 1 April 2001. The adjustment in respect of SFAS No. 133 for the year

ended 31 March 2002 is included within “Items (increasing)/decreasing net (loss)/income: Other”and increased US GAAP net loss by £38m.