TCF Bank 2000 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2000 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

TCF

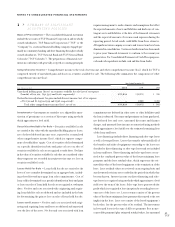

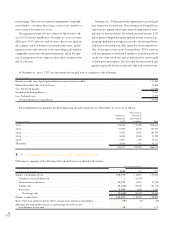

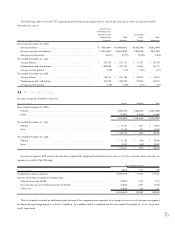

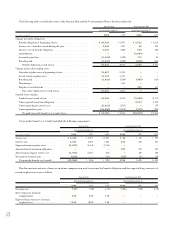

The following table sets forth TCF’s maximum and average borrowing levels for each of the years in the three-year period ended

December 31, 2000:

Securities Sold

Under Repurchase

Agreements and Discounted

Federal Funds FHLB Lease Other

(Dollars in thousands) Purchased Advances Rentals Borrowings

Year ended December 31, 2000:

Average balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 925,004 $1,888,892 $163,758 $121,048

Maximum month-end balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,151,913 2,016,040 172,348 296,750

Average rate for period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.34% 5.79% 8.55% 7.44%

Year ended December 31, 1999:

Average balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 529,359 $ 1,821,172 $ 171,997 $ 151,430

Maximum month-end balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,010,000 1,997,346 182,456 367,177

Average rate for period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.40% 5.52% 8.04% 6.27%

Year ended December 31, 1998:

Average balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 140,414 $ 1,367,104 $ 205,393 $ 92,467

Maximum month-end balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 367,280 1,804,208 222,018 214,087

Average rate for period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.60% 5.80% 8.15% 7.38%

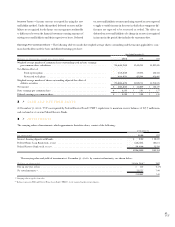

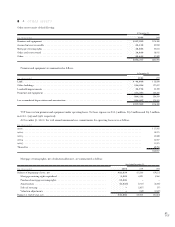

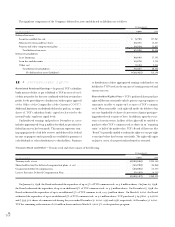

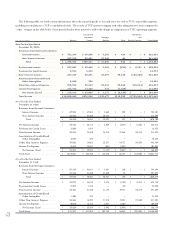

11 >INCOME TAXES

Income tax expense (benefit) consists of:

(In thousands) Current Deferred Total

Year ended December 31, 2000:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $88,746 $18,862 $107,608

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,457 2,528 8,985

$95,203 $21,390 $116,593

Year ended December 31, 1999:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 91,647 $ 2,981 $ 94,628

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,747 677 12,424

$ 103,394 $ 3,658 $ 107,052

Year ended December 31, 1998:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 91,102 $ (994) $ 90,108

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,325 (363) 18,962

$ 110,427 $ (1,357) $ 109,070

Income tax expense differs from the amounts computed by applying the federal income tax rate of 35% to income before income tax

expense as a result of the following:

Year Ended December 31,

(In thousands) 2000 1999 1998

Computed income tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $105,993 $ 95,582 $ 92,837

Increase in income tax expense resulting from:

Amortization of goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,544 2,724 3,741

State income tax, net of federal income tax benefit . . . . . . . . . . . . . . . . . . . . . . . . . 5,840 8,076 12,325

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,216 670 167

$116,593 $107,052 $109,070

The tax benefit recorded in additional paid-in capital for compensation expense for tax purposes in excess of amounts recognized

for financial reporting purposes totaled $1.5 million, $4.1 million and $2.4 million for the years ended December 31, 2000, 1999 and,

1998, respectively.