Vodafone 2002 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2002 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report & Accounts and Form 20-F Information on the Company18

to China Mobile’s board of directors. The subscription is expected to complete

in June 2002.

At 31 March 2002, China Mobile had approximately 74,402,000 registered

customers and is the second largest mobile telecommunications company in

the world, after the Company, in terms of number of proportionate registered

customers.

Australia and New Zealand

Network operations in Australia and New Zealand, both of which operate under

the Vodafone brand name, increased their registered customer base by an

aggregate 8% in the 2002 financial year, ending the year with 3,241,000

registered venture customers.

Australia and New Zealand operate digital networks based on the GSM technical

standard, providing coverage to approximately 92% and 97% of the population,

respectively. The digital network in Australia consists of approximately 2,085

operational base stations, 16 base station controllers and 12 mobile switching

centres. In New Zealand, the digital network consists of approximately 695

operational base stations that are controlled by 24 base station controllers and

are managed by 5 mobile switching centres.

In Australia, which is a highly competitive market with five mobile networks,

Vodafone’s customer base increased by 35,000 net new customers, giving a

market share of approximately 17%, compared with 19% at 31 March 2001.

In New Zealand, strong growth continued with an 23% increase in the registered

customer base to 1,095,000.

Australia and New Zealand acquired 3G spectrum for A$254 million (£87 million)

and NZ$29 million (£8 million), respectively, in recent auctions conducted in

these countries and both expect to introduce 3G services by 2004, to coincide

with the expected mass-market availability of dual-mode handsets.

On 22 June 2001, the Group announced that it had acquired an interest in

97.8% of the share capital of Mobile Communications Holdings Limited (“MCH”)

and, in accordance with the terms of the agreement, has since acquired the

remaining MCH shares. MCH held an interest in 4.5% of the Group’s Australian

subsidiary, Vodafone Pacific Limited. As a result of the transaction, the Group’s

effective interest in its Australian operations increased from 91% to 95.5%.

On 3 May 2002, the Group completed its purchase of the remaining 4.5%

minority interest in Vodafone Pacific Limited, as a result of which Vodafone

Pacific Limited became a wholly owned subsidiary undertaking.

Middle East and Africa

The Group’s operations and ownership interests in the Middle East and Africa

Region comprise Vodafone Egypt Telecommunications Company SAE (“Vodafone

Egypt”) (60%), Safaricom Limited in Kenya (30%) and Vodacom Group (Pty) Limited

in South Africa (31.5%).

The closing registered customer base of the ventures in the Middle East and

Africa region increased to 8,715,000 at 31 March 2002, which represents

growth of 37% on the closing registered customer base at 31 March 2001.

Egypt

Vodafone Egypt is Egypt’s second largest mobile operator, and operates under

the brand name Vodafone. Since its launch in November 1998, it has increased

the number of customers connected to its network to approximately 1,718,000

by 31 March 2002.

In Egypt, Vodafone offers both contract and prepaid services, with prepaid

customers representing approximately 87% of the customer base.

On 2 May 2002, Vivendi Telecom International notified the Group that, pursuant

to a put option agreement, it is required to purchase 8,400,000 shares in

Vodafone Egypt. As a result of the transaction, the Group’s interest in Vodafone

Egypt will increase from 60% to 67%.

South Africa

Vodacom is South Africa’s largest mobile operator. Its customer base increased

by 28% in the 2002 financial year to over 6,557,000 registered customers, of

whom approximately 83% are connected to the prepaid service, Vodago.

Vodacom also has a licence to operate in Tanzania where it launched services in

August 2000. During the 2002 financial year, Vodacom continued to expand into

Africa and, in December 2001, formed a joint venture in the Democratic Republic

of the Congo.

Kenya

Safaricom is the largest operator in Kenya, having a market share of 58% and

registered customer base of 440,000 at 31 March 2002.

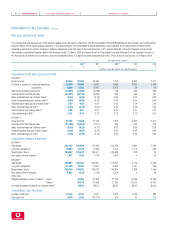

Mobile data services

Revenue streams from messaging data and internet data services (“data

revenues”) increased 87% to £2,093 million for the 2002 financial year, and

represented over 11% of service revenues in the Group’s controlled subsidiaries

during the year. For the month of March 2002, data revenues as a percentage of

service revenues increased to over 13%.

These results include, for the first time, a contribution from GPRS services, which

have now been launched in almost all of the Group’s major markets. The Group

expects that the “always-on”feature of GPRS handsets, combined with colour

screens and a generally wider choice of handsets, will accelerate the take-up

and usage of data services, including internet-based services.

During the 2002 financial year, the Group has amended its target for data

revenues. Previously, the target was to derive between 20% and 25% of service

revenues from data services by March 2004. However, due to a combination of

better than expected levels of voice revenues and delays in the availability of

GPRS applications and terminals, the target has been revised to achieve 20% of

service revenues from data services in 2004.

Further details on the Group’s strategy and plans for the development of data

services can be found in “Strategic developments – Products and services”,

below.

Third generation licences and network infrastructure

The Group has secured 3G licences in all jurisdictions in which it operates and in

which such licences have been awarded to date. Further details can be found in

“Information on the Company – Business Overview – Business Activities –

Mobile Telecommunications” above.

Cumulative expenditure on 3G licences was £13.4 billion at 31 March 2002

and was funded from the Group’s existing borrowing facilities. Most of this

expenditure (£13.1 billion) occurred during the 2001 financial year. During the

2002 financial year, the Group spent £325 million on intangible fixed assets,

including the acquisition of a further two 3G licences, in Greece and Australia,

Information on the Company continued