TCF Bank 2000 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2000 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

TCF

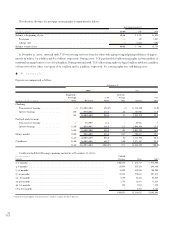

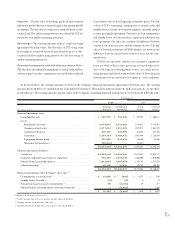

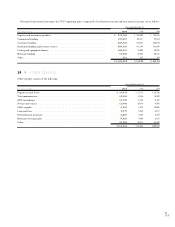

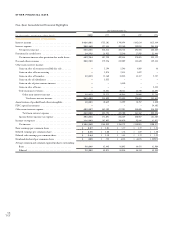

The following table sets forth the status of the Pension Plan and the Postretirement Plan at the dates indicated:

Pension Plan Postretirement Plan

Year Ended December 31, Year Ended December 31,

(In thousands) 2000 1999 2000 1999

Change in benefit obligation:

Benefit obligation at beginning of year . . . . . . . . . . . . . . . . . . . . . $ 30,728 $ 28,967 $ 9,721 $ 9,214

Service cost – benefits earned during the year . . . . . . . . . . . . . . . . . 3,248 3,297 56 426

Interest cost on benefit obligation . . . . . . . . . . . . . . . . . . . . . . . . . 2,431 2,059 523 630

Amendments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ––(2,481) –

Actuarial (gain) loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,942) (1,205) 179 69

Benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,921) (2,390) (389) (618)

Benefit obligation at end of year . . . . . . . . . . . . . . . . . . . . . . . . 32,544 30,728 7,609 9,721

Change in fair value of plan assets:

Fair value of plan assets at beginning of year . . . . . . . . . . . . . . . . . . 74,867 57,338 ––

Actual return on plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,118 18,151 ––

Benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,921) (2,390) (389) (618)

Plan merger . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . –1,768 ––

Employer contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ––389 618

Fair value of plan assets at end of year . . . . . . . . . . . . . . . . . . . . 87,064 74,867 ––

Funded status of plans:

Funded status at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54,520 44,139 (7,609) (9,721)

Unrecognized transition obligation . . . . . . . . . . . . . . . . . . . . . . . . ––2,513 4,433

Unrecognized prior service cost . . . . . . . . . . . . . . . . . . . . . . . . . . (2,926) (3,983) –770

Unrecognized net gain . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (32,808) (23,870) (797) (998)

Prepaid (accrued) benefit cost at end of year . . . . . . . . . . . . . . . $ 18,786 $ 16,286 $(5,893) $(5,516)

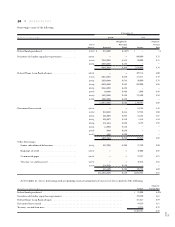

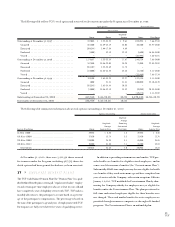

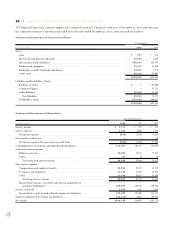

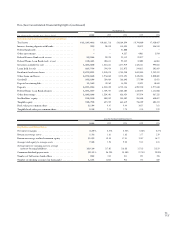

Net periodic benefit cost (credit) included the following components:

Pension Plan Postretirement Plan

Year Ended December 31, Year Ended December 31,

(In thousands) 2000 1999 1998 2000 1999 1998

Service cost . . . . . . . . . . . . . . . . . . . . $ 3,248 $ 3,297 $ 2,967 $56 $ 426 $ 299

Interest cost . . . . . . . . . . . . . . . . . . . 2,431 2,059 1,454 523 630 641

Expected return on plan assets . . . . . . (6,207) (5,155) (3,745) –––

Amortization of transition obligation . . –––209 342 342

Amortization of prior service cost . . . . (1,057) (1,057) (876) –109 109

Recognized actuarial gain . . . . . . . . . . (915) – (728) (22) (12) (58)

Net periodic benefit cost (credit) . . $(2,500) $ (856) $ (928) $766 $1,495 $1,333

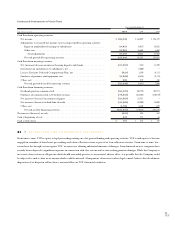

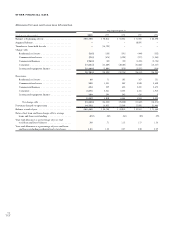

The discount rate and rate of increase in future compensation used to measure the benefit obligation and the expected long-term rate of

return on plan assets were as follows:

Pension Plan Postretirement Plan

Year Ended December 31, Year Ended December 31,

2000 1999 1998 2000 1999 1998

Discount rate . . . . . . . . . . . . . . . . . . 7.50% 7.50% 6.75% 7.50% 7.50% 6.75%

Rate of increase in future

compensation . . . . . . . . . . . . . . . 5.00 5.00 5.00 –––

Expected long-term rate of return

on plan assets . . . . . . . . . . . . . . . . 10.00 10.00 9.50 –––