Vodafone 2002 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report & Accounts and Form 20-FChief Executive’s Statement 5

Chief Executive’s Statement

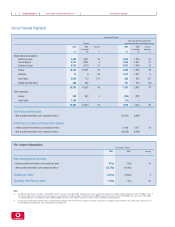

Group turnover was up 52% on last year at £22.8

billion and profit before tax, goodwill and exceptional

items was up 35% at £7.0 billion. Adjusted earnings

per share, before goodwill and exceptional items,

of 5.15 pence was up 45% and is now at a higher

level than before the Mannesmann acquisition,

ahead of the expectations we had at that time.

Free cash flow, after paying for licences, of £2.4

billion and Group net debt at 31 March of £12.0

billion were both better than our expectations and

demonstrate good control of capital expenditure and

an excellent working capital performance from the

operating companies.

The Group’s proportionate EBITDA margin before

exceptional items for the mobile businesses was

36% and total proportionate EBITDA margin,

including fixed wire and exceptional costs, was

33%, both up 3 percentage points on last year.

These improvements arise from the successful

implementation of new commercial policies, better

overhead management across most of the businesses

in the Group and lower exceptional costs.

With respect to business operations, we have seen

stability in average revenue per user (ARPU) during

the year in most markets and satisfactory customer

growth with a better mix of the customer base in

most markets.

Data revenues rose by 87% to £2.1 billion,

representing 11% of service revenues for the year

as a whole, up 3 percentage points. For the month

of March 2002, data contributed 13% of service

revenues, up 4 percentage points from March 2001.

Vodafone gained control of J-Phone Vodafone in

October 2001 and it was pleasing that it achieved

its highest ever market share in Japan for the

remainder of the year, moving into second place

in the Japanese market by the end of March. Also,

during the last year 4 million J-Phone Vodafone

customers, equivalent to one third of its customer

base, have bought camera phones. The rapid

adoption rate of the Sha-mail picture messaging

service has made it the fastest growing new

application yet seen in mobile telecommunications,

considerably outperforming SMS.

We have always seen this coming financial year

as a key transition year in the move from continued

revenue growth arising from new customer

additions, to enhanced revenue growth, primarily

from additional customer usage.

We envisage net customer growth next year of just

under 10%, allowing for the continuing need to

disconnect registered SIMs that are non-revenue

generating. At the same time we expect an

improvement in the customer mix through continued

growth in contract customers, arising in part through

competitive gain.

In addition to customer growth, we expect a modest

but real improvement in ARPU in most of our major

European markets despite reductions in incoming

call termination charges and a planned reduction

in international roaming tariffs to enhance our

competitive position.

The improvement in revenue should arise from

several different sources but primarily from the

continuing increase in data revenues from new

applications, such as picture messaging, the much

greater usage of new voice services introduced last

year, competitive gain of high spending customers

and a further increase in active customers in our

registered base.

The combination of customer growth and the

envisaged growth in ARPU should lead to double-

digit revenue growth. In addition, we will continue

our focus on improved operational performance and

expect to achieve further improvements in EBITDA

margin. Together, this will generate still better

operating cash flow in the year ahead.

On free cash flow, we expect continued good control

of capital expenditure, achieving an efficiency ratio

(capital expenditure to sales) of approximately 20%,

even with much greater expenditure on 3G this year

than last, as a prelude to the opening of 3G

services. Though we expect to increase capital

expenditure by just under £2 billion on this year’s

figure, we envisage generating similar free cash flow

this year as we did last year.

Our focus is selling more products to more of our

This year has seen the Group execute successfully the adjustments

to our strategy, announced last year, to deliver very strong operational

performance and excellent financial results.

Sir Christopher Gent

Chief Executive