TCF Bank 2000 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2000 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

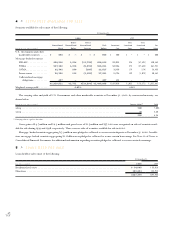

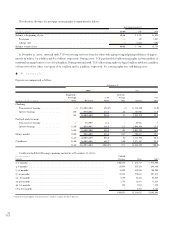

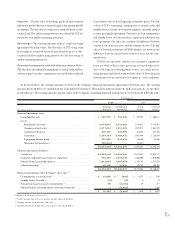

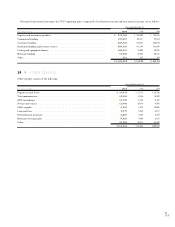

Veterans Administration (“VA”) loans serviced with partial recourse

and forward mortgage loan sales commitments, the contract or

notional amount exceeds TCF’s exposure to credit loss. TCF con-

trols the credit risk of forward mortgage loan sales commitments

through credit approvals, credit limits and monitoring procedures.

Commitments to Extend Credit – Commitments to extend

credit are agreements to lend to a customer provided there is no

violation of any condition in the contract. These commitments

generally have fixed expiration dates or other termination clauses

and may require payment of a fee. These commitments totaled

$1.1 billion and $1.2 billion at December 31, 2000 and 1999,

respectively. Since certain of the commitments are expected to

expire without being drawn upon, the total commitment amounts

do not necessarily represent future cash requirements. Collateral

predominantly consists of residential and commercial real estate

and personal property. Included in the total commitments to

extend credit at December 31, 2000 were fixed-rate mortgage loan

commitments and loans in process aggregating $27.5 million.

Standby Letters of Credit – Standby letters of credit are con-

ditional commitments issued by TCF guaranteeing the performance

of a customer to a third party. The standby letters of credit expire

in various years through the year 2005 and totaled $28.8 million

and $22 million at December 31, 2000 and 1999, respectively.

Collateral held primarily consists of commercial real estate mort-

gages. Since the conditions under which TCF is required to fund

standby letters of credit may not materialize, the cash requirements

are expected to be less than the total outstanding commitments.

VA Loans Serviced with Partial Recourse – TCF services VA

loans on which it must cover any principal loss in excess of the VA’s

guarantee if the VA elects its “no-bid” option upon the foreclo-

sure of a loan. The serviced loans are collateralized by residential

real estate and totaled $182.1 million and $184.5 million at

December 31, 2000 and 1999, respectively.

Forward Mortgage Loan Sales Commitments – TCF enters

into forward mortgage loan sales commitments in order to man-

age the market exposure on its residential loans held for sale and

its commitments to extend credit for residential loans. Forward

mortgage loan sales commitments are contracts for the delivery of

mortgage loans or pools of loans in which TCF agrees to make

delivery at a specified future date of a specified instrument, at a

specified price or yield. Risks arise from the possible inability of

the counterparties to meet the terms of their contracts and from

movements in mortgage loan values and interest rates. Forward

mortgage loan sales commitments totaled $121.7 million and $46.3

million at December 31, 2000 and 1999, respectively.

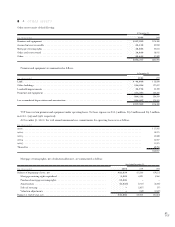

Federal Home Loan Bank Advances – Forward Settle-

ments – TCF enters into forward settlements of FHLB advances

in the course of asset and liability management and to manage

interest rate risk. Forward settlements of FHLB advances totaled

$300 million and $189 million at December 31, 2000 and 1999,

respectively.

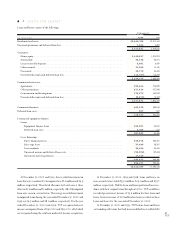

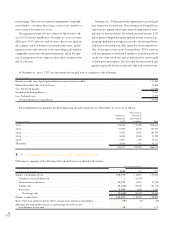

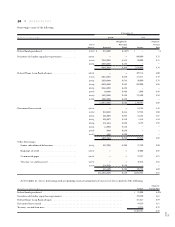

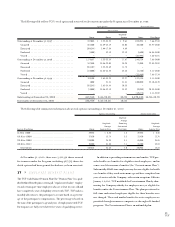

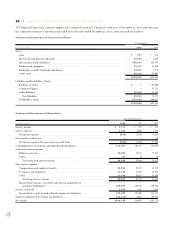

15 >FAIR VALUES OF FINANCIAL

INSTRUMENTS

TCF is required to disclose the estimated fair value of financial

instruments, both assets and liabilities on and off the balance sheet,

for which it is practicable to estimate fair value. Fair value estimates

are made at a specific point in time, based on relevant market infor-

mation and information about the financial instruments. Fair

value estimates are subjective in nature, involving uncertainties

and matters of significant judgment, and therefore cannot be deter-

mined with precision. Changes in assumptions could significantly

affect the estimates.

The carrying amounts of cash and due from banks, investments

and accrued interest payable and receivable approximate their fair

values due to the short period of time until their expected real-

ization. Securities available for sale are carried at fair value, which

is based on quoted market prices. Certain financial instruments,

including lease financings and discounted lease rentals, and all

non-financial instruments are excluded from fair value of finan-

cial instrument disclosure requirements.

The following methods and assumptions are used by the

Company in estimating fair value disclosures for its remaining

financial instruments, all of which are issued or held for purposes

other than trading.

Loans Held for Sale – The fair value of loans held for sale is

estimated based on quoted market prices.

The estimated fair value of capitalized mortgage servicing rights

totaled $49.8 million at December 31, 2000, compared with a

carrying amount of $40.1 million. The estimated fair value of cap-

italized mortgage servicing rights is based on estimated cash flows

discounted using rates commensurate with the risks involved.

Assumptions regarding prepayments, defaults and interest rates

are determined using available market information.

Loans – The fair values of residential and consumer loans are

estimated using quoted market prices. For certain variable-rate

loans that reprice frequently and that have experienced no signif-

icant change in credit risk, fair values are based on carrying val-

ues. The fair values of other loans are estimated by discounting

contractual cash flows adjusted for prepayment estimates, using

interest rates currently being offered for loans with similar terms

to borrowers with similar credit risk characteristics.

56

TCF