Vodafone 2002 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Board, on the recommendation of the Remuneration Committee, has

adopted the new policy to apply as from the start of the current financial year

(2002/2003) and the following is the policy statement that will be submitted for

an advisory shareholder vote at the Annual General Meeting on 31 July 2002:

Total remuneration levels

Under the new policy, Vodafone will benchmark total remuneration levels against

other large European parented companies, using externally provided pay data.

Total remuneration for these purposes means the sum of base salary, short,

medium and long term incentives. The European focus has been selected

because Europe is currently Vodafone’s biggest market and Vodafone is one of

the largest companies in Europe.

Award levels for the Chief Executive will be set by the Remuneration Committee

to deliver total remuneration that is between the top 25% and the top 10% of

the remuneration levels of other chief executives of large European companies.

This range has been selected to reflect Vodafone’s relative size in this region

and to recognise that Vodafone also has significant interests outside of the

region. The monetary values of the market data for this range are from

£3.4 million to £9.3 million per annum for chief executives of large European

companies. Awards of short, medium and long term incentives have been

determined so that these levels would only be delivered if the Company achieves

exceptionally demanding performance levels. The equivalent range of monetary

values of total remuneration for chief executives of large US companies and US

high technology companies is £22.5 million to £45.5 million.

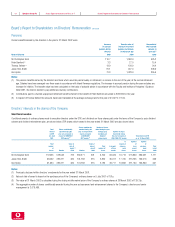

Vodafone Group Plc Annual Report & Accounts and Form 20-F Board’s Report to Shareholders on Directors’ Remuneration58

Board’s Report to Shareholders on Directors’ Remuneration continued

The total remuneration levels of other executive directors will be at approximately

65% of the Chief Executive level for the Chief Operating Officer and at

approximately 50% of the Chief Executive level for the other executive directors.

Incentive awards

Executive directors will be eligible to receive a deferred share bonus,

performance shares and share options, the release of which are dependent

upon achievement of performance targets.

Awards will be delivered in ordinary shares of Vodafone Group Plc. All awards will

be made under plans that incorporate dilution limits that are set out in the

Guidelines for Share Incentive Schemes published by the Association of British

Insurers. These Guidelines have been developed to provide a framework for the

development of share incentive schemes that link remuneration to performance

and align the interests of participating directors and senior executives with those

of shareholders.

Deferred share bonus

This short/medium term incentive is aimed at focusing executive directors on the

business priorities for the next financial year. No changes have been made under

the new policy to this aspect of Vodafone’s executive director remuneration policy

which will continue to be provided through the Vodafone Group Short Term

Incentive Plan (“STIP”).

The STIP comprises two elements: a base award that is determined by reference

to one-year performance targets and an enhancement award. The base award is

delivered in the form of shares, receipt of which is deferred for a further two

years. An enhancement award of up to 50% of the number of shares comprised

in the base award may be payable, subject to the achievement of a subsequent

two-year performance target following the initial twelve-month period. Release of

the base award and the enhancement award after the total three-year period is

dependent upon the continued employment of the participant.

Demanding base award performance targets are set annually by the

Remuneration Committee and are linked to business strategy. For the current

year, the performance measures are related to EBITDA, free cash flow and ARPU.

The targets are not disclosed as they would give clear indication of Vodafone’s

budgetary targets which are share price sensitive. The enhancement award

performance targets are related to the achievement of EPS growth targets.

More information on the STIP awards is given in the following section that

reports on 2001/2002 executive directors’ remuneration.

The Group may, at its discretion, pay a cash sum up to the value of the base

award in the event that an executive director declines the base award of shares

after the first year. In these circumstances, the executive director will cease to be

eligible to receive the related enhancement award.

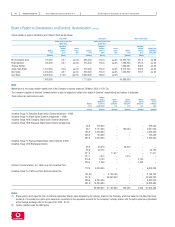

Performance shares

Performance shares will be awarded to executive directors each year to align

their interests with those of shareholders. The Vodafone Group Plc 1999 Long

Term Stock Incentive Plan will be the vehicle for the provision of these incentive

awards. Vesting of the performance shares will depend upon the Company’s

relative total shareholder return (“TSR”) performance. TSR measures the change

in value of a share and reinvested dividends over the period of measurement.

The overriding objective of the new policy on incentives is to ensure that

Vodafone is able to attract, retain and motivate executives of the highest

calibre essential to the successful leadership and effective management of a

global company at the leading edge of the telecommunications industry.

To achieve this objective, Vodafone, from the context of its UK domicile,

takes into account both the UK regulatory framework, including best practice

in corporate governance, shareholder views, political opinion and the

appropriate geographic and nationality basis for determining competitive

remuneration, recognising that this may be subject to change over time as

the business evolves.

The total remuneration will be benchmarked against the relevant market.

Vodafone is one of the largest companies in Europe and is a global business;

Vodafone’s policy will be to provide executive directors with remuneration

generally at levels that are competitive with the largest companies in Europe.

A high proportion of the total remuneration will be awarded through

performance-related remuneration, with phased delivery over the short,

medium and long term. For executive directors, approximately 80% of the

total expected remuneration will be performance-related.

Performance measures will be balanced between absolute financial measures

and sector comparative measures to achieve maximum alignment between

executive and shareholder objectives.

All medium and long term incentives are delivered in the form of Vodafone

shares and options. Executive directors are required to comply with share

ownership requirements.