TCF Bank 2001 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

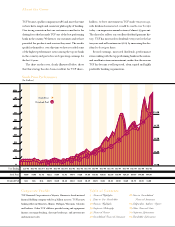

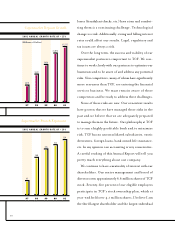

ing accounts during 2001. As the de novo super-

market branches mature, we are selling customers

other products as well. Our fee income in these

branches totaled $136.7 million for the year (up 22

percent from last year). We have put consumer lenders

in many of our supermarket branches and have proven

to many doubters that you can make loans in these

branches. We now have over $305 million in consumer

loans that were originated in supermarket branches,

up 31 percent from 2000.

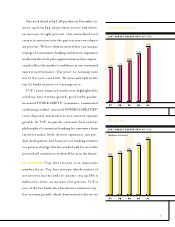

It is clear to us that our supermarket banking strategy

is working and is a significant factor in making TCF

the most convenient bank in our markets. We plan to

open approximately 15 new supermarket branches in

2002 and more in the future.

TCF competes against financial institutions that

are, in most cases, much larger and have far greater

resources. This is both good news and bad news. The

consolidation that we’ve seen in the banking industry

has in many cases created huge, unwieldy organizations

that cannot react quickly to changing competition.

On the other hand, when you walk with elephants,

you sometimes get stepped on.

We are competing in an industry that in many cases

is still in a consolidation cost-take-out mode, a strategy

that over time has proven to decrease customer service

and slow down revenue growth. However, we have

recently seen some banks come to realize the value of

top-line revenue growth and core earnings, and we

believe they may become more competitive in the

8

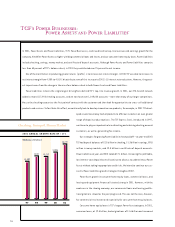

2001 ANNUAL GROWTH RATE OF +22%

2001 ANNUAL GROWTH RATE OF +31%

97 98 99 00 01

97 98 99 00 01

$88

$108

$193

$233

$305

$22

$53

$87

$112

$137

Supermarket Fee Income

(Millions of Dollars)

Supermarket Consumer Loans

(Millions of Dollars)