TCF Bank 2000 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2000 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

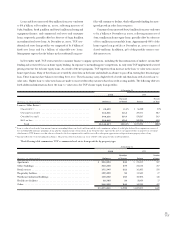

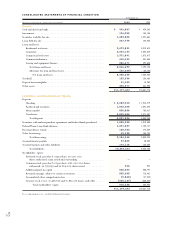

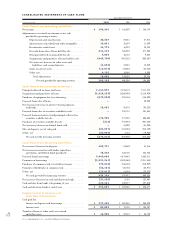

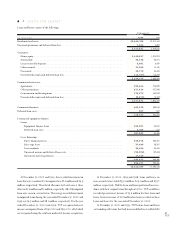

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

At December 31,

(Dollars in thousands, except per-share data) 2000 1999

Assets

Cash and due from banks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 392,007 $ 429,262

Investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 134,059 148,154

Securities available for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,403,888 1,521,661

Loans held for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 227,779 198,928

Loans and leases:

Residential real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,673,831 3,919,678

Consumer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,234,134 2,058,584

Commercial real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,371,841 1,073,472

Commercial business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 410,422 351,353

Leasing and equipment finance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 856,471 492,656

Total loans and leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,546,699 7,895,743

Allowance for loan and lease losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . (66,669) (55,755)

Net loans and leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,480,030 7,839,988

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 153,239 158,468

Deposit base intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,183 13,262

Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 395,277 351,993

$11,197,462 $10,661,716

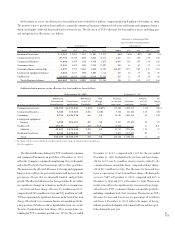

Liabilities and Stockholders’ Equity

Deposits:

Checking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,203,943 $ 1,913,279

Passbook and statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,045,388 1,091,292

Money market . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 836,888 708,417

Certificates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,805,605 2,871,847

Total deposits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,891,824 6,584,835

Securities sold under repurchase agreements and federal funds purchased . . . . . 1,085,320 1,010,000

Federal Home Loan Bank advances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,891,037 1,759,787

Discounted lease rentals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 165,763 178,369

Other borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42,125 135,732

Total borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,184,245 3,083,888

Accrued interest payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37,055 40,352

Accrued expenses and other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 174,118 143,659

Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,287,242 9,852,734

Stockholders’ equity:

Preferred stock, par value $.01 per share, 30,000,000

shares authorized; none issued and outstanding . . . . . . . . . . . . . . . . . . ––

Common stock, par value $.01 per share, 280,000,000 shares

authorized; 92,755,659 and 92,804,205 shares issued . . . . . . . . . . . . . 928 928

Additional paid-in capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 508,682 500,797

Retained earnings, subject to certain restrictions . . . . . . . . . . . . . . . . . . . . 835,605 715,461

Accumulated other comprehensive loss . . . . . . . . . . . . . . . . . . . . . . . . . . . (9,868) (47,382)

Treasury stock at cost, 12,466,626 and 10,863,017 shares, and other . . . . . . (425,127) (360,822)

Total stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 910,220 808,982

$11,197,462 $10,661,716

See accompanying notes to consolidated financial statements.

38

TCF