TCF Bank 2001 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

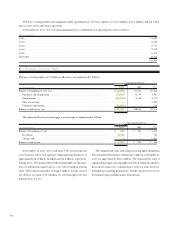

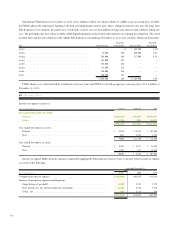

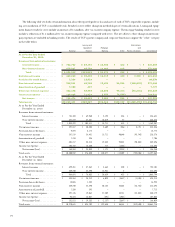

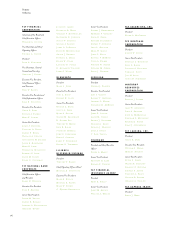

The discount rate and rate of increase in future compensation used to measure the benefit obligation and the expected long-term rate of

return on plan assets were as follows:

Pension Plan Postretirement Plan

Year Ended December 31, Year Ended December 31,

2001 2000 1999 2001 2000 1999

Discount rate . . . . . . . . . . . . . . . . . . . . . 7.50% 7.50% 7.50% 7.50% 7.50% 7.50%

Rate of increase in future compensation . . 4.50 5.00 5.00 N.A. N.A. N.A.

Expected long-term rate of

return on plan assets . . . . . . . . . . . . . . 10.00 10.00 10.00 N.A. N.A. N.A.

N.A. Not applicable.

The Pension Plan’s assets consist primarily of listed stocks. At December 31, 2001 and 2000, the Pension Plan’s assets included TCF com-

mon stock with a market value of $11.8 million and $11.3 million, respectively.

For active participants of the Postretirement Plan, a 6.8% annual rate of increase in the per capita cost of covered health care benefits was

assumed for 2002. This rate is assumed to decrease gradually to 6% for the year 2004 and remain at that level thereafter. For most retired

participants, the annual rate of increase is assumed to be 4% for all future years.

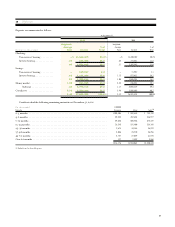

Assumed health care cost trend rates have an effect on the amounts reported for the Postretirement Plan. A one-percentage-point change

in assumed health care cost trend rates would have the following effects:

1- Percentage- 1- Percentage-

(In thousands) Point Increase Point Decrease

Effect on total service and interest cost components . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 13 $ (12)

Effect on postretirement benefits obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 131 (117)

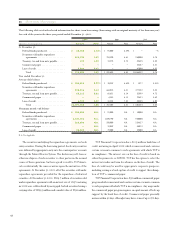

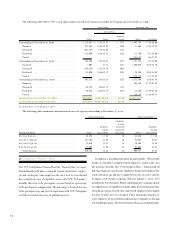

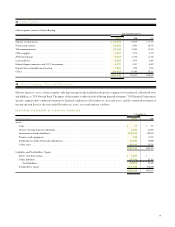

EMPLOYEES STOCK PURCHASE PLAN – The TCF Employees

Stock Purchase Plan generally allows participants to make contribu-

tions by salary deduction of up to 18% of their salary on a tax-deferred

basis (12% prior to November 1, 2001). TCF matches the contribu-

tions of all employees at the rate of 50 cents per dollar, with a max-

imum employer contribution of 3% of the employee’s salary. Employee

contributions vest immediately while the Company’s matching con-

tributions are subject to a graduated vesting schedule based on an

employee’s years of vesting service. Employee contributions and match-

ing contributions are invested in TCF stock. Employees age 50 and

over may invest all or a portion of their account balance in various

mutual funds. The Company’s matching contributions are expensed

when made. At December 31, 2001, the assets in the plan totaled

$200.2 million and included $197.3 million invested in TCF com-

mon stock. Additionally, as of December 31, 2001, $76.5 million of

plan assets were eligible for diversification under plan provisions.

TCF’s contribution to the plan was $3 million, $2.7 million and

$2.8 million in 2001, 2000 and 1999, respectively.

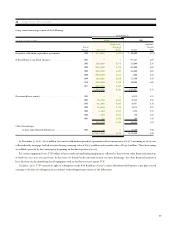

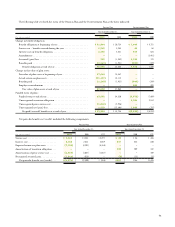

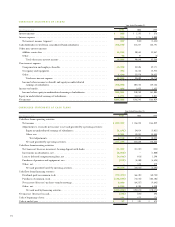

18 Derivative Instruments and Hedging Activities

Effective January 1, 2001, TCF adopted SFAS No. 133, as amended,

“Accounting for Derivative Instruments and Hedging Activities.”

SFAS No. 133 requires that all derivative instruments as defined,

including derivatives embedded in other financial instruments or

contracts, be recognized as either assets or liabilities in the statement

of financial condition at fair value. Changes in the fair value of a

derivative are recorded in the results of operations. A derivative may

be designated as a hedge of an exposure to changes in the fair value

of an asset, liability or firm commitment or as a hedge of cash flows

of forecasted transactions. The accounting for derivatives that are

used as hedges is dependent on the type of hedge and requires that a

hedge be highly effective in offsetting changes in the hedged risk.

Under SFAS No. 133, TCF’s pipeline of locked residential mort-

gage loan commitments are considered derivatives and are recorded

at fair value, with the changes in fair value recognized in gains on sales

of loans held for sale in the consolidated statements of income. TCF

economically hedges its risk of changes in the fair value of locked res-

idential mortgage loan commitments due to changes in interest rates

through the use of forward sales contracts. Forward sales contracts

require TCF to deliver qualifying residential mortgage loans or pools

of loans at a specified future date at a specified price or yield. Such

forward sales contracts hedging the pipeline of locked residential

mortgage loan commitments are derivatives under SFAS No. 133 and

are recorded at fair value, with changes in fair value recognized in gains

on sales of loans held for sale. TCF also utilizes forward sales con-

tracts to hedge its risk of changes in the fair value of its residential