TCF Bank 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ower Assets . Power Liabilities®.Top-Line Revenue Growth . Earnings

Growth . Totally Free Checking . Home Equity Loans . Innovations .

Student Banking . Campus Banking . Small Busine

Supermarket Banking Online Banking .

Online Banking . Service . TCF Financial Corporation . Express TellerSM A

elephone Banking . A National Financial Holding Company . De Novo Expansi

ower Assets . Convenient Banking . Power Liabilities . Top-Line Revenue Growt

Earnings per Share Growth . Totally Free Checking . Home Equity Loans .

Leasing . Student Banking . Campus Banking . Small Business Banking .

Express Phone Card . Online Banking . Supermarket Banking . Express

g . Convenient Banking . Service . Express Teller ATMs . Telephon

nking . De Novo Expansion . Power Assets®. Power Liabilities . Top

rowth . Earnings per Share Growth . Totally Free Checking . Home E

Loans . Leasing . Check Card . TCF Express Phone Card . Small Busine

mpus Banking . Student Banking . 2000 Annual Report . Super

arket Banking . Online Banking . Service . Convenient Banking. S

r ATMs . De Novo Expansion . Telephone Banking . Power Assets

Liabilities Earnings per Share Growth . Leasing and Equipment Finance .

ee Checking . Home Equity Loans . Leasing . Student Banking . Campus

Banking . Check Card . Express Phone C

Table of contents

-

Page 1

... . Totally Free Checking . Home Equity L ing . Student Banking . Campus Banking . Small Business Bankin ress Phone Card . Online Banking . Supermarket Banking . Expre ® . Convenient Banking . Service . Express Teller ATMs . Telepho king . De Novo Expansion . Power Assets . Power Liabilities... -

Page 2

...is a Wayzata, Minnesota based national financial holding company with $11.2 billion in assets. TCF has more than 350 banking offices in Minnesota, Illinois, Michigan, Wisconsin, Colorado and Indiana. Other TCF affiliates provide leasing, mortgage banking, and annuity, insurance and mutual fund sales... -

Page 3

... Data: Total assets ...Investments ...Securities available for sale ...Residential real estate loans ...Other loans and leases ...Goodwill ...Deposit base intangibles ...Deposits ...Securities sold under repurchase agreements and federal funds purchased ...Federal Home Loan Bank advances ...Other... -

Page 4

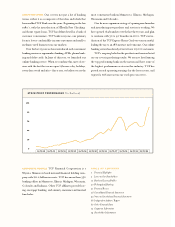

... of 1.79 percent and a return on average realized common equity of 22.40 percent. Our stock closed at $44.56 per share at December 31, 2000, up from $24.88 per share at year-end 1999, an increase of 79 percent. Our annualized total return to investors over the past ten years was over 40 percent. Our... -

Page 5

...in retail deposits in 2000. The bulk of these deposits are in lowcost checking accounts, contributing directly to our Power Liabilities and top-line revenue growth. We will continue to grow this high performance deposit base as we add to our supermarket branch network in 2001. billion dollars 3 TCF -

Page 6

... nearly 100,000 new checking accounts in 2000, growth in our Power Assets, up $896.8 million for bringing our total to 1,131,000. We now have 1.1 milthe year, a 23 percent increase from year-end 1999. lion debit cards outstanding (the 16th largest Visa Commercial lending, consumer lending, and... -

Page 7

...year, an increase of 15 percent. Through the introduction of a new, tiered money TCF's very profitable and growing deposit function allows us to operate our loan portfolio with relatively low credit risk. De Novo Branch Expansion TCF believes in a de novo market account, our money market balances... -

Page 8

... we modified and enhanced to fit That is not to say we will not do an acquisition in the our business strategy. Totally Free Checking, home future, but currently we think the de novo strategy equity loans, debit cards, annuity sales and, of course, supermarket branch banking have been our 6 TCF -

Page 9

... in 2000. This helped the debit card earn $28.7 million in fees for the year 2000. In 2001 we will introduce TCF Express Trade to provide our customers online and brokerassisted investing services. Supermarket Banking TCF now has the fourth largest supermarket branch system in the United States... -

Page 10

... our annuity and investment products in those branches where we have agents. It is clear to us that our supermarket banking strategy is working and is a significant factor in making TCF the most convenient bank in our markets. We plan to open 25 to 30 new supermarket branches in 2001 and more in the... -

Page 11

... 2000. New business for Winthrop Resources Corporation, TCF Leasing, Inc. and TCF Express Leasing increased 101 percent. We will see the results of the continued expansion of our sales force in 2001. GROWTH IN NEW BUSINESS 0 1 1 percent implement innovative and customized products and services... -

Page 12

...the number of shares we buy remains subject to the availability of capital, we plan to continue repurchasing shares as long as TCF stock remains our most attractive investment opportunity. We consider the return from repurchasing TCF stock as another hurdle rate for acquisitions. Again this year we... -

Page 13

... strength over time. We regret that Robert Delonis, retired TCF Board member and former chairman of Great Lakes National Bank Michigan, died on February 7, 2001. His contributions to TCF and to the local and national business community were considerable. He will be missed. During 2000, we welcomed... -

Page 14

..., Inc. and the TCF Express Phone Card. LEASING TCF Leasing, one of TCF's newest de novo businesses, became profitable in less than one year. TCF first entered the leasing business with its acquisition of Winthrop Resources Corporation (Winthrop) in 1997. Winthrop specializes in leasing high-tech... -

Page 15

... a broad customer base. The TCF Express Phone Card is credited with accelerating Check Card use and increasing Check Card revenue. For 2000, TCF's Check Card revenue totaled $28.7 million, an increase of $9.1 million over the 1999 total. TCF is now the 16th largest issuer of Visa debit cards in the... -

Page 16

.... This has resulted in $2.2 billion in checking accounts, $1 billion in savings, $837 million in money markets and $2.8 billion in certificates of deposit. Our Power Liabilities totaled $6.9 billion at year-end 2000, up $307 million from 1999. The additional benefit of having a growing base of low... -

Page 17

POWER LIABILITIES AND POWER ASSETS 2 billion dollars in home equity outstandings We now have more than $2 billion in home equity loans throughout the areas we serve. Our lending program in our supermarket branches is proving to be very successful ...mor e than $233 million of these loans have been... -

Page 18

... mix enhances TCF's strong sales efforts and maximizes the percent of market share we can attract. Once a customer has opened one TCF account, we have had excellent results selling additional products and services. A third key to successful expansion in supermarket or brick and mortar branches is... -

Page 19

...TCF revolves around the idea of convenience. That's why we're open 12 hours a day, seven days week and most holidays. From online banking services like TCFExpress.com, to our Express Teller ATMs and our extensive way our customers want it. branch network, TCF provides convenience the 7 days a week... -

Page 20

... offering convenient services and products will work in these cities. We plan to open two additional brick and mortar branches in 2001 and open supermarket branches as opportunities become available. GEOGRAPHICAL MANAGEMENT STRUCTURE 6 states TCF has seasoned local management teams in each region... -

Page 21

... CUSTOMER FIRST TCF is a results oriented company. Our strategy for growth through de novo expansion and new business development in key markets continues to be successful. Equally important to us is our focus on delivering great service to customers and consistent returns to our shareholders. TCF... -

Page 22

... small to medium-sized businesses in our markets. We emphasize convenience in banking, by being open 12 hours a day, holidays and seven days a week. We provide customers targeted, innovative products through multiple banking channels. These include: traditional and supermarket branches, ATMs, debit... -

Page 23

... chartered banks, TCF National Bank headquartered in Minnesota and TCF National Bank Colorado. The Company has 352 banking offices in Minnesota, Illinois, Michigan, Wisconsin, Colorado and Indiana. Other affiliates provide leasing, mortgage banking, and annuity, insurance and mutual fund sales. TCF... -

Page 24

... loan service fee charged to the banking segment was increased to a market rate in 2000. Non-interest expense totaled $29.2 million, down 10.3% from $32.6 million in 1999. During 2000, TCF's mortgage banking operation consolidated and streamlined its operations in various states. TCF's mortgage... -

Page 25

...Year Ended December 31, 1998 Average Balance Yields and Rates (Dollars in thousands) Interest(1) Interest(1) Interest(1) Assets: Investments ...Securities available for sale (2) ...Loans held for sale ...Loans and leases: Residential real estate . . Commercial real estate . Commercial business... -

Page 26

...-rate home equity and commercial loans. Competition for checking, savings and money market deposits, important sources of lower cost funds for TCF, is intense. TCF may also experience compression in its net interest margin if the rates paid on deposits increase, or as a result of new pricing... -

Page 27

...revenues, reflecting TCF's expanded retail banking and leasing operations and customer base. The increases in fees and service charges and electronic funds transfer revenues reflect the increase in the number of retail checking accounts, which totaled 1,131,000 accounts at December 31, 2000, up from... -

Page 28

...increased $11 million, or 16.3%, in 2000 and $16.6 million, or 32.8%, in 1999. These increases reflect TCF's efforts to provide banking services through its ATM network and debit cards. Included in electronic funds transfer revenues are debit card interchange fees of $28.7 million, $19.5 million and... -

Page 29

...banking and leasing activities, offset by branch sales. Advertising and promotion expenses increased $2.2 million in 2000 following a decrease of $2.6 million in 1999. The increase in 2000 was primarily due to promotional expenses associated with the TCF Express Phone Card, where customers earn free... -

Page 30

...sets forth information about loans and leases held in TCF's portfolio, excluding loans held for sale: At December 31, (In thousands) 2000 1999 1998 1997 1996 Residential real estate ...Consumer ...Commercial real estate ...Commercial business ...Leasing and equipment finance ...Total loans and... -

Page 31

...more creditworthy customers based on credit scoring models. The following table sets forth additional information about the loan-to-value ratios for TCF's home equity loan portfolio: At December 31, 2000 (Dollars in thousands) 1999 Percent of Total Balance Balance Percent of Total Loan-to-Value... -

Page 32

... year-end 1999 to $1.4 billion at December 31, 2000. Commercial business loans increased $59.1 million in 2000 to $410.4 million at December 31, 2000. TCF is seeking to expand its commercial business and commercial real estate lending activity to borrowers located in its primary midwestern markets... -

Page 33

... during the year then ended as a percentage of related average loans and leases. N.A. Not applicable. The allocated allowance balances for TCF's residential, consumer and commercial business loan portfolios at December 31, 2000 reflect the Company's continued strengthening of its credit quality and... -

Page 34

... At December 31, (Dollars in thousands) 2000 1999 1998 1997 1996 Non-accrual loans and leases: Consumer ...Residential real estate ...Commercial real estate ...Commercial business ...Leasing and equipment finance ...Other real estate owned and other assets ...Total non-performing assets ...Non... -

Page 35

...-accrual loans and leases: At December 31, 2000 (Dollars in thousands) 1999 Principal Balances Percentage of Portfolio Principal Balances Percentage of Portfolio Consumer ...Residential real estate ...Commercial real estate ...Commercial business ...Leasing and equipment finance ...Total ... $20... -

Page 36

... Change (Dollars in thousands) 2000 Number of branches ...Number of deposit accounts ...Deposits: Checking ...Passbook and statement ...Money market ...Certificates ...Total deposits ...Average rate on deposits ...Total fees and other revenues for the year ...Consumer loans outstanding ... 213... -

Page 37

... 31, 1999. The decrease in TCF's negative one-year interest-rate gap reflects the impact of projected faster prepayment rates on loan and mortgage-backed securities portfolios, and a change in management's maturity/repricing assumptions for money market deposits. 2000 was $910.2 million, or 8.1% of... -

Page 38

... TCF's interest-rate gap position at December 31, 2000: Maturity/Rate Sensitivity (Dollars in thousands) Within 30 Days 30 Days to 6 Months 6 Months to 1 Year 1 to 3 Years 3+ Years Total Interest-earning assets: Loans held for sale ...Securities available for sale (1) ...Real estate loans... -

Page 39

...tions on ATM surcharges or restrict the sharing of customer information, or adverse decisions in litigation dealing with such legislation, or in litigation against Visa and Mastercard affecting debit card fees, could have an adverse impact on TCF. On November 12, 1999, the President signed into law... -

Page 40

... per-share data) 2000 1999 Assets Cash and due from banks ...Investments ...Securities available for sale ...Loans held for sale ...Loans and leases: Residential real estate ...Consumer ...Commercial real estate ...Commercial business ...Leasing and equipment finance ...Total loans and leases... -

Page 41

...income: Fees and service charges ...Electronic funds transfer revenues ...Leasing ...Investments and insurance ...Gain on sales of loans held for sale ...Other ...Fees and other revenues ...Gain on sales of securities available for sale ...Gain on sales of loan servicing ...Gain on sales of branches... -

Page 42

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (Dollars in thousands) Balance, December 31, 1997 ...Comprehensive income: Net income ...Other... plans ...Purchase of TCF stock to fund the 401(k) plan, net ...Loan to Executive Deferred Compensation Plan, net of payments ...Balance, December 31, 2000 ... -

Page 43

Number of Common Shares Issued Common Stock Additional Paid-in Capital Retained Earnings Accumulated Other Comprehensive Income (Loss) Treasury Stock and Other Total 92,821,529 - - - - - 47,200 (18,170) - 61,687 - - 92,912,246...416) $508,682 $ 835,605 $ (9,868) $(425,127) $ 910,220 41 TCF -

Page 44

...) in cash and due from banks ...Cash and due from banks at beginning of year ...Cash and due from banks at end of year ...Supplemental disclosures of cash flow information: Cash paid for: Interest on deposits and borrowings ...Income taxes ...42 TCF Transfer of loans to other real estate owned and... -

Page 45

...recorded in noninterest income as a loss on securities available for sale. Loans Held for Sale - Loans held for sale are carried at the lower of cost or market determined on an aggregate basis, including related forward mortgage loan sales commitments. Cost of loans sold is determined on a specific... -

Page 46

... the ongoing credit needs of its customers and in order to manage the market exposure of its residential loans held for sale and its commitments to extend credit for residential loans. Derivative financial instruments include commitments to extend credit and forward mortgage loan sales commitments... -

Page 47

..., 2000, by contractual maturity, are shown below: (Dollars in thousands) Carrying Value(1) Yield Due in one year or less ...No stated maturity (2) ...(1) (2) $ 332 133,727 6.17% 7.44 7.44 $134,059 Carrying value is equal to fair value. Balance represents FRB and Federal Home Loan Bank ("FHLB... -

Page 48

... on sales of securities available for sale during 1999 and 1998, respectively. There were no sales of securities available for sale in 2000. Mortgage-backed securities aggregating $5.3 million were pledged as collateral to secure certain deposits at December 31, 2000. In addition, mortgage-backed... -

Page 49

... 31, (In thousands) 2000 1999 Residential real estate ...Unearned premiums and deferred loan fees ...Consumer: Home equity ...Automobile ...Loans secured by deposits ...Other secured ...Unsecured ...Unearned discounts and deferred loan fees ...Commercial real estate: Apartments ...Other permanent... -

Page 50

... of business on normal credit terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with unrelated persons, and in the opinion of management do not represent more than a normal credit risk of collection. During 2000, TCF purchased the equity... -

Page 51

... 15,221 14,800 13,967 11,521 60,256 $133,047 Mortgage servicing rights, net of valuation allowance, are summarized as follows: Year Ended December 31, (In thousands) 2000 1999 1998 Balance at beginning of year, net ...Mortgage servicing rights capitalized ...Purchased mortgage servicing rights... -

Page 52

...follows: Year Ended December 31, (In thousands) 2000 1999 1998 Balance at beginning of year ...Provisions ...Charge-offs ...Balance at end of year ... $946 - - $946 $ 2,738 169 (1,961) $ 946 $1,594 1,547 (403) $2,738 At December 31, 2000, 1999 and 1998, TCF was servicing real estate loans for... -

Page 53

... At December 31, 2000, borrowings with a remaining contractual maturity of one year or less consisted of the following: (Dollars in thousands) Amount WeightedAverage Rate Federal funds purchased ...Securities sold under repurchase agreements ...Federal Home Loan Bank advances ...Discounted lease... -

Page 54

...-up support by the bank line of credit. Commercial paper generally matures within 90 days, although it may have a term of up to 270 days. FHLB advances are collateralized by residential real estate loans and FHLB stock with an aggregate carrying value of $2.5 billion at December 31, 2000. 52 TCF -

Page 55

... three-year period ended December 31, 2000: Securities Sold Under Repurchase Agreements and Federal Funds Purchased Discounted Lease Rentals (Dollars in thousands) FHLB Advances Other Borrowings Year ended December 31, 2000: Average balance ...Maximum month-end balance ...Average rate for period... -

Page 56

...as follows: At December 31, (In thousands) 2000 1999 Deferred tax assets: Securities available for sale ...Allowance for loan and lease losses ...Pension and other compensation plans ...Total deferred tax assets ...Deferred tax liabilities: Lease financing ...Loan fees and discounts ...Other, net... -

Page 57

... and 2000, loans totaling $6.4 million and $2 million, respectively, were made by TCF to the Executive Deferred Compensation Plan trustee on a nonrecourse basis to purchase shares of TCF common stock for the accounts of participants. The loans are repayable by the participants over five years and... -

Page 58

... and interest rates are determined using available market information. Loans - The fair values of residential and consumer loans are into forward mortgage loan sales commitments in order to manage the market exposure on its residential loans held for sale and its commitments to extend credit for... -

Page 59

... of checking, passbook and statement loans held for sale are based upon quoted market prices. The fair values of TCF's remaining commitments to extend credit and standby letters of credit are estimated using fees currently charged to enter into similar agreements. For fixed-rate loan commitments... -

Page 60

... to the market price of TCF common stock on the date of grant. Restricted stock granted in 1998 generally vests within five years, but may be subject to a delayed vesting schedule if certain return on equity goals are not met. Restricted stock granted to certain executive officers in 2000 will vest... -

Page 61

... S The TCF Cash Balance Pension Plan (the "Pension Plan") is a qualified defined benefit plan covering all "regular stated salary" employees and certain part-time employees who are at least 21 years old and have completed a year of eligibility service with TCF. TCF makes a monthly allocation to the... -

Page 62

...(998) $(5,516) Net periodic benefit cost (credit) included the following components: Pension Plan Year Ended December 31, (In thousands) Postretirement Plan Year Ended December 31, 1998 2000 2000 1999 1999 1998 Service cost ...Interest cost ...Expected return on plan assets ...Amortization of... -

Page 63

...1, 2000, TCF's wholly owned bank subsidiaries located in Minnesota, Illinois, Wisconsin and Michigan had been identified as reportable segments. In April 2000, TCF merged these four bank charters into one national bank charter headquartered in Minnesota. Following the bank merger, certain management... -

Page 64

... of TCF's operating segments. Leasing and Equipment Finance Mortgage Banking Eliminations and Reclassifications (In thousands) Banking Other Consolidated At or For the Year Ended December 31, 2000: Revenues from External Customers: Interest Income ...Non-Interest Income ...Total ...Net... -

Page 65

... expense consists of the following: Year Ended December 31, (In thousands) 2000 1999 1998 Deposit account losses ...Telecommunication ...ATM interchange ...Postage and courier ...Office supplies ...Loan and lease ...Federal deposit insurance ...Mortgage servicing rights ...Other ... $ 19,479 13... -

Page 66

20 > PARENT COMPANY FINANCIAL INFORMATION TCF Financial Corporation's (parent company only) condensed statements of financial condition as of December 31, 2000 and 1999, and the condensed statements of operations and cash flows for the years ended December 31, 2000, 1999 and 1998 are as follows: ... -

Page 67

...Other, net ...Total adjustments ...Net cash provided by operating activities ...Cash flows from investing activities: Net (increase) decrease in interest-bearing deposits with banks ...Investments in and advances to subsidiaries, net ...Loan to Executive Deferred Compensation Plan, net ...Purchases... -

Page 68

... and the related consolidated statements of operations, stockholders' equity, and cash flows for each of the years in the three-year period ended December 31, 2000. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion... -

Page 69

...Net interest income after provision for credit losses ...Non-interest income: Fees and other revenues ...Other non-interest income: Gain (loss) on sales of securities available for sale ...Gain on sales of loan servicing ...Gain on sales of branches ...Gain on sale of subsidiaries ...Title insurance... -

Page 70

... interest income after provision for credit losses . Fees and other revenues ...Other non-interest income: Gain on sales of securities available for sale ...Gain on sales of loan servicing ...Gain on sales of branches ...Gain on sale of subsidiaries ...Gain on sale of joint venture interest ...Gain... -

Page 71

... Loan Bank stock, at cost ...Securities available for sale ...Loans held for sale ...Residential real estate loans ...Other loans and leases ...Goodwill ...Deposit base intangibles ...Deposits ...Federal Home Loan Bank advances ...Other borrowings ...Stockholders' equity ...Tangible equity ...Book... -

Page 72

... for Loan and Lease Loss Information Year Ended December 31, (Dollars in thousands) 2000 1999 1998 1997 1996 Balance at beginning of year ...Acquired balance ...Transfers to loans held for sale ...Charge-offs: Residential real estate ...Commercial real estate ...Commercial business ...Consumer... -

Page 73

... At December 31, 2000 (1) (In thousands) Residential Real Estate Commercial Real Estate Commercial Business Consumer Leasing and Equipment Finance Total Loans and Leases Amounts due: Within 1 year ...After 1 year: 1 to 2 years ...2 to 3 years ...3 to 5 years ...5 to 10 years ...10 to 15... -

Page 74

... McMinn Todd A. Palmer Stephen W. Sinner David J. Veurink Michigan Senior Vice President Janet M. Bryant TCF Securities, Inc. President Frank A. McCarthy TCF Mortgage Corporation President Joseph W. Doyle Senior Vice Presidents Richard B. Aronson Douglas L. Dinndorf Patricia A. Roycraft Tamara... -

Page 75

... Paul Area (34) Greater Minnesota (3) Illinois 3 Advisory Committee -TCF Employee Stock Purchase Plan Executive Committee 4 Headquarters 800 Burr Ridge Parkway Burr Ridge, IL 60521 (630) 986-4900 Traditional Branches (30) Supermarket Branches (138) Includes Indiana Branch Wisconsin Headquarters... -

Page 76

... 30 Transfer Agent and Registrar Fleet National Bank c/o EquiServe Limited Partnership P.O. Box 43010 Providence, RI 02940-3010 (800) 730-4001 www.equiserve.com TCF Financial Corporation Corporate Communications 200 Lake Street East EX0-02-C Wayzata, MN 55391-1693 (952) 745-2760 Corporate Web Site... -

Page 77

Powe Gr TCF Financial Corporation 200 Lake Street East Wayzata, MN 55391-1693 www.tcfexpress.com Student B Sup Online . Telepho . Power A Ea Lea Exp Banking Ban Revenue Gr Loa Ca E In an effort to help save our natural resources, the cover and inside ma pages of this annual report are...