Supercuts 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

4. ACQUISITIONS (Continued)

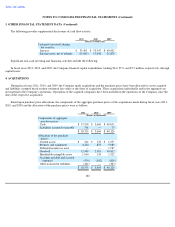

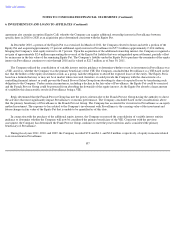

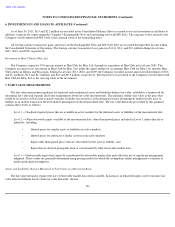

The value and related weighted average amortization periods for the intangibles acquired during fiscal years 2011 and 2010 business

acquisitions, in total and by major intangible asset class, are as follows:

The majority of the purchase price in salon acquisitions is accounted for as residual goodwill rather than identifiable intangible assets. This

stems from the value associated with the walk-in customer base of the acquired salons, which is not recorded as an identifiable intangible asset

under current accounting guidance, as well as the limited value and customer preference associated with the acquired hair salon brand. Key

factors considered by consumers of hair salon services include personal relationships with individual stylists, service quality and price point

competitiveness. These attributes represent the "going concern" value of the salon.

Residual goodwill further represents the Company's opportunity to strategically combine the acquired business with the Company's existing

structure to serve a greater number of customers through its expansion strategies. In the acquisitions of international salons and hair restoration

centers, the residual goodwill primarily represents the growth prospects that are not captured as part of acquired tangible or identified intangible

assets. Generally, the goodwill recognized in the North American salon transactions is expected to be fully deductible for tax purposes and the

goodwill recognized in the international salon transactions is non-

deductible for tax purposes. Goodwill generated in certain acquisitions, such as

the acquisition of hair restoration centers, is not deductible for tax purposes due to the acquisition structure of the transaction.

During fiscal years 2011, 2010, and 2009, the Company purchased salon operations from its franchisees. The Company evaluated the

effective settlement of the pre-existing franchise contracts and associated rights afforded by those contracts. The Company determined that the

effective settlement of the pre-existing franchise contracts at the date of the acquisition did not result in a gain or loss, as the agreements were

neither favorable nor unfavorable when compared to similar current market transactions, and no settlement provisions exist in the pre-existing

contracts. Therefore, no settlement gain or loss was recognized with respect to the Company's franchise buybacks.

103

Purchase Price

Allocation

Weighted

Average

Amortization

Period

Year Ended

June 30,

(in years)

2011 2010 2011 2010

(Dollars in

thousands)

Amortized intangible assets:

Brand assets and trade

names

$

159

$

61

10

20

Customer lists

1,207

—

7

—

Franchise agreements

269

—

40

—

Lease intangibles

151

15

20

20

Non

-

compete agreements

—

—

—

—

Other

178

58

20

20

Total

$

1,964

$

134

14

20