TCF Bank 2001 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

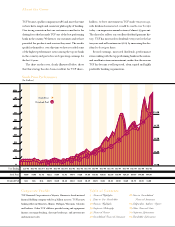

Our stock closed at $47.98 per share at December 31,

2001, up from $44.56 per share at year-end 2000,

an increase of eight percent. Our annualized total

return to investors over the past ten years was almost

29 percent. We have demonstrated that our unique

strategy of convenience banking and de novo expansion

works and the stock price appreciation we have experi-

enced reflects the market’s confidence in our continued

superior performance. Our price-to-earnings ratio

was 17.8 at year-end 2001. We now rank 14th in the

top 50 banks in price-to-earnings ratio.

TCF’s 2001 financial results were highlighted by

solid top-line revenue growth, good credit quality,

increased POWER ASSETS®(consumer, commercial

and leasing credits), increased POWER LIABILITIES®

(core deposits) and moderate non-interest expense

growth. At TCF, we put the customer first and our

philosophy of convenient banking for customers from

varied economic levels, de novo expansion, new pro-

duct development, and focus on core banking activities

is a proven strategy that has worked well for us in the

past and will continue to work well for us in the future.

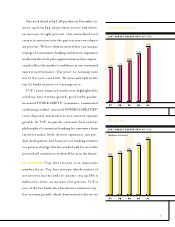

TOP-LINE REVENUE Top-line revenue is an important

number for us. Top-line revenue, which consists of

net interest income and fee income, was up $86.5

million for 2001, an increase of 11 percent. TCF is

one of the few banks that has shown consistent top-

line revenue growth, which demonstrates that we are

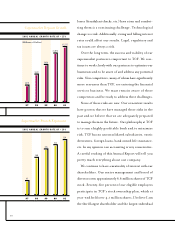

2001 ANNUAL GROWTH RATE OF +15%

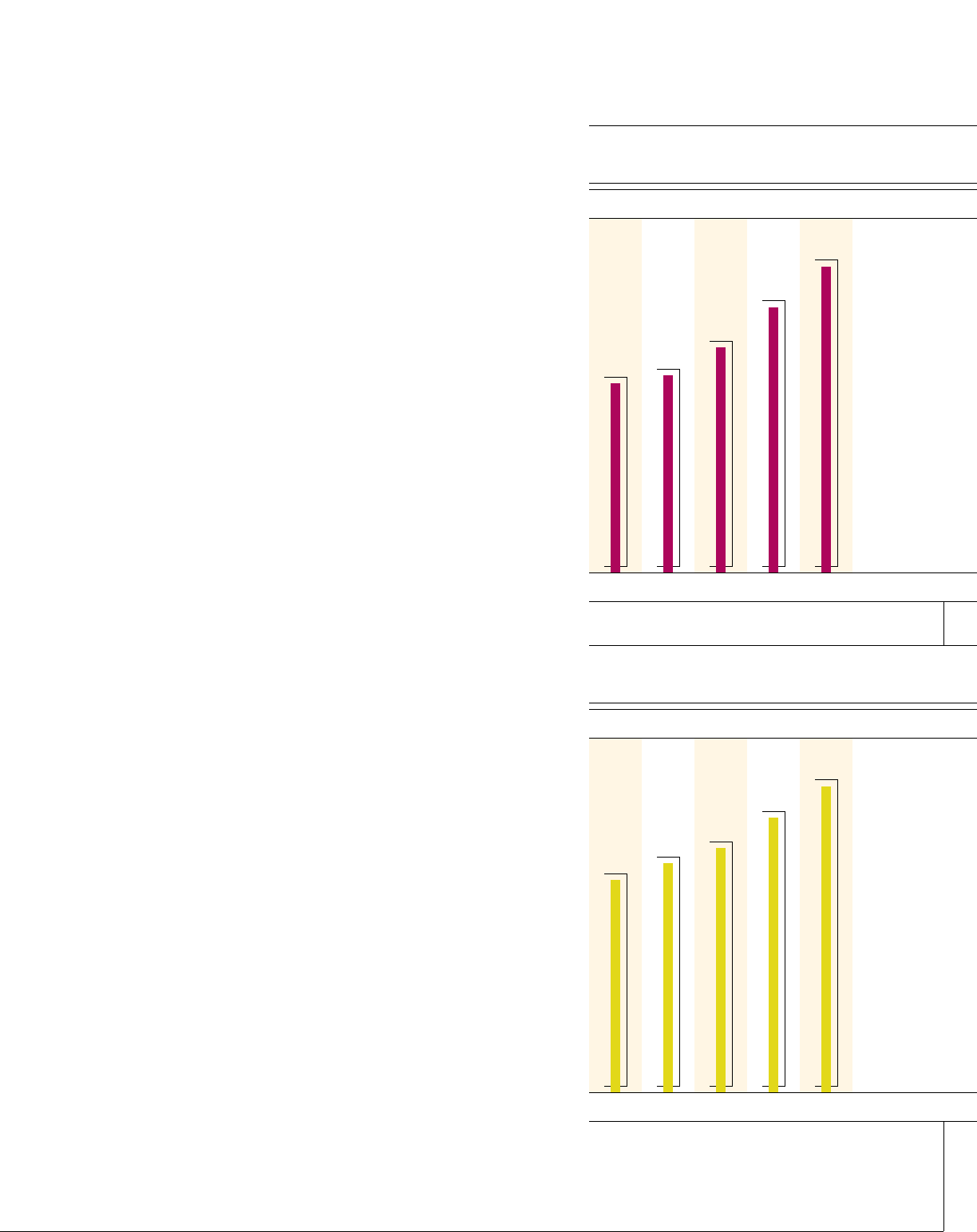

2001 ANNUAL GROWTH RATE OF +11%

(Millions of Dollars)

$1.69 $1.76

$2.00

$2.35

$2.70

97 98 99 00 01

$145

$156

$166

$186

$207

97 98 99 00 01

Diluted EPS Growth

Net Income

3