TCF Bank 2001 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

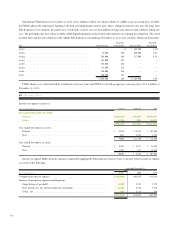

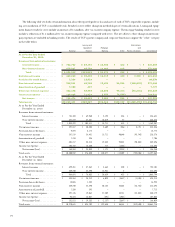

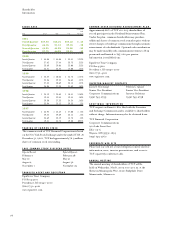

The following table sets forth certain information about the reported profit or loss and assets of each of TCF’s reportable segments, includ-

ing a reconciliation of TCF’s consolidated totals. Results for 2001 reflect changes in methodologies of certain allocations. Leasing and equip-

ment finance results for 2001 include an increase of $1.5 million, after-tax, in intercompany expense. The mortgage banking results for 2001

include a reduction of $1.2 million after-tax, in intercompany expense compared with 2000. The net offsets to these changes in intercom-

pany expenses are included in banking results. The results of TCF’s parent company and corporate functions comprise the “other” category

in the table below.

Leasing and Eliminations

Equipment Mortgage and

(In thousands) Banking Finance Banking Other Reclassifications Consolidated

At or For the Year Ended

December 31, 2001:

Revenues from external customers:

Interest income . . . . . . . . . . . . $ 722,722 $ 89,131 $ 14,334 $ 422 $ – $ 826,609

Non-interest income . . . . . . . . 313,501 45,730 12,042 213 – 371,486

Total. . . . . . . . . . . . . . . . . . $ 1,036,223 $134,861 $ 26,376 $ 635 $ – $ 1,198,095

Net interest income . . . . . . . . . . . $ 423,043 $ 39,429 $ 14,919 $ 433 $ 3,398 $ 481,222

Provision for credit losses . . . . . . . 7,359 13,519 – – – 20,878

Non-interest income. . . . . . . . . . . 313,501 45,730 15,439 96,829 (100,013) 371,486

Amortization of goodwill . . . . . . . . 7,350 427 – – – 7,777

Other non-interest expense . . . . . 432,298 38,369 20,893 99,274 (96,615) 494,219

Income tax expense . . . . . . . . . . . 109,063 12,410 3,577 (2,538) – 122,512

Net income. . . . . . . . . . . . . . . . $ 180,474 $ 20,434 $ 5,888 $ 526 $ – $ 207,322

Total assets . . . . . . . . . . . . . . . . . $10,982,411 $988,387 $374,263 $102,132 $(1,088,478) $11,358,715

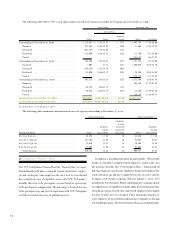

At or For the Year Ended

December 31, 2000:

Revenues from external customers:

Interest income . . . . . . . . . . . . . $ 751,103 $ 69,960 $ 5,192 $ 426 $ – $ 826,681

Non-interest income . . . . . . . . . 287,219 38,451 10,519 87 – 336,276

Total . . . . . . . . . . . . . . . . . . $ 1,038,322 $ 108,411 $ 15,711 $ 513 $ – $ 1,162,957

Net interest income. . . . . . . . . . . . . $ 397,887 $ 30,405 $ 5,609 $ (556) $ 5,191 $ 438,536

Provision for credit losses . . . . . . . . 9,594 5,178–––14,772

Non-interest income . . . . . . . . . . . 287,219 38,451 15,711 90,640 (95,745) 336,276

Amortization of goodwill . . . . . . . . . 7,310 396–––7,706

Other non-interest expense. . . . . . . 401,217 25,813 19,432 93,588 (90,554) 449,496

Income tax expense . . . . . . . . . . . . . 102,722 14,420 717 (1,266) – 116,593

Net income (loss). . . . . . . . . . . . $ 164,263 $ 23,049 $ 1,171 $ (2,238) $ – $ 186,245

Total assets . . . . . . . . . . . . . . . . . . . $ 10,800,942 $ 876,540 $ 130,477 $ 112,309 $ (722,806) $ 11,197,462

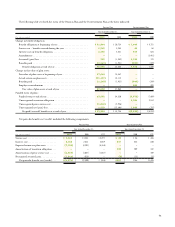

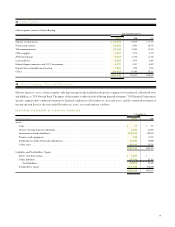

At or For the Year Ended

December 31, 1999:

Revenues from external customers:

Interest income . . . . . . . . . . . . . $ 699,451 $ 47,562 $ 4,668 $ 420 $ – $ 752,101

Non-interest income . . . . . . . . . 269,240 28,490 15,961 2 – 313,693

Total . . . . . . . . . . . . . . . . . . $ 968,691 $ 76,052 $ 20,629 $ 422 $ – $ 1,065,794

Net interest income. . . . . . . . . . . . . $ 398,264 $ 25,212 $ 6,029 $ (3,487) $ (1,805) $ 424,213

Provision for credit losses . . . . . . . . 15,065 1,858–––16,923

Non-interest income . . . . . . . . . . . 269,240 28,490 20,152 82,564 (86,753) 313,693

Amortization of goodwill . . . . . . . . . 7,320 393–––7,713

Other non-interest expense. . . . . . . 397,135 19,062 27,809 84,731 (88,558) 440,179

Income tax expense . . . . . . . . . . . . . 96,473 13,037 (491) (1,967) – 107,052

Net income (loss). . . . . . . . . . . . $ 151,511 $ 19,352 $ (1,137) $ (3,687) $ – $ 166,039

Total assets . . . . . . . . . . . . . . . . . . . $ 10,270,641 $ 524,702 $ 122,685 $ 56,188 $ (312,500) $ 10,661,716