Vodafone 2002 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

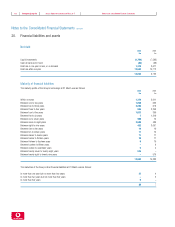

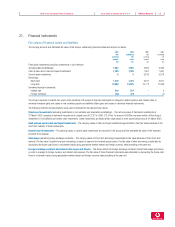

Notes to the Consolidated Financial Statements Vodafone Group Plc 99Annual Report & Accounts and Form 20-F

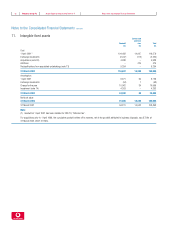

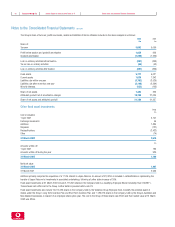

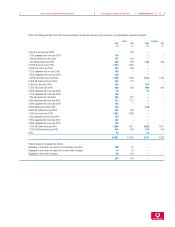

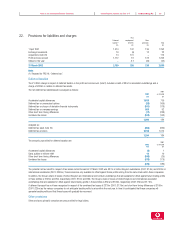

A deferred tax asset of £865m, has been recognised as at 31 March 2002 (2001 as restated: £830m). This asset relates to unvested options (£26m),

closure of derivative financial instruments (£101m) and short term timing differences and losses (£738m). The directors are of the opinion, based on recent

and forecast trading, that the level of profits and deferred tax liabilities booked in the current and next financial year will exceed the deferred tax assets being

recognised.

The Company’s deferred tax asset of £101m (2001: £118m) is in respect of the closure of derivative financial instruments. Deferred tax assets not

recognised amounted to £32m at March 2002 (2001: £37m) and arose from other timing differences.

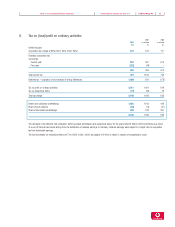

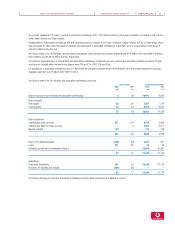

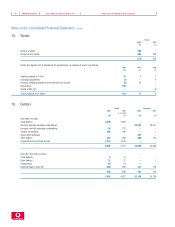

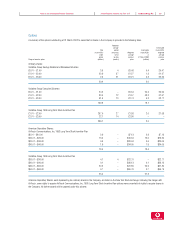

Debtors are stated after allowances for bad and doubtful debts, an analysis of which is as follows:

2002 2001 2000

£m £m £m

Opening balance at 1 April 293 132 27

Exchange adjustments 29 (20) (4)

Amounts charged to the profit and loss account 196 127 71

Acquisitions 108 172 77

Disposals –(71) –

Assets written off (100) (47) (39)

Closing balance at 31 March 526 293 132

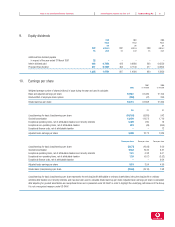

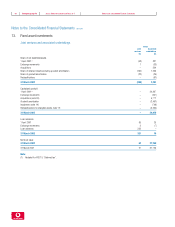

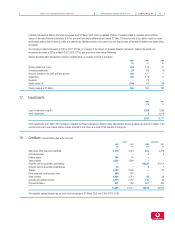

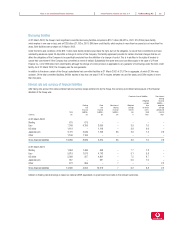

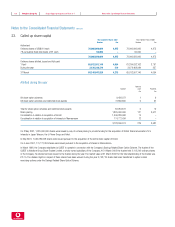

17. Investments

2002 2001

£m £m

Liquid investments (note 31) 1,789 7,593

Other investments 35,618

1,792 13,211

Other investments at 31 March 2001 primarily comprised the Group’s remaining interest in Atecs Mannesmann AG and a balancing payment in relation to the

exercise of an option over France Telecom shares acquired by the Group as a result of the disposal of Orange plc.

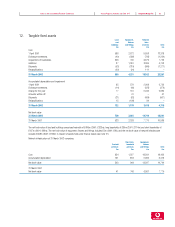

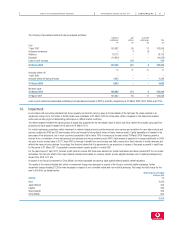

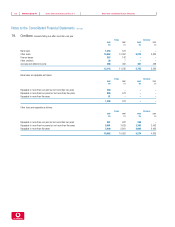

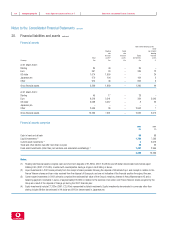

18. Creditors: amounts falling due within one year

Group Company

2002 2001 2002 2001

£m £m £m £m

Bank loans, other loans and overdrafts 1,219 3,601 810 3,376

Commercial paper ––44

Finance leases 100 10 ––

Trade creditors 3,335 1,899 ––

Amounts owed to subsidiary undertakings ––68,532 61,872

Amounts owed to associated undertakings 10 741

Taxation 3,107 2,540 –31

Other taxes and social security costs 509 285 ––

Other creditors 1,485 1,314 42 66

Accruals and deferred income 3,179 2,257 170 29

Proposed dividend 511 464 511 464

13,455 12,377 70,073 65,843

The weighted average interest rate on short-term borrowings at 31 March 2002 was 3.0% (2001: 5.8%).