Supercuts 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

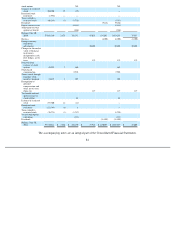

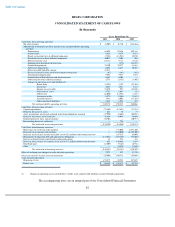

REGIS CORPORATION

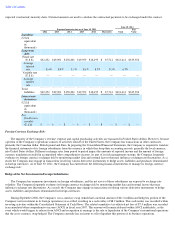

CONSOLIDATED STATEMENT OF CASH FLOWS

(In thousands)

The accompanying notes are an integral part of the Consolidated Financial Statements.

82

Years Ended June 30,

2011 2010 2009

Cash flows from operating activities:

Net (loss) income

$

(8,905

)

$

42,740

$

(124,466

)

Adjustments to reconcile net (loss) income to net cash provided by operating

activities:

Depreciation

88,602

92,466

105,145

Amortization

9,826

9,870

9,871

Equity in (income) loss of affiliated companies

(7,228

)

(11,942

)

28,940

Dividends received from affiliated companies

10,023

2,404

906

Deferred income taxes

(14,711

)

5,115

(3,843

)

Impairment on discontinued operations

—

(

154

)

183,289

Goodwill impairment

74,100

35,277

41,661

Salon asset impairments

6,681

6,428

10,201

Note receivable bad debt expense

31,227

—

—

Excess tax benefits from stock

-

based compensation plans

(67

)

(243

)

(163

)

Stock

-

based compensation

9,596

9,337

7,525

Amortization of debt discount and financing costs

6,469

6,406

—

Other noncash items affecting earnings

1,578

(3,153

)

(3,405

)

Changes in operating assets and liabilities(1):

Receivables

(2,358

)

1,192

(12,104

)

Inventories

4,629

4,823

7,128

Income tax receivable

23,855

957

(34,652

)

Other current assets

4,725

2,657

(52

)

Other assets

(11,050

)

(14,951

)

(1,327

)

Accounts payable

(2,973

)

(4,966

)

(3,613

)

Accrued expenses

3,341

6,006

(23,364

)

Other noncurrent liabilities

1,818

1,954

387

Net cash provided by operating activities

229,178

192,223

188,064

Cash flows from investing activities:

Capital expenditures

(71,469

)

(57,821

)

(73,574

)

Proceeds from sale of assets

626

70

77

Asset acquisitions, net of cash acquired and certain obligations assumed

(17,990

)

(3,664

)

(40,051

)

Proceeds from loans and investments

16,804

16,099

19,008

Disbursements for loans and investments

(72,301

)

—

(

20,971

)

Freestanding derivative settlement

—

736

—

Net cash used in investing activities

(144,330

)

(44,580

)

(115,511

)

Cash flows from financing activities:

Borrowings on revolving credit facilities

—

337,000

6,391,100

Payments on revolving credit facilities

—

(

342,000

)

(6,525,200

)

Proceeds from issuance of long

-

term debt, net of $5.2 million underwriting discount

—

167,325

85,000

Repayments of long

-

term debt and capital lease obligations

(137,671

)

(349,175

)

(92,504

)

Excess tax benefits from stock

-

based compensation plans

67

243

163

Proceeds from issuance of common stock, net of $7.2 million underwriting discount

682

159,498

3,894

Dividends paid

(11,509

)

(9,146

)

(6,912

)

Other

—

(

2,878

)

(3,848

)

Net cash used in financing activities

(148,431

)

(39,133

)

(148,307

)

Effect of exchange rate changes on cash and cash equivalents

7,975

823

(9,335

)

(Decrease) increase in cash and cash equivalents

(55,608

)

109,333

(85,089

)

Cash and cash equivalents:

Beginning of year

151,871

42,538

127,627

End of year

$

96,263

$

151,871

$

42,538

(1)

Changes in operating assets and liabilities exclude assets acquired and liabilities assumed through acquisitions