TCF Bank 2001 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

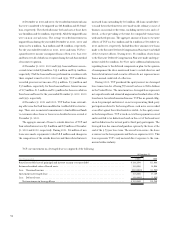

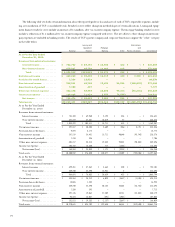

TCF purchased 3,670,107, 3,243,800 and 4,091,611 shares of

its common stock during the years ended December 31, 2001, 2000

and 1999, respectively. At December 31, 2001, TCF has 6.7 million

shares remaining in its stock repurchase programs authorized by the

Board of Directors.

On June 22, 2000, the Company entered into an agreement with

a third party that provides TCF with an option to purchase up to $50

million of TCF’s common stock under a forward share repurchase

contract. The forward transactions can be settled from time to time,

at the Company’s election, on a physical, net cash or net share basis.

The final maturity date of the agreement is June 24, 2002. At

December 31, 2001 and 2000, there were no open forward pur-

chases under this contract.

SHARES HELD IN TRUST FOR DEFERRED COMPENSATION

PLANS – TCF has deferred compensation plans that allow eligible

executives, senior officers and certain other employees to defer pay-

ment of up to 100% of their base salary and bonus as well as grants of

restricted stock. There are no company contributions to these plans,

other than payment of administrative expenses. The amounts deferred

are invested in TCF stock or other publicly traded stocks and bonds.

At December 31, 2001 the assets in the plans totaled $200.4 million

and included $193.6 million invested in TCF common stock. The cost

of TCF common stock held by TCF’s deferred compensation plans is

reported separately in a manner similar to treasury stock (that is,

changes in fair value are not recognized) with a corresponding deferred

compensation obligation reflected in additional paid-in capital.

LOANS TO DEFERRED COMPENSATION PLANS – During

1998 and 2000, loans totaling $6.4 million and $2 million, respec-

tively, were made by TCF to the Executive Deferred Compensation

Plan trustee on a non-recourse basis to purchase shares of TCF

common stock for the accounts of participants. During September

2001, most participant accounts were refinanced and an additional

$6.2 million was loaned to the plan to purchase additional shares

of TCF stock. The amount of the loan related to an individual par-

ticipant is limited to what could be serviced (fully amortized over a

five-year term) through dividend payments on existing and newly

acquired shares of TCF common stock in the participant’s account.

The loans are repayable by the participants over five years and bear

interest at 6.625% to 8.00% and are secured by a pledge of stock

acquired through the loan, future income to the participant’s account

and a contingent deferral commitment from each participant. These

loans are reflected as a reduction of stockholders’ equity as required

by generally accepted accounting principles.

During 2001, loans totaling $755,000 were made by TCF to the

Directors’ Deferred Compensation Plan trustee on a non-recourse

basis to purchase shares of TCF common stock for the accounts of

participants. The loans are repayable by the participants over five

years and bear interest at 6.625% and are secured by the shares of

TCF common stock purchases with the loan proceeds. These loans

have a remaining principal balance of $721,000 at December 31,

2001, which is reflected as a reduction of stockholders’ equity as

required by generally accepted accounting principles.

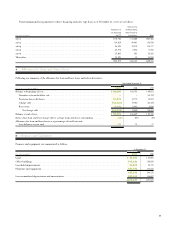

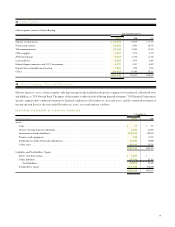

15 Regulatory Capital Requirements

TCF is subject to various regulatory capital requirements adminis-

tered by the federal banking agencies. Failure to meet minimum cap-

ital requirements can initiate certain mandatory, and possibly

additional discretionary, actions by the federal banking agencies that

could have a direct material effect on TCF’s financial statements.

Under capital adequacy guidelines and the regulatory framework for

“prompt corrective action,” TCF must meet specific capital guide-

lines that involve quantitative measures of the Company’s assets, stock-

holders’ equity, and certain off-balance-sheet items as calculated

under regulatory accounting practices..

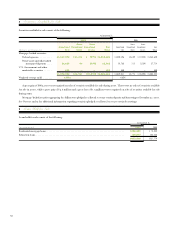

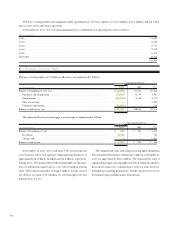

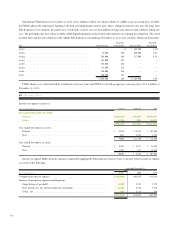

The following table sets forth TCF’s tier 1 leverage, tier 1 risk-based and total risk-based capital levels, and applicable percentages of adjusted

assets, together with the excess over the minimum capital requirements:

At December 31,

2001 2000

2

(Dollars in thousands) Amount Percentage Amount Percentage

Tier 1 leverage capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $758,728 6.62% $758,766 6.90%

Tier 1 leverage capital requirement . . . . . . . . . . . . . . . . . . . . . . . . . . . 343,996 3.00 330,110 3.00

Excess . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $414,732 3.62% $428,656 3.90%

Tier 1 risk-based capital. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $758,728 10.24% $758,766 10.66%

Tier 1 risk-based capital requirement . . . . . . . . . . . . . . . . . . . . . . . . . 296,260 4.00 284,827 4.00

Excess . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $462,468 6.24% $473,939 6.66%

Total risk-based capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $833,821 11.26% $825,527 11.59%

Total risk-based capital requirement. . . . . . . . . . . . . . . . . . . . . . . . . . 592,520 8.00 569,655 8.00

Excess . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $241,301 3.26% $255,872 3.59%