Vodafone 2002 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

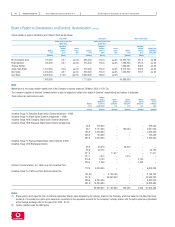

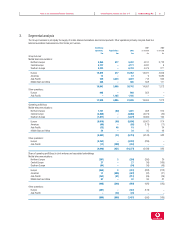

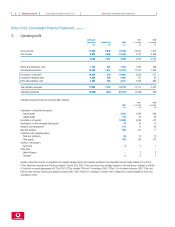

Vodafone Group Plc Annual Report & Accounts and Form 20-F Consolidated cash flows for the years ended 31 March76

2002 2002 2001 2000

Note $m £m £m £m

Net cash inflow from operating activities 30 11,545 8,102 4,587 2,510

Dividends received from joint ventures and associated undertakings 198 139 353 236

Net cash outflow for returns on investments and servicing of finance 30 (1,334) (936) (47) (406)

Taxation (776) (545) (1,585) (325)

Net cash outflow for capital expenditure and financial investment 30 (6,337) (4,447) (19,011) (756)

Net cash (outflow)/inflow from acquisitions and disposals 30 (10,960) (7,691) 30,653 (4,756)

Equity dividends paid (1,393) (978) (773) (221)

Cash (outflow)/inflow before management of liquid resources and financing (9,057) (6,356) 14,177 (3,718)

Management of liquid resources 10,035 7,042 (7,541) (33)

Net cash (outflow)/inflow from financing

Issue of ordinary share capital 5,103 3,581 65 362

Issue of shares to minorities 17 12 44 37

Capital element of finance lease payments (66) (46) (9) –

Debt due within one year:

(Decrease)/increase in short-term debt (3,542) (2,486) (407) 598

Repayment of debt acquired (1,790) (1,256) (7,181) (449)

Issue of new bonds ––2,823 –

Debt due after one year:

Increase/(decrease) in long-term debt 9646 (550)

Repayment of debt acquired (1,412) (991) (2,072) (377)

Issue of new bonds 719 505 – 4,246

Net cash (outflow)/inflow from financing (962) (675) (6,691) 3,867

Increase/(decrease) in cash in the year 16 11 (55) 116

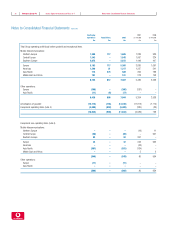

Reconciliation of net cash flow to movement in net debt

Increase/(decrease) in cash in the year 16 11 (55) 116

Cash outflow/(inflow) from decrease/(increase) in debt 6,082 4,268 6,800 (3,468)

Cash (inflow)/outflow from (decrease)/increase in liquid resources (10,035) (7,042) 7,541 33

(Increase)/decrease in net debt resulting from cash flows (3,937) (2,763) 14,286 (3,319)

Net debt acquired on acquisition of subsidiary undertakings (4,440) (3,116) (13,726) (2,133)

Translation difference 737 517 (629) 316

Other movements 71 50 (10) 1

Increase in net debt in the year (7,569) (5,312) (79) (5,135)

Opening net debt (9,578) (6,722) (6,643) (1,508)

Closing net debt 31 (17,147) (12,034) (6,722) (6,643)

The accompanying notes are an integral part of these Consolidated Financial Statements.

Consolidated cash flows for the years ended 31 March