TCF Bank 2001 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

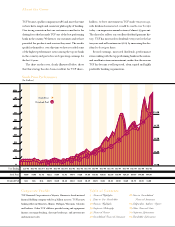

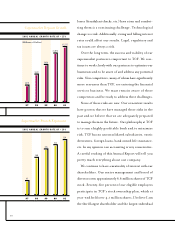

and consumer lending produced at record levels in

2001, while commercial lending and leasing also had

a good year. We increased our checking account

balances by over $332 million for the year, an increase

of 15 percent. Higher-cost certificates of deposits

decreased by $485.4 million during the year as TCF

declined to pay rates above our institutional borrowing

costs in the falling rate environment.

CREDIT QUALITY Our credit quality remained strong in

2001. Net charge-offs were $12.5 million in 2001,

only .15 percent of average loans and leases. We

provided $20.9 million for credit losses in 2001 and,

as a result, we increased our loan loss reserves by $8.4

million. Delinquency and non-performing assets were

at very low levels. Good credit quality is related not

only to the type of loans on the balance sheet, but also

the type of funding. TCF’s very profitable and growing

deposit function allows us to operate our loan portfolio

with relatively low credit risk.

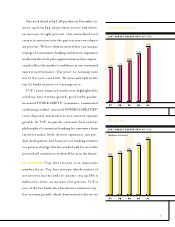

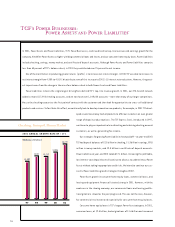

COMMERCIAL REAL ESTATE

Commercial Real

Estate has been a

long-time strength

of TCF.In 2001 we

had $562 million

in originations

and increased our

portfolio by $251

million. This was

accomplished by

lending to local

developers and

builders on real

estate projects in

our local markets.