Supercuts 2011 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

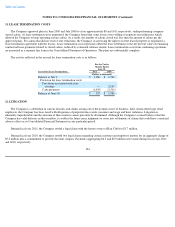

11. LEASE TERMINATION COSTS

The Company approved plans in June 2009 and July 2008 to close approximately 80 and 160, respectively, underperforming company-

owned salons. As lease settlements were negotiated, the Company found that some lessors were willing to negotiate rent reductions which

allowed the Company to keep operating certain salons. As a result, the number of salons closed was less than the amount of salons per the

approved plans. For salons that did not receive rent reductions, the Company ceased using the right to use the leased property or negotiated a

lease termination agreement with the lessors. Lease termination costs represents either the lease settlement or the net present value of remaining

contractual lease payments related to closed salons, reduced by estimated sublease rentals. Lease termination costs from continuing operations

are presented as a separate line item in the Consolidated Statement of Operations. The plans are substantially complete.

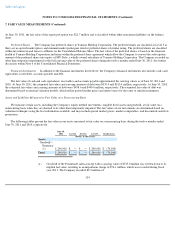

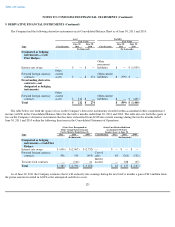

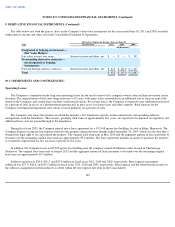

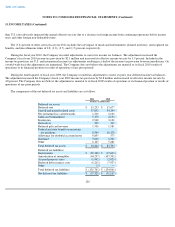

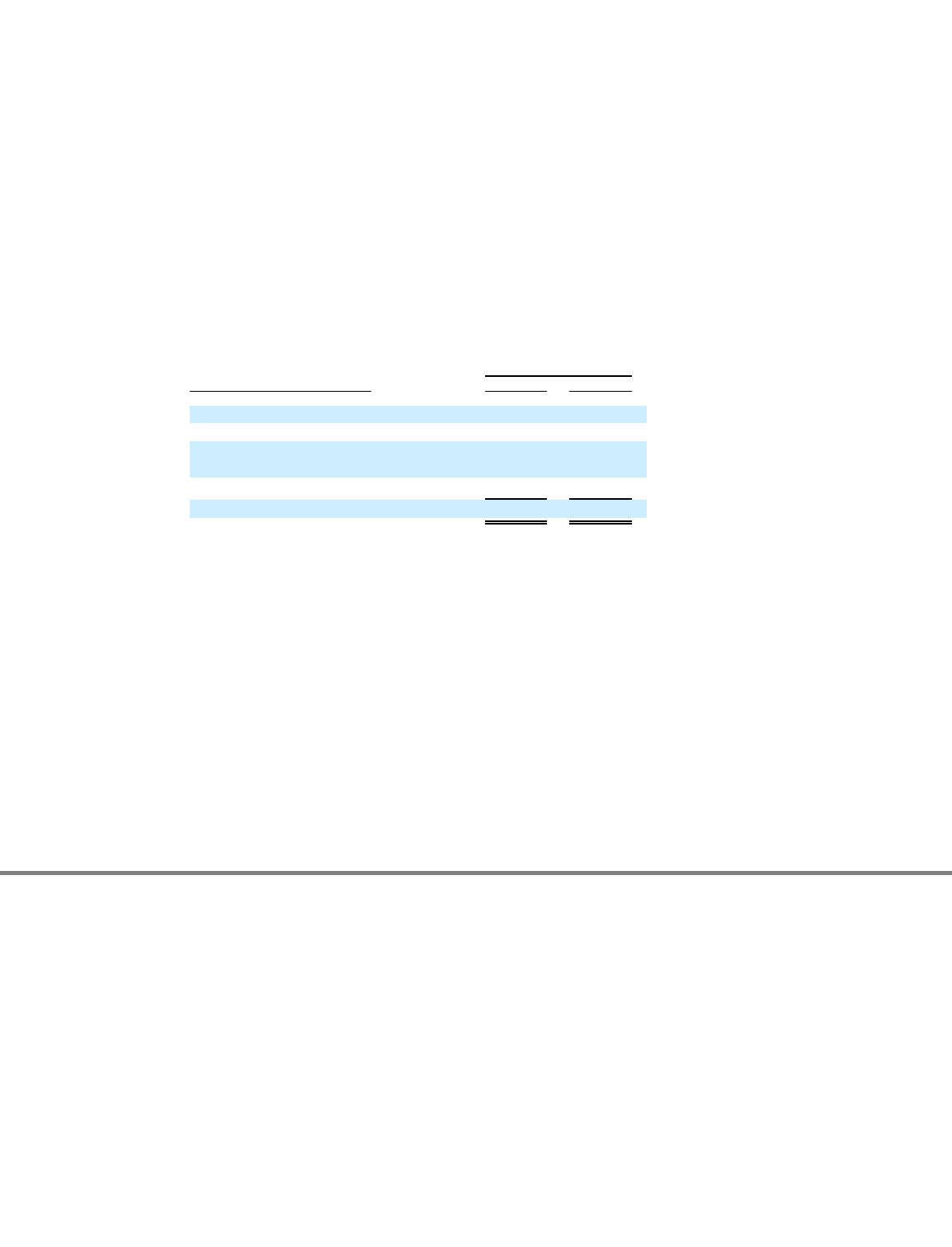

The activity reflected in the accrual for lease termination costs is as follows:

12. LITIGATION

The Company is a defendant in various lawsuits and claims arising out of the normal course of business. Like certain other large retail

employers, the Company has been faced with allegations of purported class-wide consumer and wage and hour violations. Litigation is

inherently unpredictable and the outcome of these matters cannot presently be determined. Although the Company's counsel believes that the

Company has valid defenses in these matters, it could in the future incur judgments or enter into settlements of claims that could have a material

adverse effect on its Consolidated Financial Statements in any particular period.

During fiscal year 2011, the Company settled a legal claim with the former owner of Hair Club for $1.7 million.

During fiscal year 2010, the Company settled two legal claims regarding certain customer and employee matters for an aggregate charge of

$5.2 million plus a commitment to provide discount coupons. Payments aggregating $4.3 and $0.9 million were made during fiscal years 2011

and 2010, respectively.

124

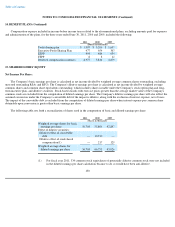

For the Twelve

Months Ended

June 30,

Accrual for Lease Terminations

2011

2010

(Dollars in thousands)

Balance at July 1,

$

1,386

$

2,760

Provision for lease termination costs:

Provisions associated with store

closings

—

2,145

Cash payments

(1,059

)

(3,519

)

Balance at June 30,

$

327

$

1,386