TCF Bank 2000 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2000 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

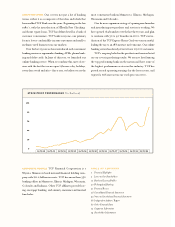

shares of stock at an average cost of $22.76 per share

in 2000). The stock price appreciation we experi-

enced in 2000 can be attributed to our superior

performance, in addition to the market's accep-

tance of our unique strategy of convenience bank-

ing and de novo expansion. Our price-to-earnings

ratio moved from 12.4x at year-end 1999 to 19x at

year-end 2000, lifting TCF from a discount price-

to-earnings ratio (as compared with our peers) to

a premium ratio. We now rank ninth in the top 50

banks in price-to-earnings ratio.

Year 2000's financial results were highlighted

by solid top-line revenue growth, improved credit

quality, increased POWER ASSETS

commercial and leasing credits), increased POWER

LIABILITIES®(core deposits) and flat non-interest

expenses. I believe that TCF's philosophy of conve-

nient banking for customers from all economic lev-

els, along with de novo expansion, new product

development, and our focus on core banking activ-

ities, is a proven strategy that has worked well for

us in the past and will work well for us in the future.

TCF is one of the few banks that

has shown consistent top-line revenue growth. Top-

line revenue, which consists of net interest income

and fee income, was up $63.9 million for 2000, an

increase of 9 percent. This is an important number

3

TCF

®(consumer,

Top-Line Revenue

1

SUPERMARKET

BRANCH

DEPOSITS

billion dollars

Our 213 supermarket branches topped $1 billion in retail

deposits in 2000. The bulk of these deposits are in low-

cost checking accounts, contributing directly to our Power

Liabilities and top-line revenue growth. We will continue

to grow this high performance deposit base as we add to our

supermarket branch network in 2001.