Supercuts 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

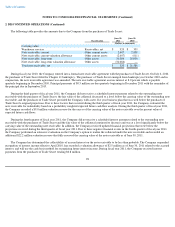

2. DISCONTINUED OPERATIONS (Continued)

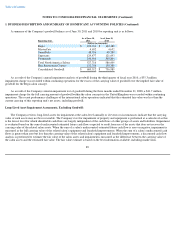

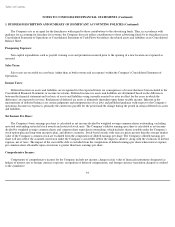

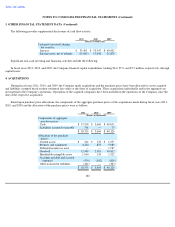

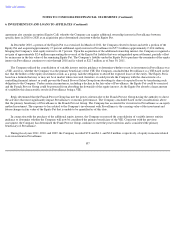

The following table summarizes the activity in the valuation allowance related to the note receivable with the purchaser of Trade Secret:

The Company utilized the consolidation of variable interest entities guidance to determine whether or not Trade Secret was a VIE, and if so,

whether the Company was the primary beneficiary of Trade Secret. The Company concluded that Trade Secret is a VIE based on the fact that the

equity investment at risk in Trade Secret is insufficient. The Company determined that the purchaser of Trade Secret has met the power criterion

due to the purchaser of Trade Secret having the authority to direct the activities that most significantly impact Trade Secret's economic

performance. The Company concluded based on the consideration above that the primary beneficiary of Trade Secret is the purchaser of Trade

Secret. The exposure to loss related to the Company's involvement with Trade Secret is the carrying value of the amount due from the purchaser

of Trade Secret and the guarantee of approximately 40 operating leases. The Company has determined the exposure to the risk of loss on the

guarantee of the operating leases to be reasonably possible. See Note 10 to the Consolidated Financial Statements for further information on the

guaranteed leases.

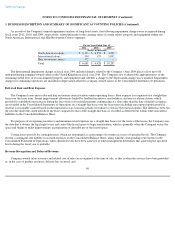

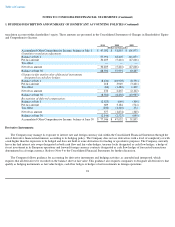

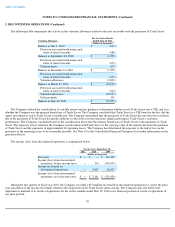

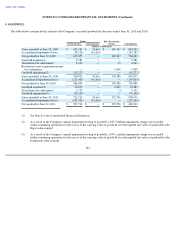

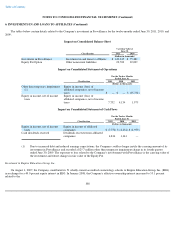

The income (loss) from discontinued operations is summarized below:

During the first quarter of fiscal year 2010, the Company recorded a $3.0 million tax benefit in discontinued operations to correct the prior

year calculation of the income tax benefit related to the disposition of the Trade Secret salon concept. The Company does not believe the

adjustment is material to its results of operations for the twelve months ended June 30, 2010 or its financial position or results of operations of

any prior periods.

99

Valuation Allowance

For the Twelve Months

Ended June 30, 2011

(Dollars in thousands)

Balance at July 1, 2010

$

(611

)

Provision associated with nonaccrual

status of interest income

(688

)

Balance at September 30, 2010

$

(1,299

)

Provision associated with nonaccrual

status of interest income

(670

)

Cash payments

670

Balance at December 31, 2010

$

(1,299

)

Provision associated with nonaccrual

status of interest income

(655

)

Valuation allowance

(9,000

)

Balance at March 31, 2011

$

(10,954

)

Provision associated with nonaccrual

status of interest income

(662

)

Valuation allowance

(22,227

)

Cash payments

150

Balance at June 30, 2011

$

(33,693

)

For the Years Ended June 30,

2011 2010 2009

(Dollars in thousands)

Revenues

$

—

$

—

$

163,436

Income (loss) from discontinued

operations, before income taxes

—

154

(190,433

)

Income tax benefit on

discontinued operations

—

3,007

58,997

Income (loss) from discontinued

operations, net of income taxes

$

—

$

3,161

$

(131,436

)