Vodafone 2002 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements Vodafone Group Plc 113Annual Report & Accounts and Form 20-F

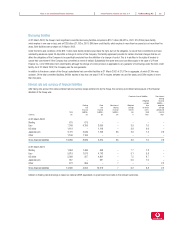

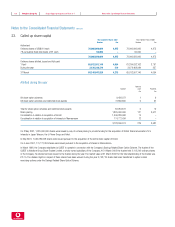

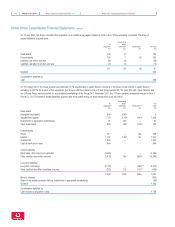

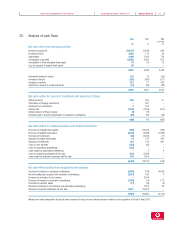

Notes:

(1) Representing 100% of the net assets of Japan Telecom and the J-Phone Group.

(2) The revaluations are provisional and may be subject to adjustment in the year ending 31 March 2003.

(3) Elimination of acquired intangible fixed assets, including goodwill.

(4) Adjustments to depreciation of tangible fixed assets to bring policy in line with the Group.

(5) Revaluation of certain tangible fixed assets to fair value.

(6) Reclassification of certain prepayments and deposits to debtors.

(7) Revaluation of certain investments to fair value.

(8) Reclassification of certain prepayments and deposits from investments, and adjustments to deferred tax assets.

(9) Primarily revaluation of acquired tax balances.

(10) Revaluation of long term borrowings to fair value.

(11) Recognition of provisions in relation to customer loyalty programme.

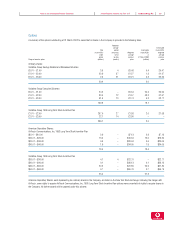

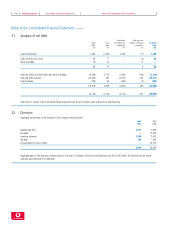

Impact on cash flow

Japan Telecom and the J-Phone Group contributed £808m to the Group’s net operating cash flows, paid £111m in respect of returns on investments and

servicing of finance, paid £118m in respect of taxation, utilised £775m for investing activities and contributed £25m from acquisitions and disposals.

Pre-acquisition results of Japan Telecom and the J-Phone Group

The profit after tax of Japan Telecom and the J-Phone Group for the period from 1 April 2001 to 1 June 2001, and for the year ended 31 March 2001

was £120m and £226m, respectively, prepared under Japanese GAAP and translated at the average exchange rates for the periods of £1 : ¥175.1 and

£1 : ¥163.8, respectively.

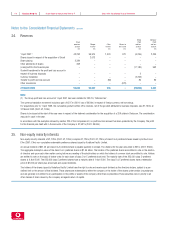

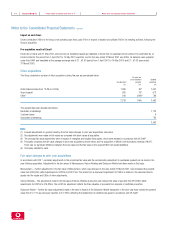

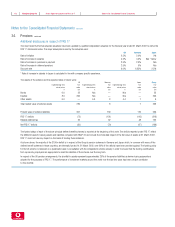

Acquisition of Eircell

Further details of the transaction can be found under “Information on the Company – Acquisitions of businesses”.

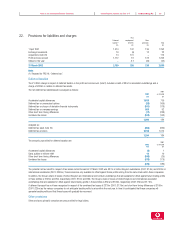

Accounting

At policy

acquisition conformity Revaluations(1) Fair value

£m £m £m £m

Tangible fixed assets 276 24(2) –300

Current assets 60 – 2(3) 62

Current liabilities (248) –(18)(3) (266)

Long-term borrowings (6) – 6 –

Net assets 82 24 (10) 96

Goodwill 2,003

Consideration satisfied by:

Ordinary shares in the Company 2,099

Notes:

(1) The revaluations are provisional and may be subject to adjustment in the year ending 31 March 2003.

(2) Adjustments to tangible fixed assets to bring depreciation policy in line with the Group.

(3) Revaluation of certain current assets and liabilities to fair value.