Supercuts 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

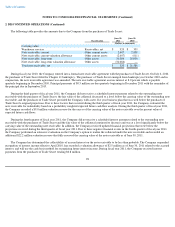

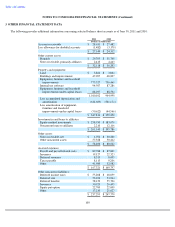

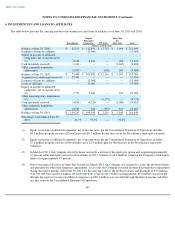

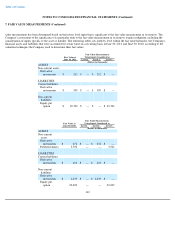

6. INVESTMENTS IN AND LOANS TO AFFILIATES

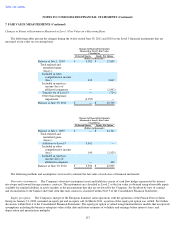

The table below presents the carrying amount of investments in and loans to affiliates as of June 30, 2011 and 2010:

105

Provalliance

Empire

Education

Group, Inc. MY Style

Hair Club

for

Men, Ltd. Total

(Dollars in thousands)

Balance at June 30, 2009

$

82,135

$

111,451

$

12,718

$

5,096

$

211,400

Payment of loans by affiliates

—

(

15,000

)

—

—

(

15,000

)

Equity in income of affiliated

companies, net of income taxes

(1)

4,134

6,431

—

909

11,474

Cash dividends received

(1,141

)

—

—

(

1,263

)

(2,404

)

Other, primarily translation

adjustments

(9,647

)

—

(

602

)

565

(9,684

)

Balance at June 30, 2010

$

75,481

$

102,882

$

12,116

$

5,307

$

195,786

Acquisition of additional interest(3)

57,301

—

—

—

57,301

Payment of loans by affiliates

—

(

15,000

)

—

—

(

15,000

)

Loans to affiliates

—

15,000

—

—

15,000

Equity in income of affiliated

companies, net of income taxes

(2)

7,752

5,463

—

567

13,782

Other than temporary impairment

(4)

—

—

(

9,173

)

—

(

9,173

)

Cash dividends received

(4,814

)

(4,129

)

—

(

1,080

)

(10,023

)

Other, primarily translation

adjustments

13,525

324

(733

)

351

13,467

Balance at June 30, 2011

$

149,245

$

104,540

$

2,210

$

5,145

$

261,140

Percentage ownership at June 30,

2011

46.7

%

55.1

%

—

50.0

%

(1) Equity in income of affiliated companies, net of income taxes per the Consolidated Statement of Operations includes

$4.1 million in equity income of Provalliance and $0.5 million for the increase in the Provalliance equity put valuation.

(2) Equity in income of affiliated companies, net of income taxes per the Consolidated Statement of Operations includes

$7.8 million in equity income of Provalliance and a $2.4 million gain for the decrease in the Provalliance equity put

valuation.

(3) In March of 2011, the Company elected to honor and settle a portion of the equity put option and acquired approximately

17 percent additional equity interest in Provalliance for $57.3 million (€ 40.4 million), bringing the Company's total equity

interest to approximately 47 percent.

(4)

Due to the natural disasters in Japan that occurred in March 2011, the Company was required to assess the preferred shares

and premium for other than temporary impairment. As a result, the Company recorded an other than temporary impairment

during the twelve months ended June 30, 2011 for the carrying value of the preferred shares and premium of $3.9 million

(326,700,000 Yen) and $5.3 million (435,000,000 Yen), respectively. Of the total impairment, $9.0 million was recorded

through the equity in income of affiliated companies and $0.2 million was recorded through the interest income and other,

net, line items in the Consolidated Statement of Operations.