TCF Bank 2001 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

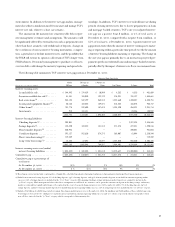

As previously noted, TCF also utilizes simulation models to esti-

mate the near-term effects (next twelve months) of changing interest

rates on its net interest income. Net interest income simulation involves

forecasting net interest income under a variety of scenarios, includ-

ing the level of interest rates, the shape of the yield curve, and spreads

between market interest rates. At December 31, 2001, net interest

income is estimated to increase by 3.1%, compared with the base case

scenario, over the next twelve months if interest rates were to sustain

an immediate increase of 200 basis points. At December 31, 2000,

net interest income was estimated to increase by .4%, compared with

the base case scenario, assuming a similar change in interest rates. If

interest rates were to decline by 200 basis points, net interest income

is estimated to decrease by 6.2%, compared with the base case sce-

nario, over the next twelve months. Simulations at December 31, 2000

projected a decrease in net interest income of 3.9%, compared with

the base case scenario, assuming a similar change in interest rates.

Management exercises its best judgment in making assumptions

regarding loan prepayments, early deposit withdrawals, and other non-

controllable events in estimating TCF’s exposure to changes in inter-

est rates. These assumptions are inherently uncertain and, as a result,

the simulation models cannot precisely estimate net interest income or

precisely predict the impact of a change in interest rates on net inter-

est income. Actual results will differ from simulated results due to the

timing, magnitude and frequency of interest rate changes and changes

in market conditions and management strategies, among other factors.

RECENT ACCOUNTING DEVELOPMENTS – Effective July 1,

2001, TCF adopted Statement of Financial Accounting Standards

(“SFAS”) No. 141, “Business Combinations,” which requires that the

purchase method of accounting be used for all business combinations

initiated after June 30, 2001. SFAS No. 141 also specifies criteria

intangible assets acquired in a purchase method business combina-

tion must meet to be recognized and reported apart from goodwill.

Effective January 1, 2002, the Company adopted SFAS No. 142,

“Goodwill and Other Intangible Assets,” which requires that good-

will and intangible assets with indefinite useful lives no longer be

amortized, but instead tested for impairment at least annually in

accordance with the provisions of SFAS No. 142.

Upon adoption of SFAS No. 142, TCF is required to evaluate its

existing intangible assets and goodwill that were acquired in prior pur-

chase business combinations, and make any necessary reclassifications

of intangible assets in order to conform with the new criteria of SFAS

No. 141 for recognition apart from goodwill. Upon adoption of SFAS

No. 142, the Company is required to reassess the useful lives and resid-

ual values of all intangible assets acquired in purchase business combi-

nations, and make any necessary amortization period adjustments by

the end of the first quarter of 2002. In addition, to the extent an intan-

gible asset is identified as having an indefinite useful life, as in the case

of goodwill, the Company will be required to test the intangible asset

for impairment in accordance with the provisions of SFAS No. 142

within the first quarter of 2002. Any impairment loss will be measured

as of the date of adoption and recognized as a cumulative effect of a

change in accounting principle during the first quarter of 2002.

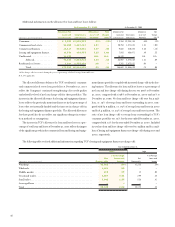

As of the date of adoption, the Company had unamortized goodwill

in the amount of $145.5 million and unamortized identifiable intan-

gible assets (deposit base intangibles) in the amount of $9.2 million, all

of which will be subject to the transition provisions of SFAS Nos. 141

and 142. Amortization expense related to goodwill was $7.8 million

($7.6 million after-tax, or 10 cents per common diluted share) and $7.7

million ($7.5 million after-tax, or 9 cents per common diluted share)

for the year ended December 31, 2001 and December 31, 2000, respec-

tively. Management finalized its study of the effects of SFAS No. 142 and

concluded that goodwill is not impaired as of January 1, 2002.

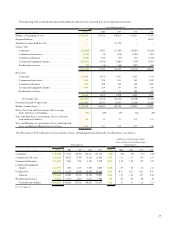

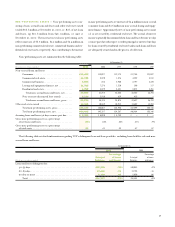

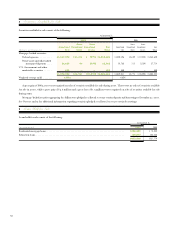

FOURTH QUARTER SUMMARY – In the fourth quarter of 2001,

TCF had net income of $54.2 million, up 3.9% from $52.2 mil-

lion in the fourth quarter of 2000. Diluted earnings per common

share was 72 cents for the fourth quarter of 2001, compared to 66

cents for the fourth quarter of 2000. The 2000 fourth quarter results

included a $5.5 million after-tax gain on sales of three branches, or

7 cents per diluted common share. TCF opened 8 new branches in

the fourth quarter of 2001, of which 3 were supermarket branches.

Net interest income was $125.7 million and $110.8 million for

the quarter ended December 31, 2001 and 2000, respectively. The

net interest margin was 4.74% and 4.33% for the fourth quarter of

2001 and 2000, respectively. TCF net interest income improved by

$10.6 million, or 9.6% over the fourth quarter of 2000 due to vol-

ume changes and $4.3 million due to rate changes.

42