TCF Bank 2001 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

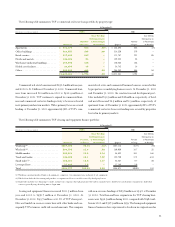

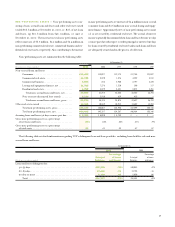

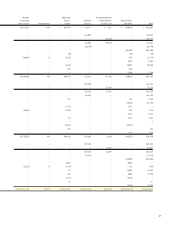

TCF provided $7 million for credit losses in the fourth quarter

of 2001, compared with $4.7 million in the fourth quarter of 2000.

Net loan and lease charge-offs were $5.6 million, or .27% of aver-

age loans and leases outstanding, compared with $2 million, or .10%

of average loans and leases outstanding during the same 2000 period.

The increase in the provision and net loan and lease charge-offs from

2000 reflects the impact of the growth in the commercial loan and

leasing and equipment finance portfolios coupled with increased

charge-offs in the leasing and equipment finance portfolio.

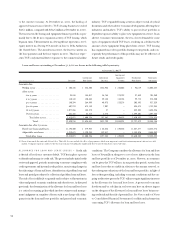

Non-interest income, excluding gains on sales of securities avail-

able for sale and branches, increased $9.3 million, or 10.7%, during

the fourth quarter of 2001 to $95.6 million. The increase was pri-

marily due to increased fees and service charges and leasing revenues,

reflecting TCF’s expanding retail banking and lease operations and

customer base.

Non-interest expense increased $14.8 million, or 12.7%, in the

fourth quarter of 2001 to $131.4 million. The increases were pri-

marily due to costs associated with expanded retail banking and leas-

ing activities.

In the fourth quarter of 2001, the effective income tax rate was

reduced to 35.36% of income before income tax expense for the

quarter due to the favorable conclusion of prior year taxes.

Legislative, Legal and Regulatory Developments

Federal and state legislation imposes numerous legal and regulatory

requirements on financial institutions. Future legislative or regulatory

change, or changes in enforcement practices or court rulings, may have

a dramatic and potentially adverse impact on TCF and its bank and

other subsidiaries.

Forward-Looking Information

This Annual Report and other reports issued by the Company, includ-

ing reports filed with the Securities and Exchange Commission, may

contain “forward-looking” statements that deal with future results, plans

or performance. In addition, TCF’s management may make such state-

ments orally to the media, or to securities analysts, investors or others.

Forward-looking statements deal with matters that do not relate strictly

to historical facts. TCF’s future results may differ materially from his-

torical performance and forward-looking statements about TCF’s

expected financial results or other plans are subject to a number of risks

and uncertainties. These include but are not limited to possible leg-

islative changes and adverse economic, business and competitive devel-

opments such as shrinking interest margins; deposit outflows; reduced

demand for financial services and loan and lease products; changes in

accounting policies or guidelines, or monetary and fiscal policies of

the federal government; changes in credit and other risks posed by TCF’s

loan, lease and investment portfolios; technological, computer-related

or operational difficulties; adverse changes in securities markets; results

of litigation or other significant uncertainties. The terrorist attacks on

September 11, 2001 have had an adverse impact on the United States’

economy and could have a continuing adverse impact on the econ-

omy and the Company’s business, most likely by reducing capital and

consumer spending. Such developments could result in decreased

demand for TCF’s products and services and increased credit losses.

43