TCF Bank 2001 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

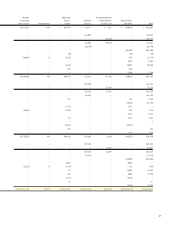

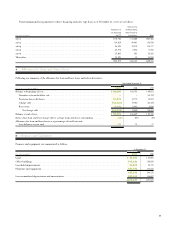

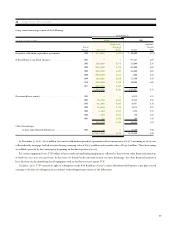

10 Deposits

Deposits are summarized as follows:

At December 31,

2001 2000

Weighted– Weighted-

Average % of Average % of

(Dollars in thousands) Rate Amount Total Rate Amount Total

Checking:

Non-interest bearing . . . . . . . . . –% $1,664,403 23.4% –% $1,430,102 20.8%

Interest bearing. . . . . . . . . . . . . . .20 872,462 12.3 .58 773,841 11.2

.07 2,536,865 35.7 .21 2,203,943 32.0

Savings:

Non-interest bearing . . . . . . . . . – 169,527 2.4 – 71,957 1.1

Interest bearing. . . . . . . . . . . . . . .61 1,121,289 15.8 1.13 973,431 14.1

.53 1,290,816 18.2 1.05 1,045,388 15.2

Money market . . . . . . . . . . . . . . . . . 1.20 951,033 13.4 3.83 836,888 12.1

Subtotal . . . . . . . . . . . . . . . . .42 4,778,714 67.3 1.17 4,086,219 59.3

Certificates . . . . . . . . . . . . . . . . . . 3.71 2,320,244 32.7 5.96 2,805,605 40.7

1.49 $7,098,958 100.0% 3.12 $6,891,824 100.0%

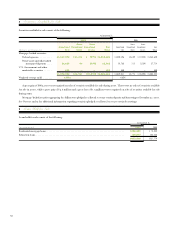

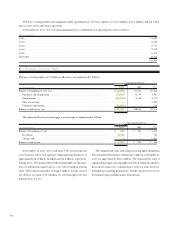

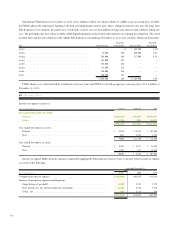

Certificates had the following remaining maturities at December 31, 2001:

(In thousands) $100,000

Maturity Minimum Other Total(1)

0-3 months . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $200,304 $ 598,485 $ 798,789

4-6 months. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59,323 457,654 516,977

7-12 months . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69,526 508,846 578,372

13-24 months . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36,385 291,800 328,185

25-36 months . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,678 34,145 36,823

37-48 months . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,046 23,210 26,256

49-60 months . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,787 27,089 31,876

Over 60 months . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 127 2,839 2,966

$376,176 $1,944,068 $2,320,244

(1) Includes no brokered deposits.