TCF Bank 2000 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2000 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

TCF

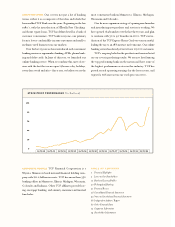

2000 was another good year for TCF. We earned a

record $186.2 million in 2000, our 10th consec-

utive year of record operating earnings. Our diluted

earnings per share increased 17.5 percent to $2.35.

Return on average assets (ROA) was 1.72 percent,

and our return on average realized common equity

(RORE) was 21.53 percent. On a cash basis (per-

haps a better measure of performance), TCF earned

$2.44 per common share, a return on average assets

lettertoour

shareholders

of 1.79 percent and a return on average realized

common equity of 22.40 percent.

Our stock closed at $44.56 per share at

December 31, 2000, up from $24.88 per share at

year-end 1999, an increase of 79 percent. Our

annualized total return to investors over the past

ten years was over 40 percent. Our stock hit a low

of $18 in March of 2000, a buying opportunity that

we took advantage of (TCF purchased 3.2 million