TCF Bank 2000 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2000 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

TCF

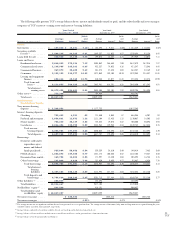

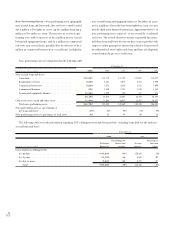

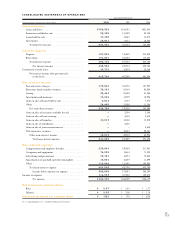

Loan and lease originations were as follows:

Year Ended December 31,

(In thousands) 2000 1999 1998

Consumer(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,111,644 $1,371,712 $1,181,027

Commercial . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 768,024 746,769 519,386

Leasing and equipment finance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 648,052 327,265 199,639

Residential real estate(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 893,873 1,362,742 2,023,078

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $3,421,593 $3,808,488 $3,923,130

(1) Includes loans held for sale.

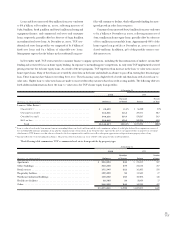

Allowance for Loan and Lease Losses – Credit risk is the

risk of loss from a customer default. TCF has in place a process to

identify and manage its credit risk. The process includes initial

credit review and approval, periodic monitoring to measure com-

pliance with credit agreements and internal credit policies, mon-

itoring changes in the risk ratings of loans and leases, identification

of problem loans and leases and special procedures for collection

of problem loans and leases. The risk of loss is difficult to quan-

tify and is subject to fluctuations in values and general economic

conditions and other factors. See Notes 1 and 7 of Notes to

Consolidated Financial Statements for additional information

concerning TCF’s allowance for loan and lease losses.

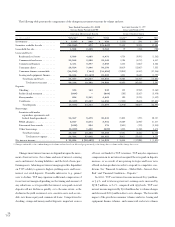

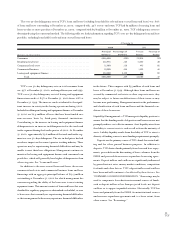

Commercial real estate loans increased $298.4 million from

year-end 1999 to $1.4 billion at December 31, 2000. Commercial

business loans increased $59.1 million in 2000 to $410.4 mil-

lion at December 31, 2000. TCF is seeking to expand its com-

mercial business and commercial real estate lending activity to

borrowers located in its primary midwestern markets. At December

31, 2000, approximately 87% of TCF’s commercial real estate

loans outstanding were secured by properties located in its pri-

mary markets. In addition, approximately 96% of TCF’s com-

mercial business and commercial real estate loans are secured either

by properties or underlying business assets. At December 31, 2000

and December 31, 1999, there were no commercial real estate loans

with terms that have been modified in troubled debt restructur-

ings included in performing loans.

Leasing and equipment finance increased $363.8 million from

year-end 1999 to $856.5 million at December 31, 2000. At

December 31, 2000, $165.8 million or 25.4% of TCF’s lease

portfolio was funded on a non-recourse basis with other banks

and consequently TCF retains no credit risk on such amounts.

This compares with non-recourse fundings of $178.4 million or

38.9% at December 31, 1999. Total loan and lease originations

for TCF’s leasing business were $648.1 million during 2000,

compared with $327.3 million in 1999 and $199.6 million in

1998. At December 31, 2000, the backlog of approved transac-

tions related to TCF’s leasing business totaled $165.6 million,

compared with $125.2 million at December 31, 1999. The increase

in the leasing and equipment finance portfolio is primarily due

to the de novo expansion activity of TCF Leasing, which began in

1999. Included in this portfolio at December 31, 2000 are $144.4

million of loans and leases secured by trucks and trailers, com-

pared with $34.1 million at December 31, 1999. TCF’s expanded

leasing activity is subject to the risk of cyclical downturns and other

adverse economic developments affecting these industries and mar-

kets. TCF Leasing has originated most of its portfolio during

2000, and consequently the performance of this portfolio may

not be reflective of future results and credit quality.