TCF Bank 2000 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2000 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

TCF

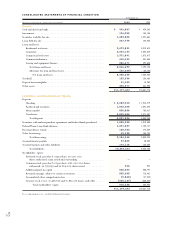

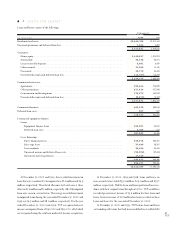

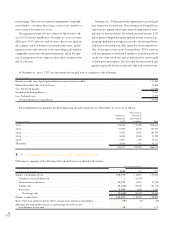

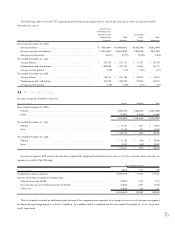

6>LOANS AND LEASES

Loans and leases consist of the following:

At December 31,

(In thousands) 2000 1999

Residential real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $3,666,765 $3,911,184

Unearned premiums and deferred loan fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7,066 8,494

3,673,831 3,919,678

Consumer:

Home equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,168,827 1,974,924

Automobile . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38,138 55,271

Loans secured by deposits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,881 6,859

Other secured . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,900 11,148

Unsecured . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,175 26,634

Unearned discounts and deferred loan fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (16,787) (16,252)

2,234,134 2,058,584

Commercial real estate:

Apartments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 324,666 276,045

Other permanent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 871,614 637,980

Construction and development . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .178,372 162,570

Unearned discounts and deferred loan fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,811) (3,123)

1,371,841 1,073,472

Commercial business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 409,915 350,816

Deferred loan costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 507 537

410,422 351,353

Leasing and equipment finance:

Loans:

Equipment finance loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 204,351 43,647

Deferred loan costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,708 513

207,059 44,160

Lease financings:

Direct financing leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 658,678 446,351

Sales-type leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37,645 30,387

Lease residuals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30,426 24,384

Unearned income and deferred lease costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (94,506) (52,626)

Investment in leveraged leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .17,169 –

649,412 448,496

856,471 492,656

$8,546,699 $7,895,743

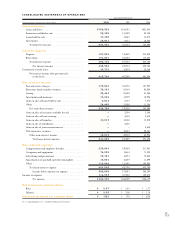

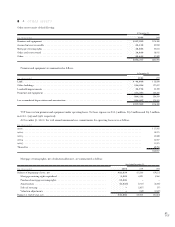

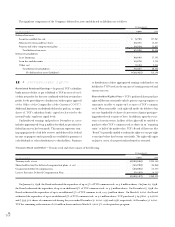

At December 31, 2000 and 1999, the recorded investment in

loans that were considered to be impaired was $6.1 million and $4.5

million, respectively. The related allowance for loan losses at those

dates was $1.2 million and $1 million, respectively. All of the impaired

loans were on non-accrual status. The average recorded investment

in impaired loans during the year ended December 31, 2000 and

1999 was $4.3 million and $8.1 million, respectively. For the year

ended December 31, 2000 and 1999, TCF recognized interest

income on impaired loans of $40,000 and $519,000, all of which

was recognized using the cash basis method of income recognition.

At December 31, 2000, 1999 and 1998, loans and leases on

non-accrual status totaled $35.2 million, $24.1 million and $33.7

million, respectively. Had the loans and leases performed in accor-

dance with their original terms throughout 2000, TCF would have

recorded gross interest income of $3.9 million for these loans and

leases. Interest income of $1.6 million has been recorded on these

loans and leases for the year ended December 31, 2000.

At December 31, 2000 and 1999, TCF had no loans and leases

outstanding with terms that had been modified in troubled debt