TCF Bank 2001 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

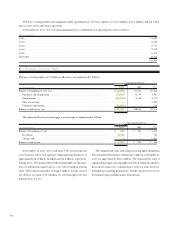

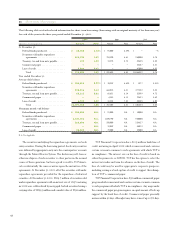

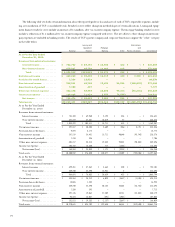

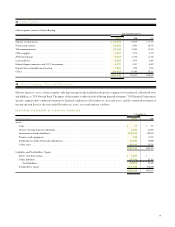

17 Employee Benefit Plans

The TCF Cash Balance Pension Plan (the “Pension Plan”) is a qual-

ified defined benefit plan covering all “regular stated salary” employ-

ees and certain part-time employees who are at least 21 years old and

have completed a year of eligibility service with TCF. TCF makes a

monthly allocation to the participant’s account based on a percentage

of the participant’s compensation. The percentage is based on the sum

of the participant’s age and years of employment with TCF. Participants

are fully vested after five years of qualifying service.

In addition to providing retirement income benefits, TCF provides

health care benefits for eligible retired employees, and in some cases

life insurance benefits (the “Postretirement Plan”). Substantially all

full-time employees may become eligible for health care benefits if they

reach retirement age and have completed ten years of service with the

Company, with certain exceptions. Effective January 1, 2000, TCF

modified the Postretirement Plan by eliminating the Company subsidy

for employees not yet eligible for benefits under the Postretirement Plan.

The plan provisions for full-time and retired employees then eligible

for these benefits were not changed. These and similar benefits for

active employees are provided through insurance companies or through

self-funded programs. The Postretirement Plan is an unfunded plan.

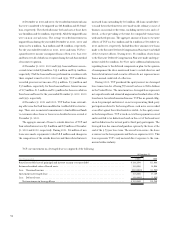

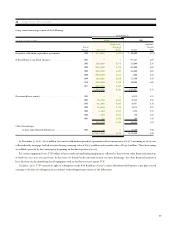

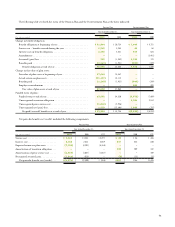

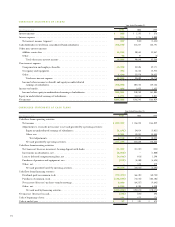

The following table reflects TCF’s stock option and restricted stock transactions under the Program since December 31, 1998:

Stock Options Restricted Stock

Exercise Price

Weighted-

Shares Range Average Shares Price Range

Outstanding at December 31, 1998 . . . . . . . . . . . . . . . . 1,178,657 $ 2.22-33.28 $ 17.67 1,443,734 $ 7.66-34.00

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 247,550 23.56-29.03 25.25 21,050 22.53-28.59

Exercised . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (551,107) 2.22-23.69 11.73 – –

Forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (112,000) 23.56-33.28 32.36 (11,760) 8.11-34.00

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . – – – (331,889) 7.66-27.34

Outstanding at December 31, 1999 . . . . . . . . . . . . . . . . 763,100 2.63-33.28 22.27 1,121,135 8.11-34.00

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,000 21.81 21.81 1,300,080 22.10-43.70

Exercised . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (283,585) 2.63-28.88 20.25 – –

Forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (13,000) 23.56-32.19 28.32 (20,940) 20.88-34.00

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . – – – (125,175) 8.11-28.59

Outstanding at December 31, 2000 . . . . . . . . . . . . . . . 467,515 3.46-33.28 23.32 2,275,100 16.56-43.70

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . – – – 262,340 27.98–48.20

Exercised . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (86,832) 3.46–32.19 17.47 – –

Forfeited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10,558) 23.56–32.19 24.73 (18,850) 27.98–48.20

Vested . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . – – – (59,179) 16.56–40.75

Outstanding at December 31, 2001. . . . . . . . . . . . . . 370,125 5.33–33.28 24.65 2,459,411(1)

Exercisable at December 31, 2001. . . . . . . . . . . . . . . 204,127 5.33–33.28 22.48

(1) 848,899 shares vested on January 2, 2002.

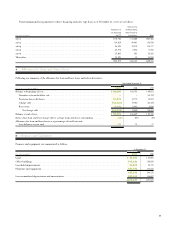

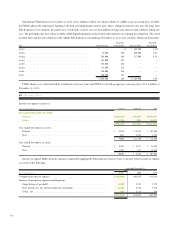

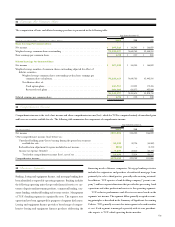

The following table summarizes information about stock options outstanding at December 31, 2001:

Options Outstanding Options Exercisable

Weighted-

Average

Weighted- Remaining Weighted-

Average Contractual Average

Exercise Price Range Shares Exercise Price Life in Years Shares Exercise Price

$5.33 to $20.00 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43,325 $ 7.83 1.9 43,325 $ 7.83

$20.01 to $25.00 . . . . . . . . . . . . . . . . . . . . . . . . . . . 167,250 23.59 7.0 96,902 23.61

$25.01 to $30.00. . . . . . . . . . . . . . . . . . . . . . . . . . . . 72,050 28.91 7.5 30,400 28.94

$30.01 to $33.28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87,500 31.50 6.1 33,500 32.26

Total Options . . . . . . . . . . . . . . . . . . . . . . . . . . . . 370,125 24.65 6.3 204,127 22.48

64