TCF Bank 2001 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

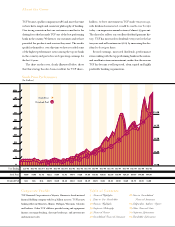

TCF became a public company in 1986 and since that time

we have had a simple and consistent philosophy of banking.

Our strong conviction that our customers come first is the

driving force that has made TCF one of the best performing

banks in the country. We listen to our customers and we have

provided the products and services they want. The results

speak for themselves; over this time we have recorded some

of the highest performance ratios among the top 50 banks

in the country and posted record operating earnings for

the last 11 years.

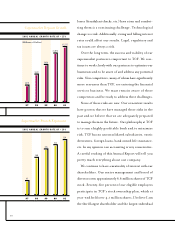

The chart on the cover, clearly illustrated below, shows

that this strategy has also been excellent for TCF share-

Corporate Profile

TCF Financial Corporation is a Wayzata, Minnesota-based national

financial holding company with $11.4 billion in assets. TCF has 375

banking offices in Minnesota, Illinois, Michigan, Wisconsin, Colorado

and Indiana. Other TCF affiliates provide leasing and equipment

finance, mortgage banking, discount brokerage, and investments

and insurance sales.

Table of Contents

1Financial Highlights

2

Letter to Our Shareholders

12Business Highlights

20Corporate Philosophy

21Financial Review

42Consolidated Financial Statements

47Notes to Consolidated

Financial Statements

72IndependentAuditors’ Report

73Other Financial Data

74Corporate Information

76Shareholder Information

holders. A $100 investment in TCF made ten years ago,

with dividends reinvested, would be worth over $1,250

today – an impressive annual return of almost 29 percent.

The chart also reflects our excellent dividend payment his-

tory. TCF has increased its dividend every year for the last

ten years and will continue in 2002 by increasing the div-

idend to $1.15 per share.

Record earnings, increased dividends, performance

ratios ranking with the top performing banks in the nation,

and excellent return on investment, make clear the reasons

TCF has become a well respected, often copied and highly

profitable banking organization.

About the Cover

Stock Price Performance

(In Dollars)

Stock Price

Dividend Paid

N/A N/A N/A $0.05 $0.10 $0.10 $0.10 $0.13 $0.19 $0.25 $0.31 $0.38 $0.50 $0.65 $0.75 $0.85 $1.00

Stock Price

Dividend Paid

Year Ending

$3.00 $3.03 $1.72 $2.22 $3.38 $1.91 $4.84 $7.25 $8.50 $10.31 $16.56 $21.75 $33.94 $24.19 $24.88 $44.56 $47.98

Jun-86 Dec-86 Dec-87 Dec-88 Dec-89 Dec-90 Dec-91 Dec-92 Dec-93 Dec-94 Dec-95 Dec-96 Dec-97 Dec-98 Dec-99 Dec-00 Dec-01

$50

45

40

35

30

25

20

15

10

5

0

$1.00

0.75

0.50

0.25

0.00