TCF Bank 2000 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2000 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

TCF

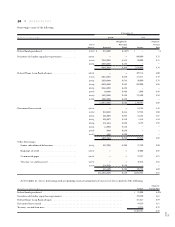

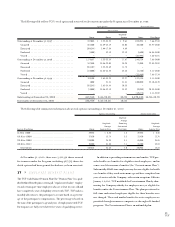

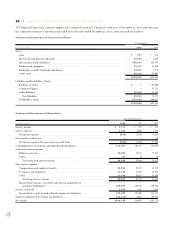

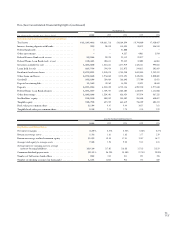

The Pension Plan’s assets consist primarily of listed stocks and government bonds. At December 31, 2000 and 1999, the Pension Plan’s

assets included TCF common stock with a market value of $11.3 million and $6.3 million, respectively.

For active participants of the Postretirement Plan, a 7.2% annual rate of increase in the per capita cost of covered health care benefits was

assumed for 2001. This rate is assumed to decrease gradually to 6% for the year 2005 and remain at that level thereafter. For most retired

participants, the annual rate of increase is assumed to be 4% for all future years, which represents the Plan’s annual limit on increases in

TCF’s contributions for retirees.

Assumed health care cost trend rates have an effect on the amounts reported for the Postretirement Plan. A one-percentage-point change

in assumed health care cost trend rates would have the following effects:

1-Percentage- 1-Percentage-

(In thousands) Point Increase Point Decrease

Effect on total of service and interest cost components . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 14 $ (13)

Effect on postretirement benefit obligation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 132 (119)

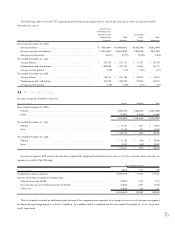

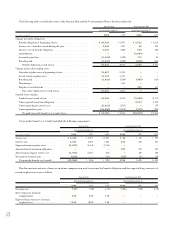

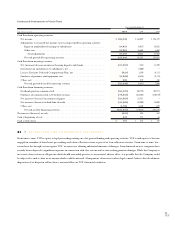

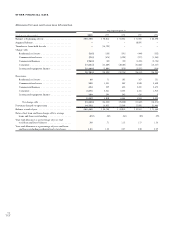

Employee Stock Purchase Plan – The TCF Employees Stock

Purchase Plan generally allows participants to make contributions

by salary deduction of up to 12% of their salary on a tax-deferred

basis pursuant to section 401(k) of the Internal Revenue Code.

TCF matches the contributions of all employees at the rate of 50

cents per dollar, with a maximum employer contribution of 3%

of the employee’s salary. Employee contributions vest immediately

while the Company’s matching contributions are subject to a grad-

uated vesting schedule based on an employee’s years of vesting ser-

vice. The Company’s matching contributions are expensed when

made. TCF’s contribution to the plan was $2.7 million, $2.8 mil-

lion and $2.7 million in 2000, 1999 and 1998, respectively.

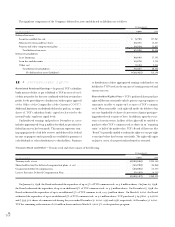

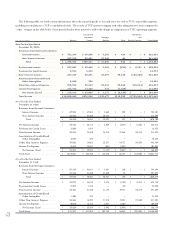

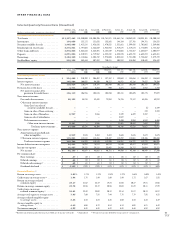

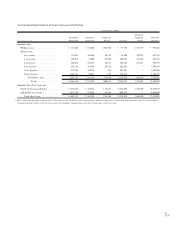

18 >BUSINESS SEGMENTS

Prior to April 1, 2000, TCF’s wholly owned bank subsidiaries

located in Minnesota, Illinois, Wisconsin and Michigan had been

identified as reportable segments. In April 2000, TCF merged

these four bank charters into one national bank charter head-

quartered in Minnesota.

Following the bank merger, certain management responsibil-

ities were realigned within the organization. Management report-

ing was revised to reflect the charter merger and the resulting

changes in responsibilities. Banking, leasing and equipment

finance, and mortgage banking have been identified as reportable

operating segments. Banking includes the following operating

units that provide financial services to customers: deposits and

investment products, commercial lending, consumer lending, res-

idential lending and treasury services. Management of TCF’s bank-

ing area is organized by state. The separate state operations have

been aggregated for purposes of segment disclosures. Leasing and

equipment finance provides a broad range of comprehensive lease

and equipment finance products addressing the financing needs

of diverse companies. Mortgage banking activities include the orig-

ination and purchase of residential mortgage loans for portfolio

loans and sales to third parties, generally with servicing retained.

In addition, TCF operates a bank holding company (“parent com-

pany”) that provides data processing, bank operations and other

professional services to the operating segments.

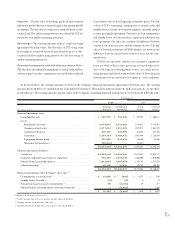

TCF evaluates performance and allocates resources based on

the segments’ net income. The segments follow generally accepted

accounting principles as described in the Summary of Significant

Accounting Policies. TCF generally accounts for intersegment sales

and transfers at cost. Each segment is managed separately with its

own president, who reports directly to TCF’s chief operating deci-

sion maker.