Vodafone 2002 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F Information on the Company10

g) Disposal of holding in Ruhrgas AG On 30 October 2001, the Group

announced that it had reached agreement with E.ON AG for the sale of the

Group’s 23.6% stake in Bergemann GmbH, through which it held an 8.2%

stake in Ruhrgas AG. Completion of the transaction is conditional on approval

from German competition authorities.

Disposal of Shinsegi Telecom, Inc. On 24 August 2001, the Group

announced that agreement had been reached to sell its 11.7% equity stake

in Shinsegi Telecom, Inc. for an undisclosed amount to SK Telecom, Ltd.

The value of net assets disposed of represented less than 1% of the Group’s

net assets.

Formation of Verizon Wireless

On 3 April 2000, the first stage of the transaction for the combination of the US

cellular operations of the Company, Bell Atlantic and GTE was completed. The

combined entity, which initially consisted of the US cellular operations of AirTouch

and Bell Atlantic, was launched as Verizon Wireless. Following completion of the

merger of Bell Atlantic and GTE to form Verizon Communications, the second

stage of the transaction was completed by the contribution of the US cellular

operations of GTE to Verizon Wireless on 10 July 2000, creating a nationwide

network on a single digital technology, covering almost 90% of the US population

and 96 of the top 100 mobile telecommunications markets within the United

States. The Group owns 45% of Verizon Wireless.

The formation of Verizon Wireless resulted in net proceeds to the Group of

approximately £2.5 billion relating to the assumption of Group debt agreed with

the other parties. Further proceeds of £2.0 billion have been realised to date

following the disposal of overlapping properties in the US, such disposals being

a condition of the regulatory approval of the transaction.

Information on the Company continued

Business Overview

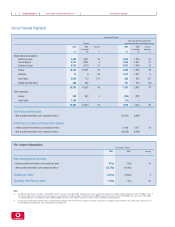

Revenues and operating income

The following table shows consolidated Group turnover and consolidated total Group operating (loss)/profit for the three years ended 31 March 2002, by geographic

region.

Years ended 31 March

Group turnover Total Group operating (loss)/profit

2002 2001 2000 2002 2001 2000

£m £m £m £m £m £m

Mobile telecommunications:

Northern Europe 5,432 4,511 3,723 757 618 830

Central Europe 4,177 4,031 6 (4,833) (4,991) (215)

Southern Europe 6,743 4,479 877 (1,971) (2,076) 146

Europe 16,352 13,021 4,606 (6,047) (6,449) 761

Americas 12 9 2,585 (555) (210) (98)

Asia Pacific 4,072 713 565 (198) (92) 8

Middle East and Africa 306 308 117 131 181 127

20,742 14,051 7,873 (6,669) (6,570) 798

Other operations:

Europe 998 953 –(4,733) (419) –

Asia Pacific 1,105 ––(432) ––

22,845 15,004 7,873 (11,834) (6,989) 798

Other operations analysed in the above table principally comprise the results of

Arcor, Mannesmann’s fixed line business in Germany, Cegetel of France, Vizzavi

Europe, the Group’s consumer portal joint venture with Vivendi Universal, and

Japan Telecom.

Total Group operating losses of £11,834 million for the year ended 31 March

2002 (2001: £6,989 million, 2000: profit of £798 million) including exceptional

operating costs of £5,408 million (2001: £320 million, 2000: £30 million) and

goodwill amortisation of £13,470 million (2001: £11,873 million, 2000: £1,710

million). See note 3 to the Consolidated Financial Statements, “Segmental

analysis”, for a further analysis of business segment information.