TCF Bank 2000 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2000 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

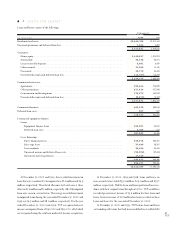

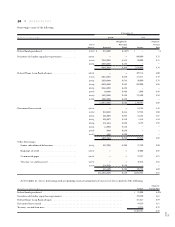

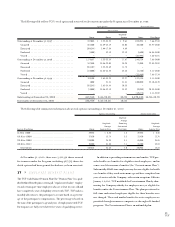

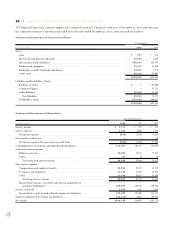

As discussed above, the carrying amounts of certain of the Company’s financial instruments approximate their fair value. The carrying

amounts disclosed below are included in the Consolidated Statements of Financial Condition under the indicated captions, except where

noted otherwise. The carrying amounts and fair values of the Company’s remaining financial instruments are set forth in the following table:

At December 31,

2000 1999

Carrying Estimated Carrying Estimated

(In thousands) Amount Fair Value Amount Fair Value

Financial instrument assets:

Loans held for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 227,779 $ 231,306 $ 198,928 $ 200,617

Loans:

Residential real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,673,831 3,712,568 3,919,678 3,825,981

Commercial real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,371,841 1,381,222 1,073,472 1,061,374

Commercial business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 410,422 410,003 351,353 347,108

Consumer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,234,134 2,408,672 2,058,584 2,116,554

Equipment finance loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . 207,059 210,434 44,160 44,160

Allowance for loan losses (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . (60,816) – (51,847) –

$8,064,250 $8,354,205 $ 7,594,328 $ 7,595,794

Financial instrument liabilities:

Certificates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2,805,605 $2,836,340 $ 2,871,847 $ 2,901,177

Securities sold under agreements to repurchase . . . . . . . . . . . . . . . 994,320 1,003,645 1,010,000 1,010,000

Federal Home Loan Bank advances . . . . . . . . . . . . . . . . . . . . . . . . 1,891,037 1,903,898 1,759,787 1,733,859

Other borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42,125 41,694 135,732 135,301

$5,733,087 $5,785,577 $ 5,777,366 $ 5,780,337

Financial instruments with off-balance-sheet risk: (2)

Commitments to extend credit (3) . . . . . . . . . . . . . . . . . . . . . . . . . $ 12,045 $ (342) $ 8,572 $ (916)

Standby letters of credit(4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2) (2) (1) (2)

Forward mortgage loan sales commitments(3) . . . . . . . . . . . . . . . . . 50 (1,151) 39 427

Federal Home Loan Bank advance forward settlements . . . . . . . . . . – (6,985) – 1,509

$ 12,093 $ (8,480) $ 8,610 $ 1,018

(1) Excludes the allowance for lease losses.

(2) Positive amounts represent assets, negative amounts represent liabilities.

(3) Carrying amounts are included in other assets.

(4) Carrying amounts are included in accrued expenses and other liabilities.

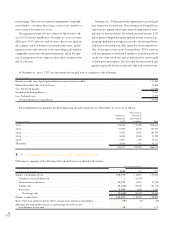

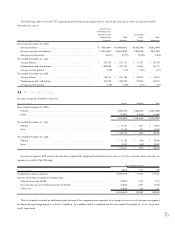

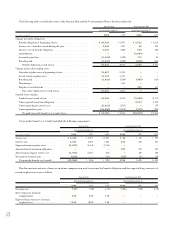

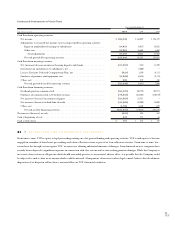

Deposits – The fair value of checking, passbook and statement

and money market deposits is deemed equal to the amount payable

on demand. The fair value of certificates is estimated based on dis-

counted cash flow analyses using interest rates offered by TCF for

certificates with similar remaining maturities.

Borrowings – The carrying amounts of short-term borrowings

approximate their fair values. The fair values of TCF’s long-term

borrowings are estimated based on quoted market prices or dis-

counted cash flow analyses using interest rates for borrowings of

similar remaining maturities.

Financial Instruments with Off-Balance-Sheet Risk –

The fair values of residential commitments to extend credit and for-

ward mortgage loan sales commitments associated with residential

loans held for sale are based upon quoted market prices. The fair

values of TCF’s remaining commitments to extend credit and

standby letters of credit are estimated using fees currently charged

to enter into similar agreements. For fixed-rate loan commitments

and standby letters of credit issued in conjunction with fixed-rate

loan agreements, fair value also considers the difference between

current levels of interest rates and the committed rates. The fair

values of forward settlements of FHLB advances are based on the

difference between current levels of interest rates and the com-

mitted rates.

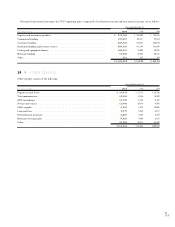

TCF has not incurred, and does not anticipate, significant

losses as a result of the recourse provisions associated with its bal-

ance of VA loans serviced with partial recourse. As a result, the car-

rying amounts and related estimated fair values of these financial

instruments were not material at December 31, 2000 and 1999.

57

TCF