TCF Bank 2001 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

losses (fraudulent checks, etc.) have risen and combat-

ting them is a continuing challenge. Technological

change is a risk. Additionally, rising and falling interest

rates could affect our results. Legal, regulatory and

tax issues are always a risk.

Over the long term, the success and viability of our

supermarket partners is important to TCF. We con-

tinue to work closely with our partners to optimize our

businesses and to be aware of and address any potential

risks. New competitors, many of whom have significantly

more resources than TCF, are entering the financial

services business. We must remain aware of these

competitors and be ready to address their challenges.

None of these risks are new. Our consistent results

have proven that we have managed these risks in the

past and we believe that we are adequately prepared

to manage them in the future. Our philosophy at TCF

is to run a highly profitable bank and to minimize

risk. TCF has no unconsolidated subsidiaries, exotic

derivatives, foreign loans, bank owned life insurance,

etc. In my opinion our accounting is very conservative.

A careful reading of this Annual Report will tell you

pretty much everything about our company.

We continue to have a mutuality of interest with our

shareholders. Our senior management and board of

directors own approximately 6.6 million shares of TCF

stock. Seventy-five percent of our eligible employees

participate in TCF’s stock ownership plan, which at

year-end held over 4.1 million shares. I believe I am

the third largest shareholder and the largest individual

10

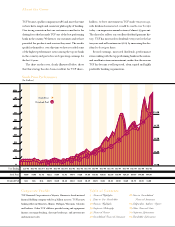

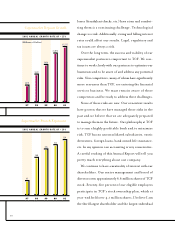

2001 ANNUAL GROWTH RATE OF +13%

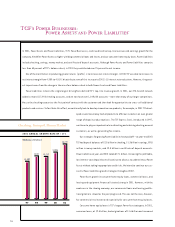

2001 ANNUAL GROWTH RATE OF +10%

$379

$618

$826

$1,074

$1,213

97 98 99 00 01

97 98 99 00 01

63

160

195

213

234

Supermarket Deposit Growth

Supermarket Branch Expansion

(Millions of Dollars)