Vodafone 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

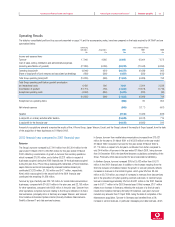

Operating and Financial Review and Prospects Vodafone Group Plc 39Annual Report & Accounts and Form 20-F

Turnover for the Middle East and Africa region comprises the turnover of the

Group’s Egyptian subsidiary. The almost three-fold increase in turnover from

£117 million for the year ended 31 March 2000 to £308 million for the year

ended 31 March 2001, reflects strong customer growth in Egypt, where the

customer base increased from 405,000 customers at 31 March 2000 to

1,171,000 customers at 31 March 2001.

Turnover for the Group’s other operations mainly comprises turnover relating to

Arcor and Telecommerce, which has subsequently been renamed Vodafone

Information Systems GmbH. Arcor is the leading wireline competitor to Deutsche

Telekom in Germany and provides telecommunication services for Deutsche

Bahn AG, the German railway company. By 31 March 2001, Arcor had more than

2.2 million contract voice customers and more than 16.2 billion voice and

internet minutes were switched over its network in the financial year. The

revenue of Arcor in the year ended 31 March 2001 reached approximately

11.6 billion. Vodafone Information Systems GmbH provides a range of activities

for Group and external customers, from the maintenance of IT facilities to the

development of technologies and services supporting cellular networks. The main

contribution to revenue is derived from the IT-solutions business.

Mobile data revenues In the year to 31 March 2001, mobile data, including SMS,

data and internet services, accounted for 8.1% of service revenues in Vodafone’s

controlled subsidiaries, comprised of 7.7% for messaging and 0.4% for internet

data. Data service revenues reached 9.3% of service revenues in the month of

March 2001, up from 1% in the prior year. This reflects particularly strong

growth in SMS usage in controlled networks, which accounted for 8.8% of

service revenues in March 2001 for controlled subsidiaries. For the total Group

including associates, mobile data represented 6.2% of service revenues for the

year and 7.0% in March 2001, measured on a proportionate basis.

In the Group’s main markets of Germany, Italy and the United Kingdom, the

growth of data revenues, mainly SMS, has resulted in revenues from data and

internet services as a proportion of total service revenues increasing to 13.4%,

6.2% and 6.6%, respectively, for the year ended 31 March 2001. Data and

internet revenues in Germany, Italy and the United Kingdom represented 16.2%,

7.2% and 7.6%, respectively, of service revenues in March 2001. SMS revenues

were the principal component of these revenue streams and represented

approximately 97% of data revenues in Germany and Italy, and over 85% of data

revenues in the United Kingdom.

For J-Phone Vodafone, the Group’s associated undertaking in Japan, data

revenues represented 12.9% of service revenues in March 2001. Internet data is

the main component of data revenues, representing 8.2% of total service

revenues. A driver of this growth in Japan is the ability to access mobile internet

services using phones with an “always-on”capacity, which differentiates the

service in Japan from the Group’s other main markets. Almost 62% of J-Phone

Vodafone’s customers now have internet-capable phones, a higher proportion of

its customer base than any other operator in Japan.

Operating profit and costs

The total Group operating loss of £6,989 million for the year ended 31 March

2001 compares with a total Group operating profit of £798 million for the year

ended 31 March 2000. This is after amortisation charges for goodwill of

£11,873 million (2000: £1,710 million) and charging exceptional operating costs

of £320 million (2000: £30 million). Before goodwill and exceptional operating

costs, total Group operating profit more than doubled from £2,538 million for the

year ended 31 March 2000 to £5,204 million for the year ended 31 March

2001. The increase in the goodwill amortisation charge from £1,710 million for

the year ended 31 March 2000 to £11,873 million for the year ended 31 March

2001 is primarily due to amortisation of the goodwill arising from the acquisition

of Mannesmann, provisionally calculated to be £83 billion, goodwill on formation

of the Verizon Wireless partnership and a full year’s amortisation charge for

goodwill relating to the acquired AirTouch operations (excluding US businesses

contributed to Verizon Wireless). These charges for goodwill amortisation have

not affected the cash flows of the Group.

Exceptional operating costs of £320 million primarily comprise impairment

charges of £91 million in relation to the carrying value of certain assets within

the Group’s Globalstar service provider businesses described below, exceptional

reorganisation costs of £85 million relating to the restructuring of the Group’s

operations in Germany and the US, and £141 million in relation to the Group’s

share of the restructuring costs incurred by Verizon Wireless.

In Europe, total Group operating profit, before goodwill amortisation and

exceptional items, increased from £1,661 million in the year ended 31 March

2000 to £3,830 million in the year ended 31 March 2001, including operating

profit from acquisitions of £2,300 million. This increase primarily reflects the

rapid growth in customer numbers in all major markets, the acquisition of

Mannesmann, the Group’s increased shareholding in Airtel and the acquisition of

a 25% equity interest in Swisscom Mobile. In Germany, connection and

marketing costs associated with the near doubling of the customer base lowered

the margin on earnings before interest, tax, depreciation and amortisation, or

EBITDA, of D2 Vodafone by six percentage points to 35%. This represents an

improvement on the 30% margin reported in the first half of the financial year,

partly due to the implementation of changes to commercial policies as D2

Vodafone focused on maximising economic returns rather than continuing to

increase the size of its customer base. In Italy, which has much lower equipment

subsidies, customer growth of 40% during the year contributed to an EBITDA

margin of 45%, an increase of three percentage points over last year. In the

United Kingdom, total operating profit before goodwill amortisation increased

13% from £706 million for the year ended 31 March 2000 to £795 million for

the year ended 31 March 2001. The percentage growth in operating profit was

less than the percentage increase in turnover as increased usage was offset by

connection costs on customer growth and tariff reductions. In the rest of the

Europe region, strong operating results were reported throughout, with

particularly strong improvements in profit margins in the Group’s subsidiaries in

Greece, the Netherlands and Spain.

In the United States, total Group operating profit, before goodwill amortisation

and exceptional costs, increased from £541 million during the year to 31 March

2000 to £1,237 million for the year ended 31 March 2001. This reflects the

inclusion of the results of US operations for a full twelve month period, the

profitable trading of Verizon Wireless during the year, as the business has

focused on gaining high value customers through new customer additions and

the migration of existing analogue customers to digital price plans, offset by the

costs of migrating US customers from analogue to digital networks.

Total Group operating profit, before goodwill amortisation, for the Asia Pacific

region increased by £17 million, from £188 million for the year ended 31 March

2000 to £205 million for the year ended 31 March 2001. This increase reflects