TCF Bank 2001 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

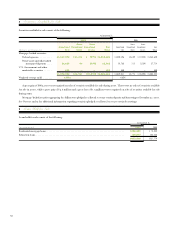

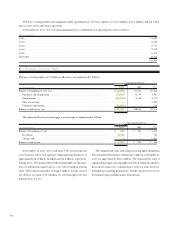

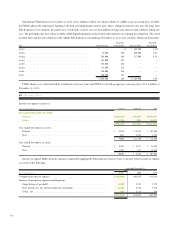

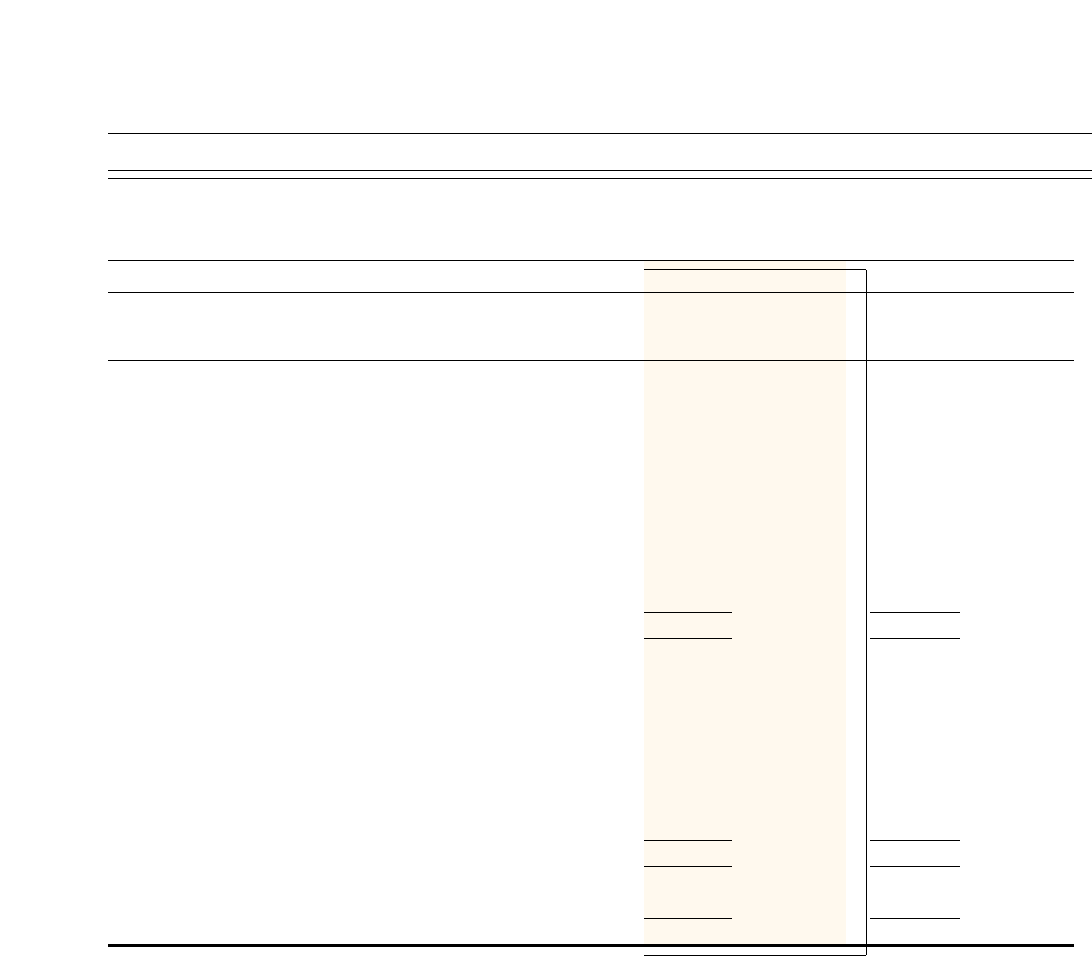

12 Long-term Borrowings

Long-term borrowings consist of the following:

At December 31,

(Dollars in thousands) 2001 2000

Weighted– Weighted-

Year of Average Average

Maturity Amount Rate Amount Rate

Securities sold under repurchase agreements. . . . . . . . . . . . 2005 $ 200,000 6.27% $ 200,000 6.27%

Federal Home Loan Bank advances. . . . . . . . . . . . . . . . . . . 2001 ––481,537 5.89

2003 135,000 5.76 135,000 5.76

2004 853,000 5.72 803,000 5.69

2005 246,000 6.02 246,000 6.02

2006 303,000 5.26 3,000 5.48

2009 122,500 5.25 122,500 5.25

2010 100,000 6.02 100,000 6.02

2011 200,000 4.85 ––

1,959,500 5.58 1,891,037 5.78

Discounted lease rentals . . . . . . . . . . . . . . . . . . . . . . . . . . 2001 ––84,529 8.81

2002 75,600 8.01 48,369 8.96

2003 46,458 8.00 20,897 9.10

2004 18,462 8.33 10,114 9.22

2005 2,684 8.50 1,355 9.15

2006 450 7.68 390 8.25

2007 12 8.53 109 8.36

143,666 8.06 165,763 8.92

Other borrowings:

Senior subordinated debentures . . . . . . . . . . . . . . . 2003 ––28,750 9.50

$2,303,166 5.79 $2,285,550 6.10

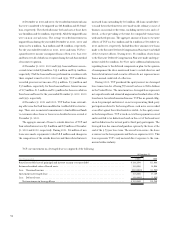

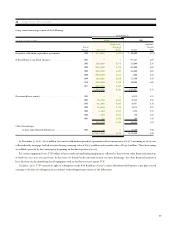

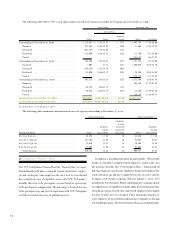

At December 31, 2001, $200 million of securities sold under repurchase agreements with an interest rate of 6.27% maturing in 2005 were

collateralized by mortgage-backed securities having a carrying value of $213.3 million and a market value of $214.7 million. These borrowings

are callable quarterly by the counterparty beginning in the third quarter of 2002.

For certain equipment leases, TCF utilizes its lease rentals and underlying equipment as collateral to borrow from other financial institutions

at fixed rates on a non-recourse basis. In the event of a default by the customer in non-recourse financings, the other financial institution

has a first lien on the underlying leased equipment with no further recourse against TCF.

On July 1, 2001, TCF exercised its right of redemption on the $28.8 million of 9.50% senior subordinated debentures at par plus accrued

earnings to the date of redemption in accordance with redemption provisions of the debentures.