TCF Bank 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

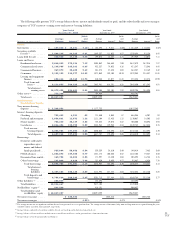

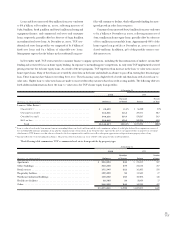

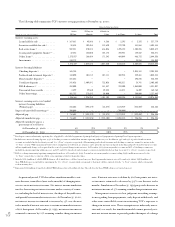

Non-Interest Expense – Non-interest expense increased $9.7 million, or 2.1%, in 2000, and $24.1 million, or 5.6%, in 1999, com-

pared with the respective prior years. The following table presents the components of non-interest expense:

Year Ended December 31, Percentage Increase (Decrease)

(Dollars in thousands) 2000 1999 1998 2000/1999 1999/1998

Compensation and employee benefits . . . . . . . . . . . . . $ 239,544 $239,053 $217,401 .2% 10.0%

Occupancy and equipment . . . . . . . . . . . . . . . . . . . . . 74,938 73,613 71,323 1.8 3.2

Advertising and promotions . . . . . . . . . . . . . . . . . . . . 19,181 16,981 19,544 13.0 (13.1)

Amortization of goodwill and other intangibles . . . . . . 10,001 10,689 11,399 (6.4) (6.2)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 118,864 112,462 109,033 5.7 3.1

Total non-interest expense . . . . . . . . . . . . . . . . . . $ 462,528 $452,798 $428,700 2.1 5.6

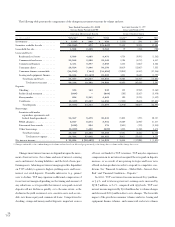

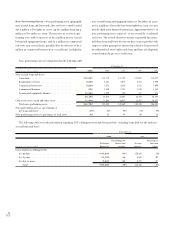

to $14.8 million in 1999. Annuity and mutual fund sales volumes

totaled $170.2 million for the year ended December 31, 2000, com-

pared with $230.5 million during 1999. The decreased volumes

during 2000 reflect the impact of lower yields offered by insurance

companies on annuity products, and the volatility of the stock mar-

ket. Sales of annuities and mutual funds may fluctuate from period

to period, and future sales levels will depend upon general economic

conditions and investor preferences. Sales of annuities will also

depend upon continued favorable tax treatment and may be nega-

tively impacted by the level of interest rates.

Gains on sales of loans held for sale decreased $735,000 in

2000, following a decrease of $2.8 million in 1999. Residential

mortgage loan sales volumes totaled $512.4 million for the year ended

December 31, 2000, compared with $360.3 million for the same

period of 1999. Education loan sales volumes totaled $100.9 mil-

lion for the year ended December 31, 2000, compared with $97.1

million for the same period of 1999. During 1999, TCF recognized

losses of $1.4 million on sales of $139.4 million of its consumer

finance automobile loan portfolio. See “Financial Condition – Loans

Held for Sale” and “Financial Condition – Loans and Leases.” Gains

or losses on sales of loans held for sale may fluctuate significantly

from period to period due to changes in interest rates and volumes,

and results in any period related to these transactions may not be

indicative of results which will be obtained in future periods.

Sales of securities available for sale produced gains of $3.2 mil-

lion and $2.2 million in 1999 and 1998, respectively. There were

no sales of securities available for sale in 2000. Gains of $3.1 mil-

lion and $2.4 million were recognized on the sales of $344.6 mil-

lion and $200.4 million of third-party loan servicing rights in

1999 and 1998, respectively. No similar activity occurred during

2000. TCF may, from time to time, sell securities available for

sale and loan servicing rights depending on market conditions.

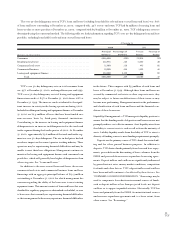

During the 1999 fourth quarter, TCF sold its title insurance and

appraisal operations and recognized a gain of $5.5 million, and will

recognize a deferred gain of up to $15 million over the ensuing five

years based upon TCF’s use of services. During 2000, $4.5 mil-

lion of this deferred gain was earned and recognized in other non-

interest income. Title insurance revenues are no longer recognized

by TCF as a result of its sale of these operations. Title insurance rev-

enues totaled $15.4 million in 1999 and $20.2 million in 1998.

During 2000, TCF recognized gains of $12.8 million on the

sales of six branches with $95.7 million in deposits, compared with

gains of $12.2 million on the sales of eight branches with $116.7

million in deposits during 1999. TCF recognized gains of $18.6

million on the sales of 14 branches with $234 million in deposits

and $5.6 million on the sale of its joint venture interest in Burnet

Home Loans during 1998. TCF periodically sells branches that it

considers to be underperforming, or have limited growth poten-

tial, and may continue to do so in the future, including one

planned branch sale during the first quarter of 2001.

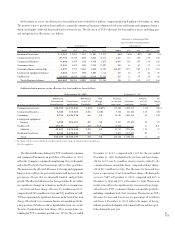

Compensation and employee benefits, representing 51.8% and

52.8% of total non-interest expense in 2000 and 1999, respec-

tively, increased $491,000, or .2%, in 2000, and $21.7 million,

or 10%, in 1999. The increases were primarily due to costs asso-

ciated with expanded retail banking and leasing activities, includ-

ing the opening of a total of 164 new branches in the past three

years, offset by cost savings from discontinued businesses.

Occupancy and equipment expenses increased $1.3 million in

2000 and $2.3 million in 1999. The increases were primarily due

to TCF’s expanded retail banking and leasing activities, offset by

branch sales.

Advertising and promotion expenses increased $2.2 million

in 2000 following a decrease of $2.6 million in 1999. The increase

in 2000 was primarily due to promotional expenses associated

with the TCF Express Phone Card, where customers earn free long

distance minutes for use of their debit cards. During 2000, TCF

awarded over 38.6 million minutes under this promotion. The

decrease in 1999 reflected a decrease in direct mail expenses relat-

ing to the promotion of consumer finance loan products. 27

TCF