TCF Bank 2000 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2000 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

income. Income from leveraged leases is recognized using a method

which approximates a level yield over the term of the leases based

on the unrecovered equity investment.

Impaired loans include all non-accrual and restructured com-

mercial real estate and commercial business loans and equipment

financings. Consumer and residential real estate loans and lease

financings are excluded from the definition of an impaired loan.

Loan impairment is measured as the present value of expected future

cash flows discounted at the loan’s initial effective interest rate or

the fair value of the collateral for collateral-dependent loans.

The allowance for loan and lease losses is maintained at a level

believed to be appropriate by management to provide for proba-

ble loan and lease losses inherent in the portfolio as of the balance

sheet date, including known or anticipated problem loans and

leases, as well as for loans and leases which are not currently known

to require specific allowances. Management’s judgment as to the

amount of the allowance, including the allocated and unallocated

elements, is a result of ongoing review of larger individual loans

and leases, the overall risk characteristics of the portfolios, changes

in the character or size of the portfolios, the level of non-per-

forming assets, historical net charge-off amounts, geographic loca-

tion, prevailing economic conditions and other relevant factors.

Residential loans, consumer loans, and smaller-balance com-

mercial loans and lease and equipment financings are segregated

by loan type and sub-type, and are evaluated on a group basis.

Loans and leases are charged off to the extent they are deemed to

be uncollectible. The amount of the allowance for loan and lease

losses is highly dependent upon management’s estimates of vari-

ables affecting valuation, appraisals of collateral, evaluations of

performance and status, and the amounts and timing of future

cash flows expected to be received on impaired loans. Such esti-

mates, appraisals, evaluations and cash flows may be subject to fre-

quent adjustments due to changing economic prospects of

borrowers, lessees or properties. These estimates are reviewed peri-

odically and adjustments, if necessary, are recorded in the provi-

sion for credit losses in the periods in which they become known.

Interest income is accrued on loan and lease balances out-

standing. Loans and leases, including loans that are considered to

be impaired, are reviewed regularly by management and are placed

on non-accrual status when the collection of interest or principal

is 90 days or more past due (150 days or more past due for loans

secured by residential real estate), unless the loan or lease is ade-

quately secured and in the process of collection. When a loan or

lease is placed on non-accrual status, unless collection of all prin-

cipal and interest is considered to be assured, uncollected inter-

est accrued in prior years is charged off against the allowance for

loan and lease losses. Interest accrued in the current year is

reversed. For those non-accrual leases that have been funded on

a non-recourse basis by third-party financial institutions, the

related debt is also placed on non-accrual status. Interest payments

received on non-accrual loans and leases are generally applied to

principal unless the remaining principal balance has been deter-

mined to be fully collectible.

Cost of loans sold is determined on a specific identification basis

and gains or losses on sales of loans are recognized at trade dates.

Premises and Equipment – Premises and equipment are car-

ried at cost and are depreciated or amortized on a straight-line

basis over their estimated useful lives.

Other Real Estate Owned – Other real estate owned is recorded

at the lower of cost or fair value minus estimated costs to sell at the

date of transfer to other real estate owned. If the fair value of an

asset minus the estimated costs to sell should decline to less than

the carrying amount of the asset, the deficiency is recognized in

the period in which it becomes known and is included in other

non-interest expense.

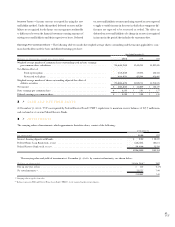

Mortgage Servicing Rights – Mortgage servicing rights are

capitalized and amortized in proportion to, and over the period

of, estimated net servicing income. TCF periodically evaluates its

capitalized mortgage servicing rights for impairment. Loan type

and note rate are the predominant risk characteristics of the under-

lying loans used to stratify capitalized mortgage servicing rights for

purposes of measuring impairment. Any impairment is recog-

nized through a valuation allowance.

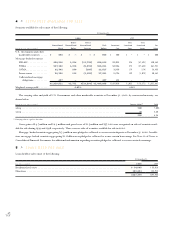

Intangible Assets – Goodwill resulting from acquisitions is

amortized over 20 to 25 years on a straight-line basis. Deposit base

intangibles are amortized over 10 years on an accelerated basis. The

Company reviews the recoverability of the carrying values of these

assets whenever an event occurs indicating that they may be impaired.

Derivative Financial Instruments – TCF utilizes derivative

financial instruments in the course of asset and liability manage-

ment to meet the ongoing credit needs of its customers and in

order to manage the market exposure of its residential loans held

for sale and its commitments to extend credit for residential loans.

Derivative financial instruments include commitments to extend

credit and forward mortgage loan sales commitments. See Note

14 for additional information concerning these derivative finan-

cial instruments.

Advertising and Promotions – Expenditures for advertising

and promotions are expensed as incurred.

44

TCF