TCF Bank 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

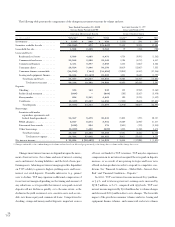

Amortization of goodwill and other intangibles decreased

$688,000 in 2000 and $710,000 in 1999. The decrease in 2000

was primarily due to reduced amortization of deposit base intan-

gibles. The write-off of goodwill associated with branch sales, which

is reported as a component of gain on sales of branches, totaled

$464,000 in 1999 and $3.3 million in 1998. No such write-offs

occurred during 2000.

Other non-interest expense increased $6.4 million, or 5.7%,

in 2000 and $3.4 million, or 3.1%, in 1999. The increases pri-

marily reflect costs associated with expanded retail banking and

leasing activities, including increases in deposit account losses. A

summary of other expense is presented in Note 19 of Notes to

Consolidated Financial Statements.

Income Taxes – TCF recorded income tax expense of $116.6

million in 2000, compared with $107.1 million in 1999 and

$109.1 million in 1998. Income tax expense represented 38.5%

of income before income tax expense during 2000, compared

with 39.2% and 41.1% in 1999 and 1998, respectively. The lower

tax rates in 2000 and 1999 reflect lower state income taxes, and

the impact of relatively lower non-deductible expenses.

Further detail on income taxes is provided in Note 11 of Notes

to Consolidated Financial Statements.

CONSOLIDATED FINANCIAL

CONDITION ANALYSIS

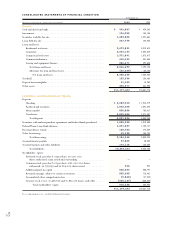

Investments – Total investments, which include interest-bear-

ing deposits with banks, federal funds sold, FHLB stock, Federal

Reserve Bank stock and other investments, decreased $14.1 mil-

lion in 2000 to $134.1 million at December 31, 2000. The

decrease primarily reflects a decrease of $20 million in interest-

bearing deposits with banks, partially offset by an increase of $5.8

million in FHLB stock. TCF had no non-investment grade debt

securities (junk bonds) and there were no open trading account

or investment option positions as of December 31, 2000. TCF is

required to invest in FHLB stock in proportion to its level of bor-

rowings from the FHLB.

Securities Available for Sale – Securities available for sale

are carried at fair value with the unrealized gains or losses, net of

deferred income taxes, reported as accumulated other compre-

hensive income (loss), which is a separate component of stock-

holders’ equity. Securities available for sale decreased $117.8 million

during 2000 to $1.4 billion at December 31, 2000. The decrease

reflects payment and prepayment activity, partially offset by pur-

chases of $314,000 of securities available for sale. At December

31, 2000, TCF’s securities available-for-sale portfolio included

$1.3 billion and $85.8 million of fixed-rate and adjustable-rate

mortgage-backed securities, respectively. Securities available for

sale totaled $1.5 billion at December 31, 1999. Net unrealized pre-

tax losses on securities available for sale totaled $15.6 million at

December 31, 2000, compared with net unrealized pre-tax losses

of $75.3 million at December 31, 1999. TCF has no plans to sell

these securities and it is not anticipated that these unrealized losses

will be realized.

Loans Held for Sale – Residential real estate and education

loans held for sale are carried at the lower of cost or market.

Education loans held for sale increased $9.3 million and resi-

dential real estate loans held for sale increased $19.5 million from

year-end 1999, and totaled $153.2 million and $74.5 million,

respectively, at December 31, 2000. As previously noted, $139.4

million of consumer finance automobile loans and $14.8 million

of related allowances were transferred to loans held for sale dur-

ing 1999 and were subsequently sold during 1999. There were no

consumer finance automobile loans classified as held for sale at

December 31, 2000. See “Loans and Leases.”

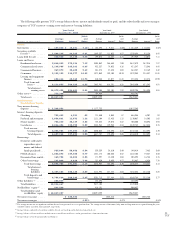

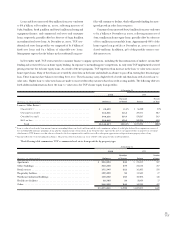

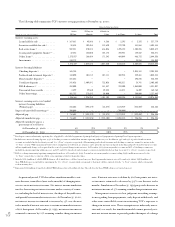

Loans and Leases – The following table sets forth information about loans and leases held in TCF’s portfolio, excluding loans held for sale:

At December 31,

(In thousands) 2000 1999 1998 1997 1996

Residential real estate . . . . . . . . . . . . . . . . . . . . . . . . $ 3,673,831 $3,919,678 $3,765,280 $ 3,623,845 $2,252,312

Consumer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,234,134 2,058,584 1,876,554 1,976,699 1,728,368

Commercial real estate . . . . . . . . . . . . . . . . . . . . . . . 1,371,841 1,073,472 811,428 859,916 858,225

Commercial business . . . . . . . . . . . . . . . . . . . . . . . . . 410,422 351,353 289,104 240,207 157,057

Leasing and equipment finance . . . . . . . . . . . . . . . . . 856,471 492,656 398,812 368,521 296,958

Total loans and leases . . . . . . . . . . . . . . . . . . . . $ 8,546,699 $7,895,743 $7,141,178 $ 7,069,188 $5,292,920

28

TCF