TCF Bank 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2001 annual report

TCF FINANCIAL CORPORATION

A NATIONAL FINANCIAL HOLDING COMPANY

Ordinary peopledoing extraordinary

things,everyday.

Table of contents

-

Page 1

Ordinary people doing extraordinary things,everyday. 2001 annual report TC F F I N A NC I A L C O R P O R AT I O N A N AT I O N A L F I N A NC I A L H O L D I NG C O M PA N Y -

Page 2

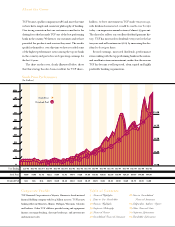

...-based national financial holding company with $11.4 billion in assets. TCF has 375 banking offices in Minnesota, Illinois, Michigan, Wisconsin, Colorado and Indiana. Other TCF affiliates provide leasing and equipment finance, mortgage banking, discount brokerage, and investments and insurance sales... -

Page 3

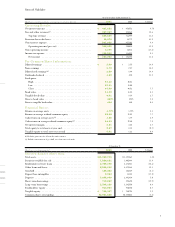

...(2) ...Cash return on average realized common equity(2) ...Net interest margin ...Total equity to total assets at year end ...Tangible equity to total assets at year end ...(1) Excludes gains on sales of branches and securities. (2) Excludes amortization of goodwill, net of income tax benefit. 1.79... -

Page 4

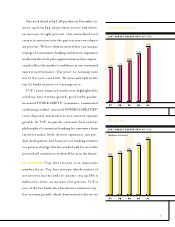

... to providing outstanding service to our customers, every day. DEAR SHAREHOLDERS TCF had another great year. We earned a record $207.3 million in 2001, our 11th consecutive year of record operating earnings. Our diluted earnings per share increased 15 percent to $2.70. Return on average assets... -

Page 5

...EPS Growth 2001 ANNUAL GROWTH RATE OF +15% $2.70 $2.35 $2.00 $1.69 $1.76 97 98 99 00 01 (core deposits) and moderate non-interest expense growth. At TCF, we put the customer first and our philosophy of convenient banking for customers from varied economic levels, de novo expansion, new product... -

Page 6

... changed balance sheet. Expanding the number of fee income producing products and services while growing the overall customer base fuels fee income growth. TCF added 117,900 new checking accounts in 2001, bringing our total to over 1,249,000 accounts. We have a 78 percent debit card penetration rate... -

Page 7

... levels in 2001, while commercial lending and leasing also had a good year. We increased our checking account balances by over $332 million for the year, an increase of 15 percent. Higher-cost certificates of deposits decreased by $485.4 million during the year as TCF declined to pay rates above our... -

Page 8

... check cards issued, TCF is the 13th largest issuer of VISA check cards in the United States. The TCF Express Card provides our customers the convenience of having purchases deducted directly from their checking accounts and is a significant part of fee income for TCF. ® DE NOVO BRANCH EXPANSION... -

Page 9

...strategy, innovative products and services continue to add to our success. "Totally Free Checking" , "Free Small Business Checking" , home equity loans, debit cards, investment sales and, of course, supermarket branch banking have been our most successful innovations. Over the last few years we have... -

Page 10

ing accounts during 2001. As the de novo superSupermarket Fee Income 2001 ANNUAL GROWTH RATE OF +22% (Millions of Dollars) $137 market branches mature, we are selling customers other products as well. Our fee income in these branches totaled $136.7 million for the year (up 22 percent from last year... -

Page 11

... can create increased loan losses. Deposit TCF has the fourth largest supermarket branch network in the country.Our customers enjoy the convenience of combining their financial and shopping needs in one stop, seven days a week,360+ days a year, during extended hours. TCF's de novo banking expertise... -

Page 12

... risks are new. Our consistent results have proven that we have managed these risks in the past and we believe that we are adequately prepared Supermarket Branch Expansion 2001 ANNUAL GROWTH RATE OF +10% to manage them in the future. Our philosophy at TCF is to run a highly profitable bank and to... -

Page 13

... entrepreneurial business people who also own TCF stock. We appreciate their continued guidance and support. We also thank our outstanding team of employees, 97 98 772 913 1,032 99 00 01 Fee Revenue Per Retail Checking Account 2001 ANNUAL GROWTH RATE OF +10% $209 who truly do put the customer... -

Page 14

... Totally Free Online combines a no-fee, easy-to-use banking service with TCF's popular checking account products. With TCF Totally Free Online, we are providing exactly the services our customers asked for, at zero cost to them. Today, over 100,000 TCF customers use our online banking system. SM TCF... -

Page 15

...as business and home equity loans, deposit and insurance products to better serve this underserved market. And, consistent with our retail approach, our convenient branch network, ATMs, automated phone system, and online banking are all available to our small business customers. TCF's Small Business... -

Page 16

... new money market products to offer our customers an even greater range of deposit product options. The TCF Express Card, introduced in 1997, Checking, Savings & Money Market 2001 ANNUAL GROWTH RATE OF +17% continues to play an important role in attracting and retaining checking account customers... -

Page 17

...-pricing home equity loan products have allowed us to provide our customers with attractive loan rates and loan-tovalue options, while maintaining our credit quality, which is among the highest of the top 50 banks in the country. Also, in the face of the almost full-year refinance boom in 2001, TCF... -

Page 18

...provide excellent expansion opportunities. We opened 21 supermarket branches in 2001 and plan to open approximately 15 more in 2002. TCF's consistent track record of success in supermarket banking is built on our strong sales culture, coupled with our convenience-based products and services. We have... -

Page 19

... Automated Phone System, our extensive network of TCF EXPRESS TELLERSM ATMs, or online at www.tcfexpress.com. In 2001 we implemented several new and innovative products and services: Sunday banking hours SM and TCF Express TradeSM online discount brokerage. in traditional branches, TCF Totally Free... -

Page 20

...-cost checking account base. In 2001, TCF Minnesota introduced its Small Business Banking Group to bring TCF's convenience-based products and services to this underserved market. We will continue to expand in Minnesota by adding branches in growing areas and developing innovative new products. The... -

Page 21

... channels and businesses - every day. We know that giving great customer service will help us attract and retain more customers - and make TCF an even more convenient place to bank. Rewarding our employees for giving great customer service is important to us - we know companies that have high... -

Page 22

... active volunteerism or service In addition to the numerous grants awarded, TCF also benefited the on boards and committees. community by supporting affordable housing efforts, providing There are a variety of ways local nonprofit organizations receive financial support from TCF: • Branch Funds... -

Page 23

...banking; we're open up to 12 hours a day, seven days a week, 360+ days per year. We provide customers innovative products through multiple banking channels, including traditional and supermarket branches, TCF EXPRESS TELLERSM ATMs, TCF Express Cards, phone banking, and Internet banking. and services... -

Page 24

... open seven days a week and on most holidays, extensive full-service supermarket branch and automated teller machine ("ATM") networks, and telephone and Internet banking. TCF's philosophy is to generate top-line revenue growth (net interest income and fees and other revenues) through business lines... -

Page 25

....1 2000/1999 Total assets ...Securities available for sale ...Residential real estate loans ...Other loans and leases ...Checking, savings and money market deposits...Certificates ...Borrowings ...Stockholders' equity...Tangible equity ...Per common share: Book value ...Tangible equity ... 2001 $11... -

Page 26

...on sales of branches and securities available for sale) totaled $309.3 million, up 12.7% from $274.4 million in 2000. This improvement was primarily due to increased fees and service charges and electronic funds transfer revenues, reflecting TCF's expanded retail banking operations and customer base... -

Page 27

..., 2001 Yields Average and Balance Interest(1) Rates Year Ended December 31, 2000 Average Balance Yields and Interest(1) Rates Year Ended December 31, 1999 Average Balance Yields and Interest(1) Rates (Dollars in thousands) Assets: Investments ...$ 164,362 Securities available for sale(2) ...1,706... -

Page 28

... checking, savings and money market deposits, important sources of lower cost funds for TCF, is intense. TCF may also experience compression in its net interest margin if the rates paid on deposits increase, or as a result of new pricing strategies and lower rates offered on loan products in order... -

Page 29

..., reflecting TCF's expanded retail banking and leasing operations and customer base. The increases in fees and service charges and electronic funds transfer revenues primarily reflect the increase in the number of retail checking accounts, which totaled 1,249,000 accounts at December 31, 2001, up... -

Page 30

...2001/2000 2000/1999 2001 2000 1999 Fees and service charges ...Electronic funds transfer revenues ...Leasing and equipment finance ...Mortgage banking ...Investments and insurance...Other ...Fees and other revenues ...Gains on sales of: Branches...Securities available for sale . . Loan servicing... -

Page 31

... some types of equipment which TCF leases, resulting in a decline in the amount of new equipment being placed into service. The following table sets forth information about mortgage banking revenues: Year Ended December 31, (Dollars in thousands) Percentage Increase (Decrease) 1998 1997 2001/2000... -

Page 32

... offset by branch sales. Advertising and promotion expenses increased $1.7 million in 2001 following an increase of $2.2 million in 2000. These increases are primarily due to retail banking activities and promotional expenses associated with the TCF Express Phone Card, where customers earn free long... -

Page 33

...S - Total investments, which include interest- bearing deposits with banks, federal funds sold, Federal Home Loan L O A N S A N D L E A S E S - The following table sets forth information about loans and leases held in TCF's portfolio, excluding loans held for sale: Year Ended December 31, (Dollars... -

Page 34

...the balance in the residential loan portfolio will continue to decline, which will provide funding for anticipated growth in other loan categories. Consumer loans increased $275.2 million from year-end 2000 to $2.5 billion at December 31, 2001, reflecting an increase of $291.6 million in home equity... -

Page 35

... $250,000. Leasing and equipment finance increased $100.3 million from year-end 2000 to $956.7 million at December 31, 2001. At December 31, 2001, $143.7 million or 20.6% of TCF's lease portfolio was funded on a non-recourse basis with other banks and consequently TCF retains no credit risk on such... -

Page 36

... businesses totaled $126.1 million, compared with $165.6 million at December 31, 2000. The increase in the leasing and equipment finance portfolio is primarily due to the de novo expansion activity of TCF Leasing, which began in 1999. The investment in a leveraged lease represents a 100% equity... -

Page 37

... statistics: Year Ended December 31, (Dollars in thousands) 2001 2000 1999 1998 1997 Balance at beginning of year ...Acquired balance ...Transfers to loans held for sale ...Charge-offs: Consumer ...Commercial real estate...Commercial business ...Leasing and equipment finance ...Residential... -

Page 38

... information regarding TCF's leasing and equipment finance net charge-offs: Year Ended December 31, 2 2001 Net Charge-offs % of Average Loans and Leases Net Charge-offs 2000 % of Average Loans and Leases (Dollars in thousands) Winthrop ...Wholesale ...Middle market...Truck and trailer ...Small... -

Page 39

... loans held for sale and nonaccrual loans and leases: At December 31, 2 2001 Principal Balances Percentage of Loans and Leases Principal Balances 2000 Percentage of Loans and Leases (Dollars in thousands) Loans and leases delinquent for: 30-59 days...60-89 days ...90 days or more ...Total... -

Page 40

... year-end 2000. TCF's delinquency rates are determined using the contractual method. The following table sets forth information regarding TCF's over 30-day delinquent loan and lease portfolio, excluding loans held for sale and non-accrual loans and leases: At December 31, 2 2001 Principal Balances... -

Page 41

.../2000 2000/1999 2001 2000 Number of branches ...Number of deposit accounts ...Deposits: Checking...Savings ...Money market ...Subtotal ...Certificates ...Total loans and leases ...Average rate on deposits ...Total fees and other revenues for the year ...Consumer loans outstanding ... 234 740,457... -

Page 42

... Although TCF manages other risks, such as credit and liquidity risk, in the normal course of its business, the Company considers interest-rate risk to be its most significant market risk. TCF, like most financial institutions, has a material interest-rate risk exposure to changes in both short-term... -

Page 43

...Years 3+ Years Total Interest-earning assets: Loans held for sale ...Securities available for sale(1) ...Real estate loans(1) ...Leasing and equipment finance(1) . . Other loans(1) ...Investments ...Interest-bearing liabilities: Checking deposits(2) ...Savings deposits(2) ...Money market deposits... -

Page 44

...after-tax gain on sales of three branches, or 7 cents per diluted common share. TCF opened 8 new branches in the fourth quarter of 2001, of which 3 were supermarket branches. Net interest income was $125.7 million and $110.8 million for the quarter ended December 31, 2001 and 2000, respectively. The... -

Page 45

... of securities available for sale and branches, increased $9.3 million, or 10.7%, during the fourth quarter of 2001 to $95.6 million. The increase was primarily due to increased fees and service charges and leasing revenues, reflecting TCF's expanding retail banking and lease operations and customer... -

Page 46

... and lease losses ...Net loans and leases ...Premises and equipment, net ...Goodwill ...Deposit base intangibles ...Other assets ... Liabilities and Stockholders' Equity Deposits: Checking ...Savings ...Money market ...Subtotal ...Certificates ...Total deposits ...Short-term borrowings ...Long-term... -

Page 47

...: Fees and service charges ...Electronic funds transfer revenues ...Leasing and equipment finance ...Mortgage banking ...Investments and insurance ...Other ...Fees and other revenues ...Gains on sales of branches ...Gains on sales of securities available for sale ...Gains on sales of loan servicing... -

Page 48

Consolidated Statements of Stockholders' Equity (Dollars in thousands) Balance, December 31, 1998 ...Comprehensive income: Net income ...Purchase of TCF stock to fund the Employees Stock Purchase Plan, net ...Loan to deferred compensation plans, net of payments... Balance, December 31, 2001 ...See ... -

Page 49

Number of Common Shares Issued 92,912,246 108,041) - - - - 92,804,205 48,546 92,755,...15,842) - (416) (425,127) - - - - (148,043) (3,057) 646 11,049 2,405 (9,744) - (4,646) $(576,517) $ Total 845,502 166,039 (54,973) 111,066 (60,755) (106,106) (60) (2,178) 9,543 10,580 - 1,390 808,982 186,245 37,... -

Page 50

... of and principal collected on securities available for sale ...Purchases of securities available for sale ...Net decrease in federal funds sold ...Net increase in Federal Home Loan Bank stock ...Sales of deposits, net of cash paid ...Other, net ...Net cash used by investing activities ...3,352,341... -

Page 51

... holding company engaged primarily in community banking, mortgage banking and leasing and equipment finance through its wholly owned subsidiaries, TCF National Bank and TCF National Bank Colorado ("TCF Colorado"). TCF National Bank and TCF Colorado own leasing and equipment finance, mortgage banking... -

Page 52

... the unrecovered equity investment. Loans and leases, including loans that are considered to be impaired, are reviewed regularly by management and are placed on non-accrual status when the collection of interest or principal is 90 days or more past due (150 days or more past due for loans secured by... -

Page 53

... needs of its customers and in order to manage the market exposure of its residential loans held for sale and its commitments to extend credit for residential loans. Derivative financial instruments include commitments to extend credit and forward mortgage loan sales commitments. TCF does not use... -

Page 54

... recognized on sales of securities available for sale during 1999. Mortgage-backed securities aggregating $1.1 billion were pledged as collateral to secure certain deposits and borrowings at December 31, 2001. See Notes 11 and 12 for additional information regarding securities pledged as collateral... -

Page 55

...Loans and leases consist of the following: At December 31, 2001 2000 Percentage Change (Dollars in thousands) Consumer: Home equity...Other secured... Commercial business...Leasing and equipment finance: Equipment finance loans ...Lease financings: Direct financing leases ...Sales-type leases ...... -

Page 56

... at December 31, 2001. The aggregate amount of loans to outside directors of TCF and their related interests was $31.8 million and $27 million at December 31, 2001 and 2000, respectively. During 2001, $12 million of new loans were made, repayments totaled $8.8 million and changes in the composition... -

Page 57

...selected statistics: Year Ended December 31, (Dollars in thousands) 2001 2000 1999 Balance at beginning of year ...Transfers to loans held for sale...Provision for credit losses ...Charge-offs ...Recoveries ...Net charge-offs ...Balance at end of year...Ratio of net loan and lease charge-offs to... -

Page 58

...: Year Ended December 31, (In thousands) 2001 2000 1999 Balance at beginning of year ...Provisions ...Charge-offs ...Balance at end of year... $ 946 4,400 - $ 946 - - $ 2,738 169 (1,961) $ 946 $ 5,346 $ 946 At December 31, 2001, 2000 and 1999, TCF was servicing real estate loans for... -

Page 59

10 Deposits Deposits are summarized as follows: At December 31, 2001 Weighted- Average Rate % of Total WeightedAverage Rate 2000 % of Total (Dollars in thousands) Amount Amount Checking: Non-interest bearing ...Interest bearing...Savings: Non-interest bearing ...Interest bearing...Money market... -

Page 60

...: 2001 (Dollars in thousands) 2000 Rate Amount Rate Amount 1999 Rate Amount At December 31, Federal funds purchased ...Securities sold under repurchase agreements ...Treasury, tax and loan note payable...Commercial paper ...Line of credit ...Total ...Year ended December 31, Average daily balance... -

Page 61

... consist of the following: At December 31, (Dollars in thousands) 2001 Year of Maturity Weighted- Average Rate 2000 WeightedAverage Rate Securities sold under repurchase agreements...Federal Home Loan Bank advances... 2005 2001 2003 2004 2005 2006 2009 2010 2011 Amount $ 200,000 Amount... -

Page 62

... are collateralized by residential real estate loans and FHLB stock with an aggregate carrying value of $2.5 billion at December 31, 2001. 13 Income Taxes Income tax expense consists of: (In thousands) Current Deferred Total Year ended December 31, 2001: Federal ...State ...$112,288 6,188 $118... -

Page 63

...) 2001 2000 Deferred tax assets: Securities available for sale ...Allowance for loan and lease losses ...Pension and other compensation plans...Total deferred tax assets ...Deferred tax liabilities: Securities available for sale ...Lease financing ...Loan fees and discounts ...Mortgage servicing... -

Page 64

...loan proceeds. These loans have a remaining principal balance of $721,000 at December 31, 2001, which is reflected as a reduction of stockholders' equity as required by generally accepted accounting principles. 15 executives, senior officers and certain other employees to defer payment of up to 100... -

Page 65

...; that is, an entity has granted something of value to an employee generally in return for their continued employment and services. The fair value based method is designated as the preferred method of accounting by SFAS No. 123. Compensation expense for restricted stock under SFAS No. 123 and... -

Page 66

... provisions for full-time and retired employees then eligible for these benefits were not changed. These and similar benefits for active employees are provided through insurance companies or through self-funded programs. The Postretirement Plan is an unfunded plan. The TCF Cash Balance Pension Plan... -

Page 67

... - (797) $(5,893) Net periodic benefit cost (credit) included the following components: Pension Plan Year Ended December 31, (In thousands) Postretirement Plan Year Ended December 31, 1999 2001 2000 1999 2001 2000 Service cost ...Interest cost...Expected return on plan assets ...Amortization of... -

Page 68

... employee's years of vesting service. Employee contributions and matching contributions are invested in TCF stock. Employees age 50 and over may invest all or a portion of their account balance in various mutual funds. The Company's matching contributions are expensed when made. At December 31, 2001... -

Page 69

.... Changes in assumptions could significantly affect the estimates. The carrying amounts of cash and due from banks, investments and accrued interest payable and receivable approximate their fair values due to the short period of time until their expected realization. Securities available for sale... -

Page 70

... mortgage loan sales commitments...Loans: Consumer...Commercial real estate ...Commercial business ...Equipment finance loans ...Residential real estate ...Allowance for loan losses(1) ...Financial instrument liabilities: Checking, savings and money market deposits ...Certificates...Short-term... -

Page 71

... Summary of Significant Accounting Policies. TCF generally accounts for intersegment sales and transfers at cost. Each segment is managed separately with its own president, who reports to TCF's chief operating decision maker. 69 Banking, leasing and equipment finance, and mortgage banking have been... -

Page 72

.... The results of TCF's parent company and corporate functions comprise the "other" category in the table below. Banking Leasing and Equipment Finance Mortgage Banking Other Eliminations and Reclassifications Consolidated (In thousands) At or For the Year Ended December 31, 2001: Revenues from... -

Page 73

...TCF National Bank. The impact of this transfer is reflected in the following financial statements. TCF Financial Corporation's (parent company only) condensed statements of financial condition as of December 31, 2001 and 2000, and the condensed statements of income and cash flows for the years ended... -

Page 74

...039 Year Ended December 31, (In thousands) 2001 2000 1999 Cash flows from operating activities: Net income ...Adjustments to reconcile net income to net cash provided by operating activities: Equity in undistributed earnings of subsidiaries...Other, net ...Total adjustments ...Net cash provided... -

Page 75

... operations or other activities. TCF engages in foreclosure proceedings and other collection actions as part of its loan collection activities. From time to time, borrowers have also brought actions against TCF, in some cases claiming substantial amounts of damages. Some financial services companies... -

Page 76

... 2001 and 2000, and the related consolidated statements of income, stockholders' equity, and cash flows for each of the years in the three-year period ended December 31, 2001. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express... -

Page 77

... 2001 At Sept. 30, 2001 At June 30, At March 31, 2001 2001 At Dec. 31, 2000 At Sept. 30, 2000 At June 30, At March 31, 2000 2000 Selected Financial Condition Data: Total assets ...Securities available for sale ...Residential real estate loans ...Other loans and leases ...Deposits ...Borrowings... -

Page 78

... T CAROL B. SCHIRMERS Vice Chairman, General Counsel and Secretary G R E G O RY J . P U L L E S Executive Vice President, Chief Financial Officer and Treasurer NEIL W. BROWN MINNESOTA MICHIGAN President MARK L. JETER President T H O M A S J . WA G N E R Executive Vice Presidents SARA L. EVERS... -

Page 79

... M. EGGEMEYER III 3 Advisory Committee -TCF Employee Stock Purchase Plan 4 Executive Committee 5 De Novo Expansion Committee Traditional Branches M I N N E A P O L I S / S T . P AU L A R E A ( 4 2 ) G R E A T E R M I N N E S O TA ( 6 ) TCF MORTGAGE CORPORATION President, Castle Creek Capital LLC... -

Page 80

... E. Korstange Senior Vice President Corporate Communications (952) 745-2755 ADDITIONAL INFORMATION Patricia L. Quaal Senior Vice President Investor Relations (952) 745-2758 1997 Fourth Quarter Third Quarter Second Quarter First Quarter TCF's report on Form 10-K is filed with the Securities and... -

Page 81

...00 12/31/01 Assumes $100 invested December 31, 1991 with dividends reinvested. CREDIT RATINGS Last Rating Action Last Review October 2001 Last Rating Action Last Review December 2000 Moody's TCF National Bank: Outlook Issuer Long-term deposits Short-term deposits Bank financial strength Stable A2... -

Page 82

TCF Financial Corporation 200 Lake Street East Wayzata, MN 55391-1693 www.tcfexpress.com E In an effort to help save our natural resources, the cover and inside pages of this annual report are printed on paper stock made from 30% post-consumer waste and a total 50% recycled fiber content. This ...